Want to build wealth? Make these small changes today

March 9, 2021

This paid piece is sponsored by The First National Bank in Sioux Falls.

By Don Rahn, wealth advisory manager

We’re three months into 2021, and the New Year’s resolution makers are looking a little less excited and ambitious about reaching their goals. Why is that? The reality is most resolutions don’t work out because we bite off more than we can chew. We get discouraged if we don’t see results right away.

That’s why our team at First National Wealth Management takes a different approach when it comes to helping people reach their financial goals. We believe that small changes can make a huge impact. Here are some small changes you can make to your finances today that will have big results in the future.

We also covered this topic on the latest episode of our podcast, “Common Cents on the Prairie.” Find it wherever you stream your podcasts or on our website!

Gradually increase your retirement savings rate

One of our favorite small changes with big results is gradually increasing retirement contributions.

Fidelity® studied the contribution rates and balances of Americans’ retirement accounts. They found that the average American in his or her 60s contributes 11 percent of gross annual income and the average balance of their those accounts is $182,100.

Does that sound like enough to live on in retirement to you? The cost of health care-related expenses alone could eat up those savings.

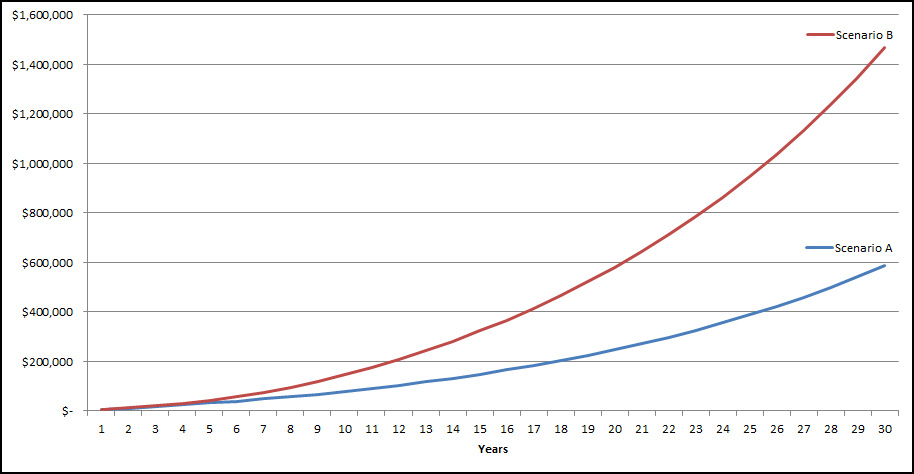

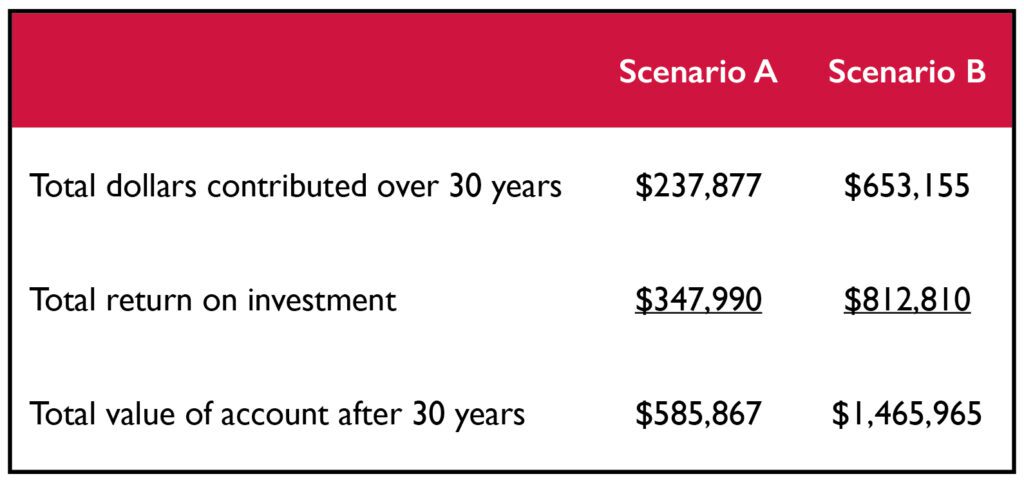

So how much should you save for retirement? Our general rule of thumb is to save 15 percent to 20 percent each year. We used two hypothetical scenarios to show this concept in action. In the graph below, we assumed each household had a gross annual income of $100,000 and an annual return of 6 percent on its investment portfolio. Both households also started out by saving 5 percent of their gross annual income.

