MarketBeat October market recap

Nov. 1, 2023

This paid piece is sponsored by MarketBeat.

Pathward Financial Inc. (NASDAQ: CASH): Pathward Financial has expanded its partnership with TabaPay, a leading money movement platform for merchants and a leading fintech brand. This partnership allows Pathward to build on its banking as a service model by enabling TabaPay customers to perform “push and pull payments” for a complete end-to-end solution.

In other news, Pathward Financial announced its fourth quarter earnings Oct. 25. The company posted earnings per share of $1.36 on revenue of $160.99 million. Both numbers beat analysts’ expectations.

SAB Biotherapeutics Inc. (NASDAQ: SABS): On Oct. 19, the clinical-stage biopharmaceutical company announced it had completed the approval process to commence a phase 1 clinical trial for its lead therapeutic candidate, SAB-142, which is designed to delay the onset or progression of Type 1 diabetes.

First Interstate BancSystem Inc. (NASDAQ: FIBK): On Oct. 25, First Interstate BancSystem reported its earnings for the third quarter. The bank generated a net income of $72.7 million, or 70 cents per share. Both numbers were higher than the same quarter in the prior year.

The bank also announced a quarterly dividend of 47 cents per share that will be paid to shareholders of record as of Nov. 6.

The Bancorp Inc. (NASDAQ: TBBK): On Oct. 26, The Bancorp inaugurated its new office in The Bancorp Building in Sioux Falls. The Bancorp is now the third largest bank in South Dakota as measured by total assets.

The bank also reported its quarterly earnings for the period ending Sept. 30. Net income of $50.1 million calculates to 92 cents per diluted share. The latter number was 70 percent higher than the 54 cents per share the company reported in the prior year.

Wells Fargo & Co. (NYSE: WFC): On Oct. 13, Wells Fargo reported its quarterly earnings for the third quarter. The bank delivered earnings per share of $1.39 on revenue of $20.86 billion. The bank also announced a dividend of 35 cents per share that will be paid to shareholders of record on Nov. 3.

The bank also announced that despite shedding 60,000 workers and closing 6 percent of its branches, additional cuts would need to be made to improve operational efficiency.

NorthWestern Energy Group (NASDAQ: NWE): On Oct. 4, volunteers from NorthWestern installed foam insulation on the foundation of seven Habitat for Humanity homes in Butte, Montana.

On Oct. 26, NorthWestern reported quarterly earnings per share of 49 cents on revenue of $321.10 million. Both numbers missed analysts’ expectations.

CNH Industrial NV (NYSE: CNHI): Time magazine recognized CNH Industrial’s New Holland T7 Methane Power LNG tractor with a special mention in the magazine’s annual Best Invention List. The annual awards highlight “the most impactful new products and ideas, recognizing products, software and services that are solving compelling problems creatively.”

Citigroup Inc. (NYSE: C): On Oct. 19, Citigroup announced an inaugural program in which the bank will be the confirming bank for letters of credit for Banco Bolivariano in Ecuador. The program, which aligns with Citi’s membership in 2X Global, will support women-led small and medium enterprises, or SMEs, that meet related eligibility criteria.

On Oct. 13, the bank announced its quarterly earnings for the period ending Sept. 30. The bank delivered earnings per share of $1.52 on revenue of $20.14 billion. The bank also announced a dividend of 52 cents per share payable to shareholders of record on Nov. 6.

McDonald’s Corp. (NYSE: MCD): On Oct. 30, McDonald’s announced earnings for the third quarter. The fast-food giant delivered $3.19 per share on revenue of $6.69 billion. Both numbers beat analysts’ expectations.

In separate news, the company announced an increase in its quarterly dividend to $1.67 per share, a 10 percent increase from the prior year. The dividend will be paid to shareholders of record on Dec. 1.

Walmart Inc. (NYSE: WMT): On Oct. 26, Walmart conducted its 10th annual Open Call Event. This was an opportunity for over 700 businesses nationwide to pitch U.S.-made, grown or assembled products to Walmart and Sam’s Club merchants. This year, the company issued 180 “golden tickets,” with an additional 470 products listed under further consideration for future deals.

