First Premier Bank plans new corporate headquarters after decades of impressive growth

Feb. 18, 2019

One day late last year, the approximately 2,300 people who work at First Premier Bank and Premier Bankcard watched a video with a memorable message.

It featured their leadership in a musical parody of “Willy Wonka & the Chocolate Factory.”

There was Premier Bankcard CEO Miles Beacom, outfitted as the famous candy maker, with First Premier Bank CEO Dana Dykhouse and president Dave Rozenboom assuming the roles of Oompa Loompas.

The lip-syncing was memorable. So was the end, when employees learned they would be receiving a “Wonkers” bar at their desks, with the potential for a golden ticket.

For staff accustomed to impressive displays of appreciation – Premier’s employee events have featured entertainment from the likes of Keith Urban and Luke Bryan and included pickup trucks as prizes – there likely was no doubt something significant was coming.

They learned that every chocolate bar, in fact, held a golden ticket. And that it could be redeemed for a new Apple Watch.

“It was pretty awesome. They were really excited,” senior vice president of marketing Brenda Bethke said.

Premier, though, has a lot to celebrate. While the national credit card company often is what outsiders associate with the brand, First Premier Bank quietly has grown into a diversified bank with significant growth.

That will become more evident this year when it plans to build a new corporate headquarters for the bank on land it owns on the northeast corner of 14th Street and Minnesota Avenue.

“We’re physically out of space,” Rozenboom said. “As we’ve grown, we’ve taken certain components of our business and shifted them to other locations. This will help us regain some synergy between those customer-facing teams and, more importantly, be convenient to our customers.”

Behind the growth

The bank’s customer base has grown and diversified immensely since it was acquired by Denny Sanford in 1986. It now counts 17 branches along the Interstate 29 corridor, including 10 plus an operations center in Sioux Falls.

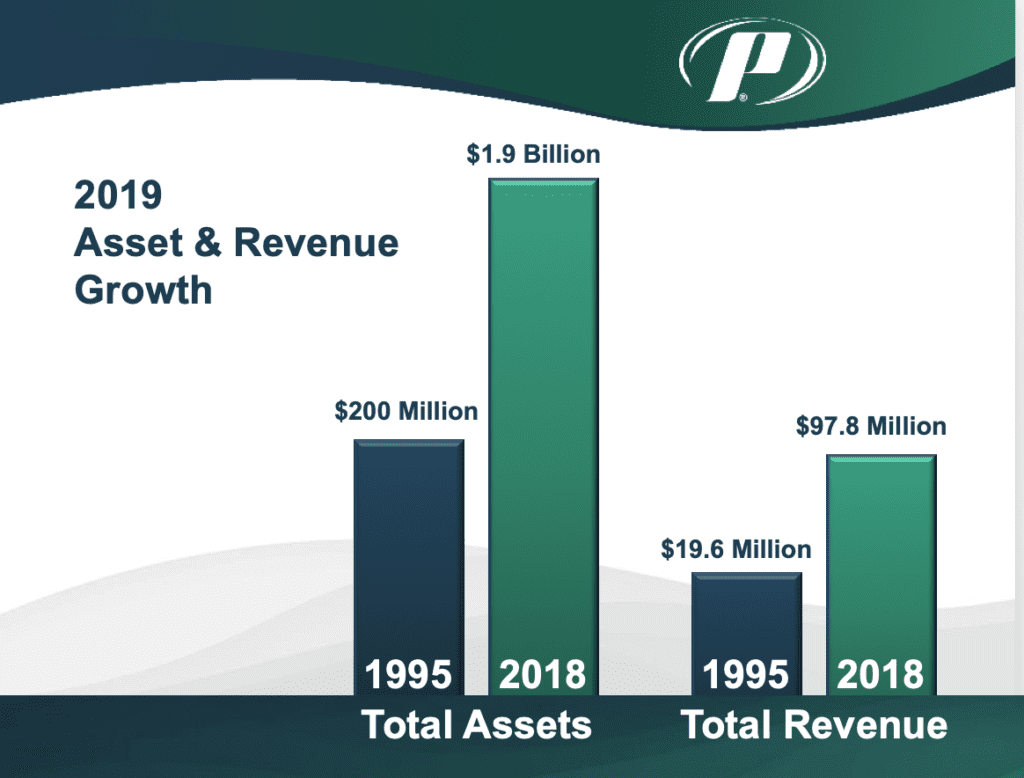

Since 1995, total assets have increased from $200 million to $1.9 billion. Revenue has jumped from $19.6 million to $97.8 million.

“The bank has been a remarkable growth story,” Rozenboom said. “Instead of being a high-performing bank, it’s become an extraordinarily high-performing bank. Denny was entrepreneurial by nature and encouraged us to find ways that we could provide services to people around the U.S. using the work ethic and employees we have here.”

In addition to providing services common for a full-service community bank – personal, business, ag banking and home loans – First Premier has branched into functions that give it a nationwide footprint.