The difference? The household in scenario A saved at the 5 percent rate for 30 years and didn’t make any changes. Scenario B, however, eventually worked its way up to saving 15 percent and contributed at that rate for the next 20 years. Take a look at the difference it made in the ending value of the portfolio!

One way to make this change easier is through gradual increases. You don’t need to go from saving 5 percent to 15 percent overnight. Each year, increase your contribution by 1 percentage point, and you probably won’t even miss the extra money you are contributing.

Make a net worth statement

Like any type of change, you need to keep track of your progress. When you’re working toward financial change, the best way to track your progress is by making a net worth statement each year.

A net worth statement is configured by taking your total assets minus your total liabilities. It’s an overall picture that we use to advise our clients on reaching their financial goals.

We have an online software program for tracking net worth called FNB Wealth Check. It shows the value of any account we manage, and you also can connect any other outside accounts, including bank accounts, 401(k)s or other types of employer-sponsored retirement plans. The software also can track liabilities such as home mortgages, lines of credit or credit cards. If you’re interested in becoming our client and tracking your net worth through FNB Wealth Check, contact us!

Pay down debt

On the note of tracking liabilities, we advise getting debt paid off before you’re retired. That’s because in retirement you will no longer have the income needed to support those debt payments.

Credit card debt and other forms of high-interest debt should get paid off first, especially when there’s no asset to show for it. Any debt that has a higher interest rate than what you could expect to get as a return on an investment account is considered high interest and should be paid off as soon as possible.

Student loan debt is a common concern for many people when it comes to paying off debt. We recommend clients reduce student debt within five to 10 years of graduation, regardless of the interest rate.

Build an emergency fund

A big, unexpected expense can set you behind on getting to where you want to be financially. That’s why we recommend establishing one of two types of emergency funds.

The first is a starter emergency fund. A starter emergency fund for someone just starting out in his or her career without any savings should have at least $1,000 for emergency expenses, so you don’t have to put them on a credit card. We’d recommend building that up to $2,000 to $3,000 eventually.

For those more established in a career, we suggest having three to six months of expenses saved. This way, if you would suddenly lose your job, you won’t have to pull from any retirement or investment accounts.

Saving for big expenses

The two most common big expenses we advise our clients on are a down payment on a home and kids’ college. Those both require some significant planning.

When making a down payment on a home, conventional wisdom has been to put down 20 percent, but there are lots of different factors to consider. Our wealth advisory team can discuss those things, and our mortgage lenders ultimately can help find a home-financing option that works for you and the goals we set.

When it comes to saving for your kids’ college, it’s important to put yourself first. You should make sure your own financial goals are taken care of before taking on a big expense like paying for your children’s college. We covered this topic in depth on episode two of our podcast, and we share which financial goals you should accomplish for yourself.

Set a budget with a purpose

Lots of people really hate budgets. If that sounds like you, it could be because you’re doing it without a purpose or in a way that doesn’t work for you.

First of all, your budget needs to have a ‘why.’ Why did you decide to make a budget? Keeping this in mind provides direction, purpose and accountability.

Second, you need to budget in a way that fits your situation. There are two types of budgets: a traditional budget, where you track every dollar you make and spend, and a savings goal budget, where you set a goal of how much to save and worry less about everything else.

A traditional budget is useful for those living on a tight budget where every dollar counts and every dollar needs to have a purpose. If you’re budgeting with your spouse, using a traditional budget and tracking every dollar you make and spend sometimes can cause friction. In those cases, you probably have a little more income to work with, and it might make more sense to shift your focus toward your savings goals and less on your spending – that is as long as you have your debts under control.

Ready to get started?

If you need a little extra accountability, we can help. Our team of advisers has the knowledge and expertise to create a plan that you can stick to and that accomplishes your financial goals without biting off more than you can chew. Contact us today to see how you can start making some small changes with big results!

Any comments, insights, or strategies discussed in this article are intended to be general in nature and, therefore, may not be suitable for you and your situation, whatever that may be. Before acting on anything written here, please consult with your attorney, CPA, and/or your financial adviser.