Family business conference to feature lessons from ‘Texas patriarch’ on original Southfork Ranch

Dec. 28, 2022

This paid piece is sponsored by the Prairie Family Business Association.

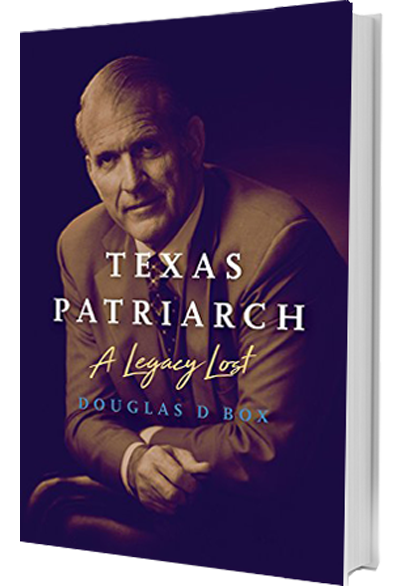

Douglas Box is the first to tell you his family business story isn’t one to try to emulate.

“It’s basically a horror story, a cautionary tale, and you might even hear me say on stage that it’s my driver’s education shocker film,” said Box, who was the second generation of a Texas business that would have appeared every bit the success story from the outside looking in.

Until it wasn’t.

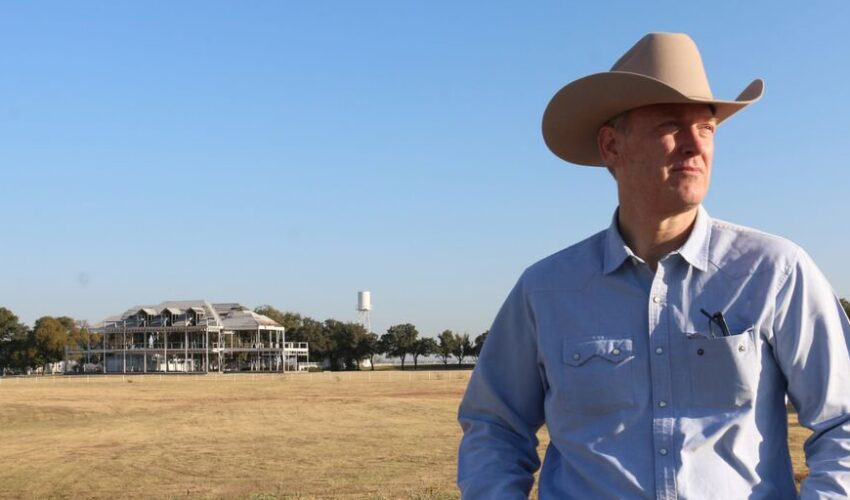

Box’s father, Cloyce, was a larger-than-life figure in business – a “Texas patriarch” who rose from Depression-era poverty to become a star NFL receiver and the owner of the original Southfork Ranch featured in the “Dallas” TV series.

Beginning in the 1950s, the family controlled a number of public and private companies with interests in oil and gas, cement manufacturing and real estate. Following his father’s sudden death in 1993 and a litigious four-year family ordeal, Box and his brothers were forced to sell their family’s flagship oil and gas concern, Box Energy Corp.

For nearly two decades, Box has worked in the field of family business, facilitating succession planning, corporate governance and mediation for business owners and high net-worth individuals.

He’s now the lead family dynamics specialist at Wells Fargo Private Bank and will be among the featured speakers at the Prairie Family Business Association Annual Conference held April 27-28, 2023, in Sioux Falls.

We sat down with Doug Box to learn more about his family story and the ways he’s guiding other families while using the lessons he has learned along the way.

What are your early memories of growing up in a family business?

I have no recollection of my father not being a very successful entrepreneur. There’s a picture of me on my sixth birthday, and he’d come home to take a picture of me, and he’s got a business suit on and looks very much like the CEO he was. Life was good growing up. We lived on the ranch where the TV show “Dallas” first started, the original Southfork Ranch, but it wasn’t like a country club.

We had to work. My dad put us to work hauling hay and painting fences. But we had all the things wealthy families had – we had airplanes and buses and helicopters – and my dad was just one of those guys, a self-made man.

You were 36 when your dad passed away unexpectedly – the youngest of his four sons. What happened to the family and business after that?

My dad had an air of invincibility about him. He was once described like a cat – always landing on his feet. But my dad, like a lot of entrepreneurs, was highly leveraged, and we were keenly aware of the risk that brought. It was like a house of cards. We didn’t have a succession plan in place. And while my dad sort of relished an opportunity to come into a conflicted situation, he was gone, and in his place instead you had four male egos and four differing opinions and four boys who didn’t really know how to relate to each other as business partners. We were all wired very differently, and we should not have tried to be in business together – different values, communication styles, subconscious rivalry, just a lot of family dynamics.

What are the big takeaways from your experience that you now share with other families?

One of the biggest takeaways is that you need to work on your family’s culture to create a positive atmosphere of trust and communication. And we did not do that. No. 1, in large part because we didn’t know how important it was, and No. 2 – and this is going to sound odd – but we didn’t think our father would die. Nobody does. Nobody really thinks that. And so when he did, we were left with what I would describe as a very weak family culture. Weak in the sense that we were not prepared for this transition. So plan while you can because this stuff is pretty complex. None of it is really intellectually challenging, but there are so many layers to the cake: multigenerational wealth transfer, the legal part of it, the managerial succession layer and the governance, which serves as a foundation. And there are family retreats and meetings to consider, which we didn’t have any of that because this was the 1990s and the industry was not fully developed then.

Now, as a family dynamics specialist, what kinds of thing do you hear families working through in their businesses?

Many of them still need the basics, the fundamentals, and that’s pretty consistent. But a lot of families have made a lot of money, and they’re thinking about their kids inheriting it and wanting to know how to not ruin their kids with too much wealth. It’s a good problem to have, but it’s a problem, and it’s on their minds. And that’s because they’ve seen what can happen in other wealthy families. There are strategies to prevent this. Education is paramount, hearing other people’s stories and embracing best practices.

What’s your relationship like with your brothers now?

Just because of the sheer passage of time and the fact we are all in our mid-to-late 60s, we just are very different people than we were 25 years ago. And now that we’re all older, we know the importance of family relationships, and we value those relationships a lot more than we ever did, so we get along. My oldest brother is deceased, but my two surviving brothers and I are very close. But the cost was very high. I don’t recommend it.

Doug Box will share much more insight at the 2023 Prairie Family Business Association Annual Conference. Click here for information and to register for in-person or virtual attendance. And save $100 with Early Bird pricing through Jan. 31, 2023.