Bender outlook: Sioux Falls commercial real estate market primed for ‘a lot of success’

March 3, 2022

Sioux Falls is in for another big year — thanks in part to significant cash still being held in bank deposits, according to the annual market outlook from Bender Commercial Real Estate Services.

In 2021, “Sioux Falls had a wonderful year. It was a banner year,” Bender president Reggie Kuipers said.

This year, is “going to be a great year. We’re going to have a lot of success this year,” he continued, adding he expects residential multifamily to set an all-time record and continued strength from the industrial market, which he called “absolutely on fire.”

He cautioned, though, that the final outcome could fall a bit short of expectations at the beginning of the year.

Like the rest of the country, the Sioux Falls area is showing signs of inflation and appreciation in its commercial real estate transactions.

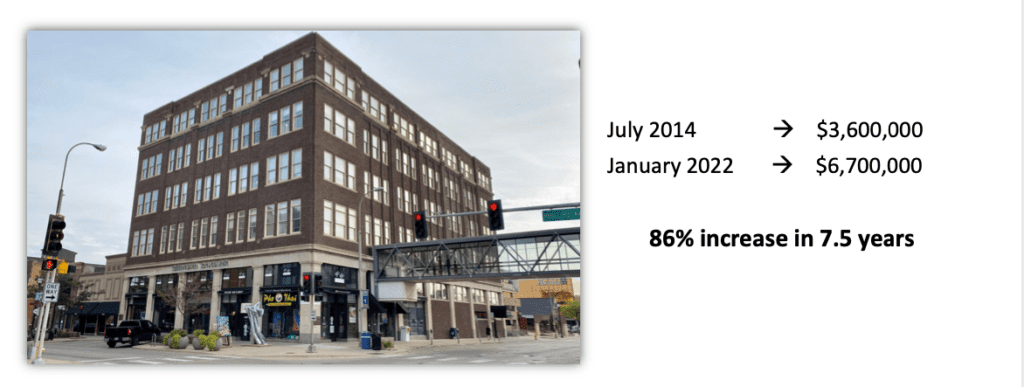

Want a sense for how the market has changed?

When Shriver Square sold in 2014, the price was $3.6 million.

Fast-forward to early this year, and it sold for $6.7 million.

That’s an 86 percent increase in just over seven years, with less than $100,000 in improvements put into the building.

“We could have put several buildings up on this slide,” Kuipers said, adding that with improvements at Shriver, “we think there’s still some runway with this building” to increase in value.

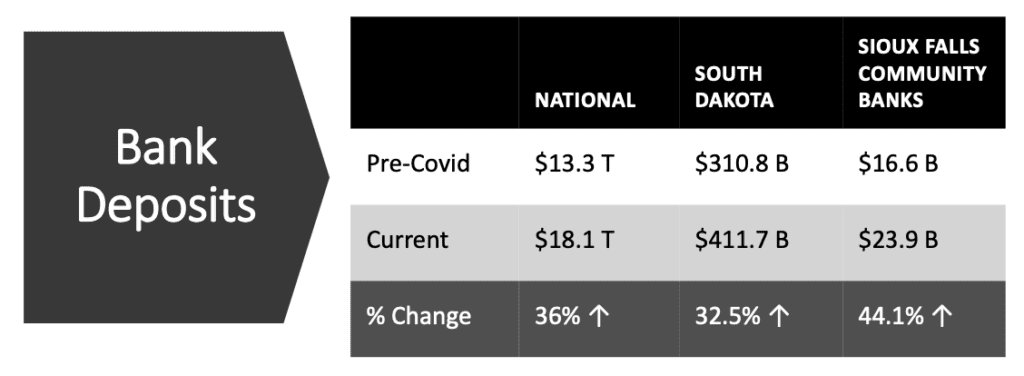

And there’s likely still plenty of cash that could be deployed, Kuipers said. Take a look at how bank deposits have increased during the pandemic.

“You want to know why people are paying for real estate?” Kuipers said. “Because they can.”

Office market

“COVID has completely shifted the way we view office space,” Bender’s Alex Soundy said.

“If you’re an employer and you’re trying to entice your employees to come to the office, you need to offer a quality workspace or some type of incentives.”

Some of the “older, worn-out office product” is converting to industrial space nationwide and locally.

One example is Wells Fargo, which sold a former call center to Graco for $8.3 million earlier this year.

“I think we’re going to continue to see older office product get repurposed for other uses in the years to come,” Soundy said.

Overall vacancy for the Sioux Falls market is 9.6 percent, down from 9.9 percent last year, while it absorbed more than 195,000 square feet of new space. The national average is 15.5 percent.

Locally, the class A vacancy rate is 3.3 percent and trending down, while class B and C are at 12.6 percent and trending up.

“If you own a class A office building and are in Sioux Falls, it has to feel really good,” Soundy said.

The downtown overall vacancy is 5.8 percent, while the market outside downtown is 11.1 percent.

“The expansion of our downtown market is a direct result of business’ desire to be downtown,” Soundy said, adding he expects a “redshift” of what class A office space is downtown and rising rents with the additions of Cherapa Place and The Steel District’s new office buildings.

The suburban market also has demand for more new space, he added.

“Area to keep your eye on: South Minnesota Avenue,” he said.

At the same time, “we’re still continuing to see parking lots of these large corporate offices appear somewhat vacant,” Soundy said.

Business owners are on a three-year timetable to make a decision on returning, he continued.