Target Corp. (NYSE: TGT): Halloween has just passed, but Target is already gearing up for the holidays. The company has announced four weeks of Black Friday deals, which will run through Thanksgiving week. This is a strategy that many retailers are taking as a way of incentivizing customers and boosting holiday sales. The company also is bringing back its Holiday Price Match Guarantee starting Oct. 22 and running through Dec. 24.

Macy’s Inc. (NYSE: M): Macy’s issued its curated “Gifts We Love” list for the holiday season Oct. 19. The list includes unique and thoughtful gifts for everyone in the family.

The company also announced a quarterly dividend of 16.5 cents per share, which is payable to shareholders of record as of Dec. 15.

Amazon.com Inc. (NASDAQ: AMZN): On Oct. 26, Amazon reported earnings for the third quarter. The company delivered earnings per share of 94 cents on revenue of $143.08 billion.

In separate news, the European Union announced a Feb. 14 deadline for its review of Amazon’s proposed $1.65 billion purchase of iRobot Corp. (NASDAQ: IRBT).

Costco Wholesale Corp. (NASDAQ: COST): On Oct. 4, Costco reported net sales of $22.75 billion for September, an increase of 6 percent from $21.46 billion in September 2022.

Costco also will have a new leader as of Jan. 1. CEO Craig Jelinek will step down and be replaced by the company’s president and chief operating officer, Ron Vachris.

Ford Motor Co. (NYSE: F): The big news for Ford Motor was a tentative agreement with the United Auto Workers that will end the strike that began in early October. The union agreed to resume working at all plants immediately.

On Oct. 26, Ford reported quarterly earnings of 39 cents per share on revenue of $43.80 billion. Both numbers were short of analysts’ expectations. Separately, Ford announced a 15 cents per share dividend that will be available to shareholders of record on Nov. 1.

General Motors Co. (NYSE: GM): As of this writing, General Motors appears to have a deal with the UAW. The union previously reached a tentative agreement with rival Ford Motor.

On Oct. 24, GM reported quarterly earnings of $2.28 per share on revenue of $44.13 billion. Both numbers beat analysts’ expectations. The company also announced a dividend of 9 cents per share payable to shareholders of record on Dec. 1.

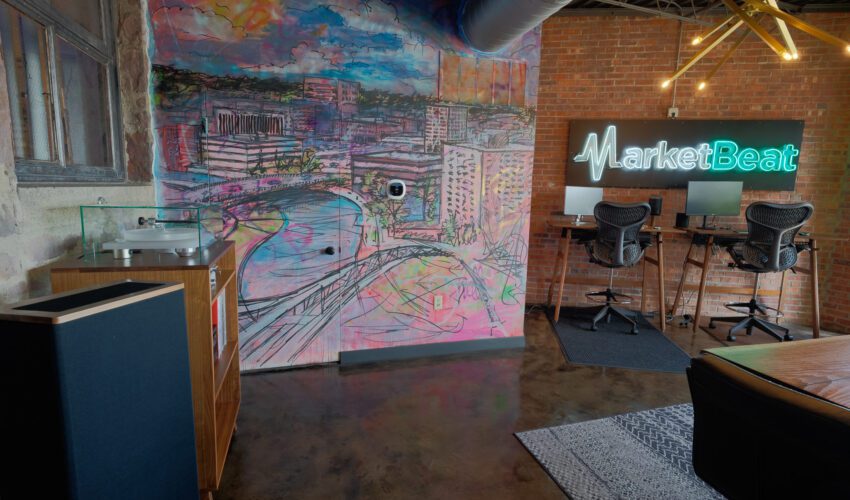

MarketBeat overview

MarketBeat was founded in 2011 with the mission of creating high-quality stock research tools and making them available to investors at all levels. The site uses the latest technology to provide proprietary, comprehensive, accurate and up-to-the-minute financial data, including information about analyst recommendations, dividend declarations and earnings announcements.

All this information and more is made available for free on the company’s website and via the company’s daily newsletters. MarketBeat aims to be a go-to resource for both retail and institutional investors. Currently, over 15 million individuals visit MarketBeat.com every month.