Don’t wait to take advantage of energy-efficiency incentives in Inflation Reduction Act

Dec. 21, 2022

This paid piece is sponsored by Eide Bailly LLP.

By Kristin Gustafson, PE, CEM, BEMP, LEED AP

A version of this article appeared on eidebailly.com.

Booming building meccas like the Sioux Falls market have huge tax incentive opportunities for those building, renovating, acquiring and designing commercial buildings, single-family homes and multifamily developments. Eide Bailly’s Business Credits & Incentives team consists of CPAs, Professional Engineers, energy modelers, LEED professionals, HERS raters, data scientists, architects and construction specialists all positioned to maximize your credits and deductions in the built environment.

The Inflation Reduction Act, passed in August, significantly enhances the 179D Energy Efficient Commercial Buildings Deduction and the 45L New Energy Efficient Home Credit. With the passing of the act, now tax-exempt organizations also can benefit from these energy-efficiency incentives.

Changes to 45L and 179D

The 179D Energy Deduction and 45L Residential Credit originally were introduced in the Energy Policy Act of 2005 as annual extenders, meaning the provisions sunset and were renewed every few years. In late 2020, the 179D Energy Deduction was made permanent at $1.80 per square foot in the Consolidated Appropriations Act of 2021, indexed to inflation.

179D Energy Efficient Commercial Building Property is a deduction of up to $1.88 per square foot for properties placed in service before Jan. 1, 2023, and up to $5 per square foot for projects placed in service from Jan. 1, 2023, to Dec. 31, 2032.

The Inflation Reduction Act extended the 45L Residential Credit at the current rate of $2,000 per unit for single-family and multifamily (three stories and less) through the end of 2022, and both the 179D Energy Deduction and the 45L Residential Credit are extended at increased values through the end of 2032.

The 45L New Energy Efficient Home Credit is a credit of up to $2,000 per unit for properties placed in service before Jan. 1, 2023, and up to $5,000 per unit for projects placed in service from Jan. 1, 2023, to Dec. 31, 2032.

Ten years of certainty — until 2032 — allows for proactive planning, including:

- Accounting and tax departments incorporating these incentives into their Capitalization Policy and Fixed Asset Ledgers.

- Developers, owners, contractors and architects including these incentives during design and construction.

These increased benefits can allow accounting and tax departments to both increase cash flow and contribute to ESG efforts. And developers, owners, contractors and architects can design and build sustainably while also minimizing tax liabilities.

179D Energy Deduction enhancements

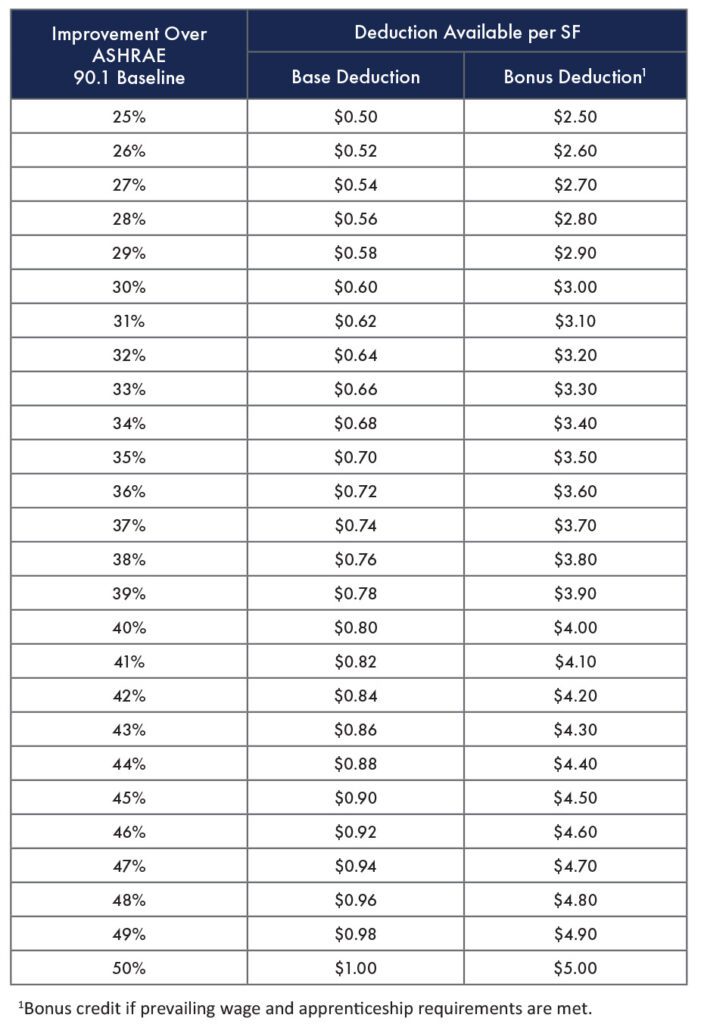

Starting in 2023, the base deduction rate starts at 50 cents per square foot for 25 percent improvement against a baseline model and increases incrementally up to $1 per square foot for 50 percent improvement. A bonus deduction is available for projects meeting prevailing wage and apprenticeship requirements. This bonus deduction starts at $2.50 per square foot and increases 10 cents for each percentage improvement up to $5 per square foot.