That includes treasury services, an area where the bank has grown relationships with payroll processors to become the 10th largest ACH-originating bank in the country.

“We decided it was a business we could do from South Dakota where geography didn’t really matter,” Dykhouse said. “We started back in 1995 converting paper checks to electronic checks, and now we’ll move about $15 billion a month for people. The vast majority is payroll processing.”

First Premier also has grown its ATM-funding business line, which provides $180 million to customers who fund 9,500 independently owned ATMs nationwide in places such as hotels, casinos and convenience stores.

“It’s a pretty small world … and we’re unique in this business,” Rozenboom said. “It’s a seamless transaction (for owners). They own the machine but never touch the cash.”

Wealth management also has become a center of growth for Premier. The trust department manages $2.8 billion in funds for individuals, businesses and foundations. That compares to $150 million in 1995.

Indirect lending has contributed significantly too after Premier saw a Great Recession-era opportunity in regional lending for RV, boat and marine dealer customers in a five-state area.

“We were in the right place at the right time and started knocking on doors at these dealerships and built up a network of about 125 dealers,” Dykhouse said. “It taught us relationships are important, and it worked out well for us.”

The diversified approach to business growth has resulted in a bank with 60 percent of its revenue in interest income and 40 percent in non-interest income. It has been the winning bidder to serve as the state of South Dakota’s bank since 1996 and the city of Sioux Falls’ since 2004.

The diversification “helps us be a lot more recession-proof,” Dykhouse said. “We don’t just rely on our loan portfolio to pay the bills.”

Denny Sanford, owner; Dana Dykhouse, First Premier Bank CEO; Dave Rozenboom, First Premier Bank president; and Miles Beacom, Premier Bankcard CEO

It’s also sitting at 22.1 percent capitalization, far above the 10 percent regulatory requirement for a well-capitalized bank and ahead of the 14 percent median of South Dakota-chartered banks. Sanford remains the sole owner.

“Denny has been very philanthropic, but he’s left a lot of money in the bank for us to grow,” Dykhouse said.

The organization is well known for its philanthropy too, with $3.7 million in corporate giving annually and $1.3 million from employees.

Still, Premier will never operate at the scale of some its global competitors, Dykhouse added.

“We cannot out-price the competition or out-build the competition,” he said. “We can’t out-innovate them. We will have good technology but rarely will we be first to market with technology. So our strategic advantage is our people. And that’s why the focus has totally been on that for our growth.”

“Our strategic advantage”

Viewed through that lens – the employees are the strategic advantage – the generous gifts and elaborate celebrations take on more meaning.

“When your strategic advantage is your people, you want to do everything you can,” Dykhouse said. “The thing we tell new staff at orientation is that if you’re simply trading time for money, find something else to do. It has to be more enjoyable. You have to grow and develop. You have to get better at what you do. We want you to get promoted and volunteer in the community and have fun at our celebrations.”

There are about 400 employees who work for the bank. This year, 86 people will mark five-year milestone anniversaries of at least 20 years.

“We have people age 16 to 76. They come from all walks of life, a lot of countries, so how do you get that many people to work together? We said from day one, ‘This is how you’re going to interact with each other and how you’re going to interact with our customers, and if you want to work here, you have to hold those values,’ ” Dykhouse said.

“They’re pretty common sense, like the golden rule, but as an organization you all hold each other accountable. Dave and I and Miles are no different than a first-year teller. We’re all expected to live up to those values, and it’s helped make us successful.”

From the outside looking in, there also seems to be a distinct, shared sense of humor. Having fun at work, it seems, has always been allowed.

Leadership still dissolves into laughter thinking back on the early days of company events, when Bethke’s limited marketing budget resulted in a guest performance by Twiggy the water-skiing squirrel – who, incidentally, would go on to national fame and YouTube immortality with an act that’s exactly what it sounds like.

The squirrel zipped around a swimming pool set up in the parking lot at a new bank branch in Sioux Falls.

“Dana got in the pool,” Bethke recounted. “And the squirrel skied around him.”

It was picked up by a local television station and became the play of the day on ESPN’s “SportsCenter.”

“Our budget was more modest – when Twiggy is the highlight of the year versus Luke Bryan,” Dykhouse laughed.

Joking aside, though, the bank has been serious in recent years about establishing a foundation for its future.

Premier has spent the past five years in particular investing in a broad range of upgrades to internal and external programs and services, much of it technology related.

“We’ve been making sure our systems are built for the future and not the past,” Rozenboom said. “We’ve completely rebuilt the guts of the business.”

Now, it’s time to build a physical presence that reflects how far the bank has come.

While details will be released before construction starting this year, Premier’s leadership said its headquarters will be attractive but functional, a reward to staff and customers.

“We tell our staff that most banks build extraordinary buildings and fill them with ordinary people,” Dykhouse said. “We build nice but more ordinary buildings – and fill them with extraordinary people.”