Dakota Outlook: Inflation will cause personal income drop for South Dakotans

Dec. 8, 2022

A new publication from the nonprofit Dakota Institute for Business and Economic Analysis is forecasting that continued inflation will result in negative real personal income for South Dakotans compared with a year ago.

The quarterly Dakota Outlook was released this week and looked at the macroeconomy, wages and income, housing and the labor force.

It’s produced by the Dakota Institute, a nonprofit with a social entrepreneurship business model. Revenue from business consulting funds the operation and public benefits such as research and analysis.

“We are hoping to grow the Dakota Institute into the go-to resource for economic analysis and expertise in the state and region,” said CEO Jared McEntaffer.

“We want to be top of mind when business leaders, legislators, journalists and the general public need information on economic trends and insights into how those trends might impact their businesses or communities.”

The quarterly Dakota Outlook is meant to allow experts a way to share “the trends we’re seeing and where we think things might be headed,” McEntaffer said.

The inaugural edition explored how South Dakotans’ income is not keeping up with inflation and is “unlikely to at any point in the near future,” McEntaffer said. “Inflation is not going away any time soon. The Fed is trying to keep a lid on inflation, but it is not working – at least not at the speed the Fed would like to see.”

The labor market is “stubbornly strong,” he continued, meaning “businesses expect strong demand for their goods and services at least for the next several quarters. The Fed will not see inflation slow if demand – and therefore prices – continues to chug along without any regard for the Fed’s interest rate movements.”

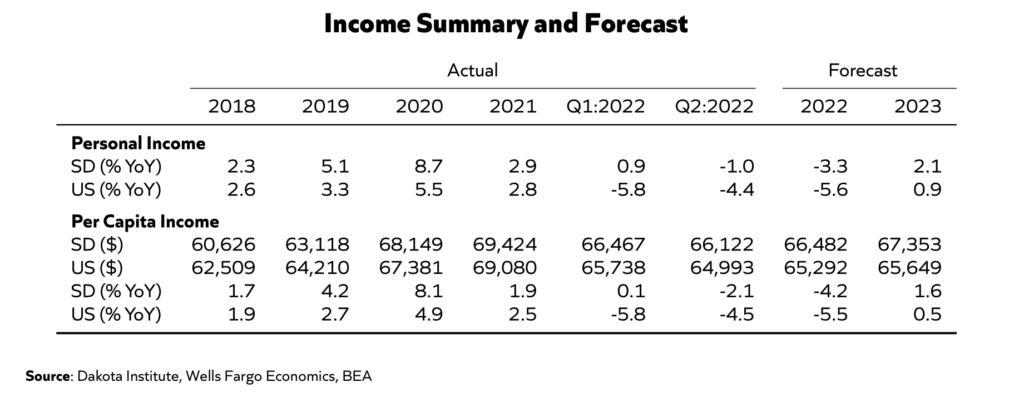

The Dakota Outlook is forecasting South Dakotans’ inflation-adjusted incomes will shrink by 3.3 percent this year, while nationally they will drop 5.6 percent.

Its state-level forecasting leverages “econometric and time-series forecasting models,” McEntaffer said, along with forecasts around inflation from other experts.

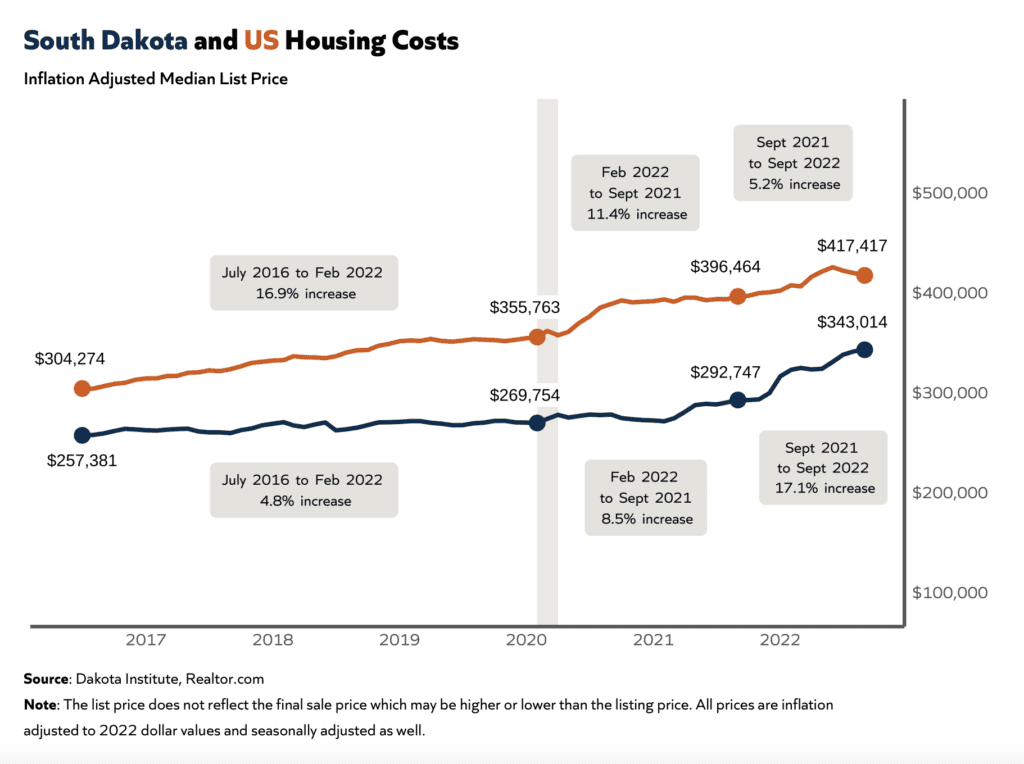

The report also included an analysis from Northern State University’s Aaron Scholl, who determined that even after accounting for inflation, the median list price for a home in South Dakota increased 17.1 percent from September 2021 to September 2022. That compares with 6.4 percent nationally.

“There’s no comparable data from the ‘housing bubble’ period in the early 2000s, but I would be surprised if prices rose that quickly in the run-up to the housing crash,” McEntaffer said.

Dakota Outlook formed a board in 2019 but put the organization on hold during the pandemic. McEntaffer came on board earlier this year after wrapping up consulting work in Rapid City. He’s supported by fellows from the university system: Scholl from NSU and Dave Sorenson at Augustana University.

“Our focus this year has primarily been on developing the concept and building the team of fellows to help produce the Dakota Outlook so we can build our brand and reputation,” he said.

“We have seed funding, so our focus has been foundation building rather than chasing revenue from the get-go. That said, we have completed some economic impact reports for health care organizations and also done a couple data analysis projects over the last year.”

The institute also is planning to actively grow its consulting pipeline next year, including collaboration to produce housing studies in South Dakota communities.

To read the full edition of Dakota Outlook, click here.