The Inflation Reduction Act modifies the previous lifetime limit on using the 179D deduction to instead a three-year cap, meaning a building can be eligible for the 179D deduction every three years, assuming at least one of the systems contributing to energy efficiency has been properly renovated.

This deduction is now applicable to real estate investment trusts and still applies to private building owners along with certain tax-exempt entities who can allocate the deduction to the “designers” — generally architects, engineers and contractors who are primarily responsible for designing the property. Qualified tax-exempt entities include:

- Federal government

- State or local government entities

- Indian tribal governments

- Other tax-exempt organizations including not-for-profit hospitals

45L Residential Credit enhancements

Under the Inflation Reduction Act extension, energy-efficient single-family homes and multifamily developments three stories and less can receive a tax credit of $2,000 per unit, and manufactured homes can receive a tax credit of $1,000 per unit.

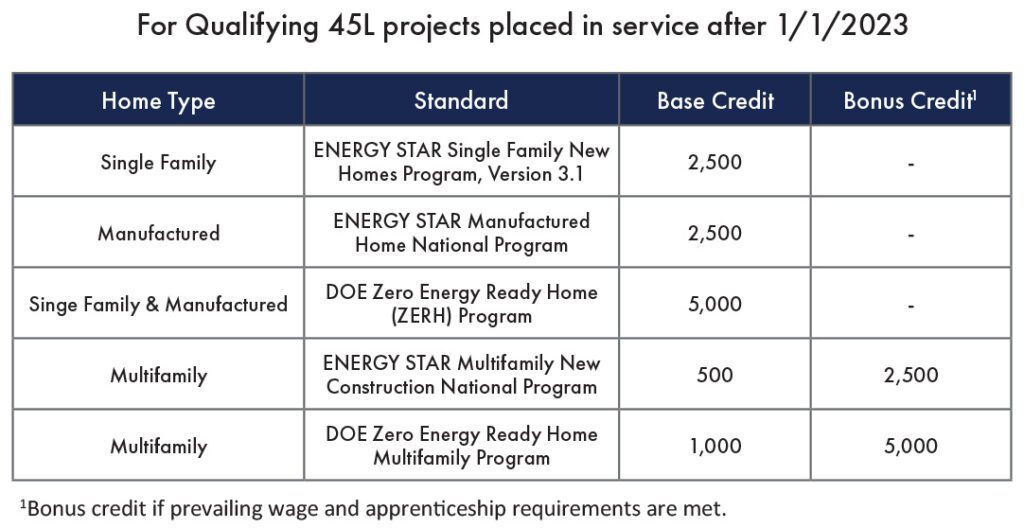

The 45L Residential Credit is changing in 2023, with multifamily homes starting at a base credit of $500 per unit and a bonus credit of $2,500 per unit for projects meeting prevailing wage and apprenticeship requirements. Additional credits are available for projects meeting the Department of Energy Zero Energy Ready home program requirements.

For single-family homes and manufactured homes, the base credit is $2,500 per unit, increasing to $5,000 per unit for projects meeting prevailing wage and apprenticeship requirements.

Starting in 2023, there are no limits on the height of the qualifying project or energy-efficient multifamily projects pursuing 45L Residential Credits.

For affordable housing projects qualifying for the Low-Income Housing Tax Credit, there is no basis reduction for 45L projects, meaning qualified projects can claim both the LIHTC and 45L.

Choosing the right firm for energy-efficiency credits and deductions

Tax credits and deductions exist to help taxpayers save money and promote energy efficiency. The first step is understanding whether a project qualifies for these incentives. Working alongside a trusted business adviser with a proven track record in the energy-efficiency space will help you maximize these new opportunities.

Eide Bailly’s nationally recognized industry specialists have the expertise to help you maximize energy-efficient incentives. We have worked with hundreds of clients, helping to maximize benefits equating to millions of dollars saved.

Get started with your energy-efficiency tax credits and deductions today. Let’s Talk.