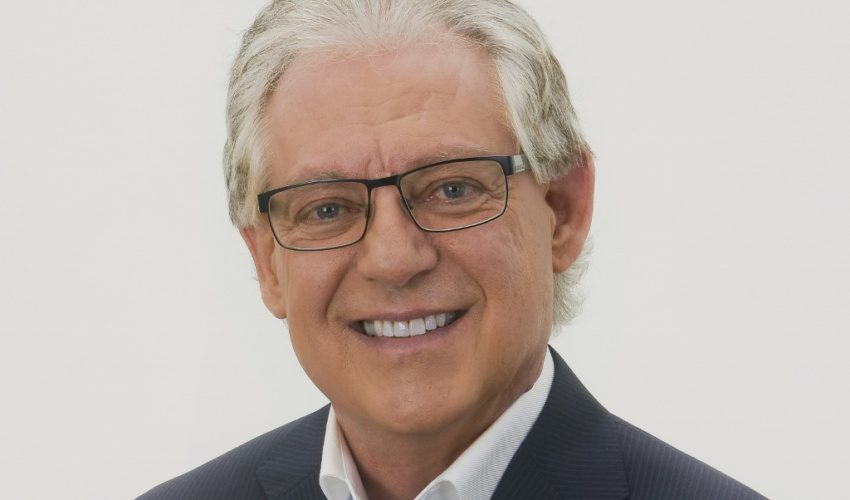

Ratchford: Is real estate homeownership still a good investment?

Aug. 5, 2019

This paid piece is sponsored by The Tony Ratchford Group.

By Tony Ratchford, broker for KW Realty Sioux Falls, CRS, ABR, SRES, Luxury Homes Institute

The number of closed properties in the Sioux Empire is down nearly 12 percent year-over-year. Potential buyers in the age group of 25-34 are not buying as they have in the past, giving concern for the older market who are wondering who will buy their house when they downsize. The housing crash of 2006-08 wiped away large portions of equity.

These are just a few of the comments we hear in the news. The solution or answer to the above is to trust 80 years of history and our economic system.

Going back to 1940, the average home value in the USA was $30,600. When looking at every 10-year increment, it was always higher than the previous 10-year number, and in 2000 it was four times the value at $119,600.

In January 2010, the cost of a newly constructed home was $218,200, even after a substantial drop in prices between 2006 and then. A new house in June 2019 would have cost $310,400 on average. Just for the record, the only reason for the crash of 2006 was government intervention trying to develop a market that couldn’t have been.

Surprisingly, the greatest portion of many retirees’ net worth is their home. A house was a place for them to live, and it turned out to be a continuous investment plan as well.

In America, people will move five times in their adult life on average. A change in housing is driven by one’s lifestyle: the starter home where investing begins, the move-up home where more space is required, the family home for more comfort, the empty-nester home with less space and finally the retirement home with lower maintenance.

First-time buyers continue to be the driving force behind a strong bull market, and we are seeing ownership in that group dropping from 44 percent to 40 percent today. The reasons for the drop are plentiful, but it is mostly driven by economics and commitment. This has slowed the market some, but one can anticipate they eventually will get into the market.

The primary key to building equity in a home is time. The sooner someone steps into the world of homeownership the more opportunity there is to let inflation and debt-reduction take hold. Ideally, start with a 30-year loan, and maintain the remaining length of the loan regardless of when a move happens, and the house is debt-free in 30 years.

It’s good to know homes appreciate at the rate of inflation plus 1 percent each year. That means the equity in a home after 30 years will have buying power 30 percent greater than inflation. There also are potential income tax savings and a place to call home with freedom to live the way you want.

As always, we invite you to call or text 605-359-4100.