“We believe they’re on the second half of that timetable and decisions will be made this year for how they’re going to handle that office space going forward,” he said.

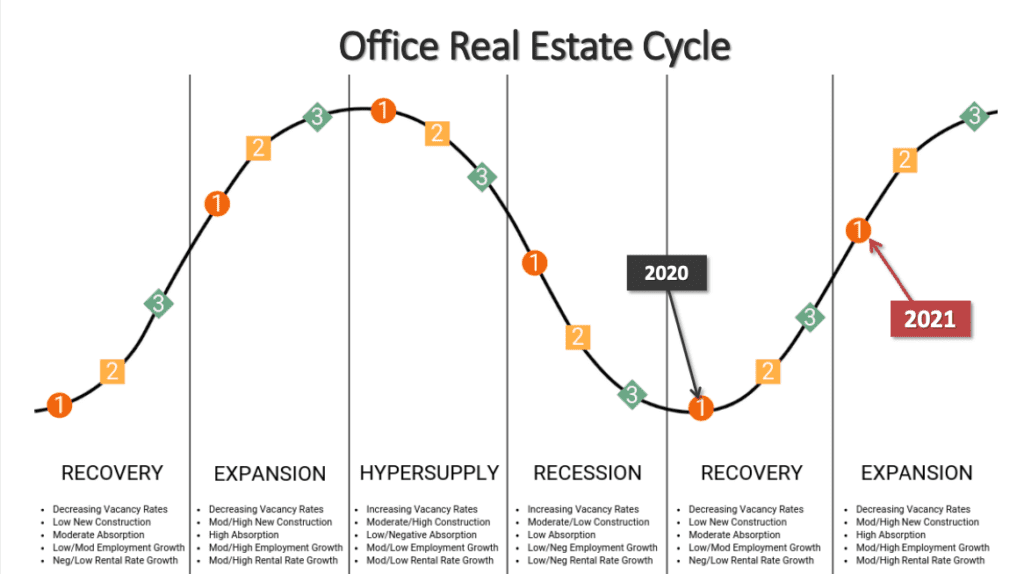

Here’s where Bender estimates the office sector is in the real estate cycle.

Industrial market

The way inventory is managed is changing for businesses, leading to significant activity in the industrial sector.

“What a lot of these companies are doing is they’re switching to a ‘just in case’ model,” Bender’s Rob Fagnan said. “They’re stockpiling inventory right now. What we’re seeing is a lot of buildings getting oversized or companies leasing additional space, sending it out to third-party companies.”

Last year, the city added about 4 million square feet — the equivalent of 70 football fields, and a 16.7 percent increase from 2020.

For instance, FedEx had planned to build a 150,000-square-foot facility, and it ended up adding 330,000.

“They overbuilt because they were banking on the future growth of Sioux Falls,” Fagnan said.

“With all this new construction, it’s not surprising we’re starting to see a tapering off of transactions in the market.”

The market still has a 1.43 percent vacancy rate, down from about 4 percent last year, despite absorbing 4.5 million square feet.

“I can guarantee you we are not going to see 4 million square feet get built this year,” Fagnan said, adding there are some new buildings coming that are being built without immediate users.

“With some of those spec projects, I think we’ll start to see it (vacancy) ever so slightly increase.”

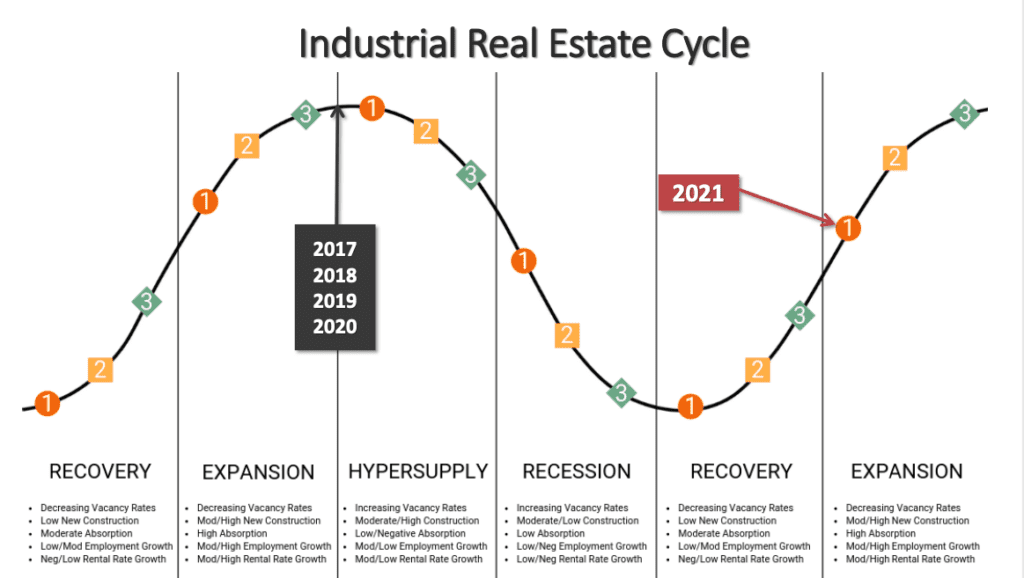

Here’s where Bender estimates the industrial sector is in the real estate cycle.

Retail market

New national names, including Chick-fil-A and Chipotle, dominated retail headlines in the past year, with development centering around Empire Place in front of The Empire Mall.

“That’s a big deal for one area to attract that many national retailers on their first site,” Bender’s Rob Kurtenbach said.

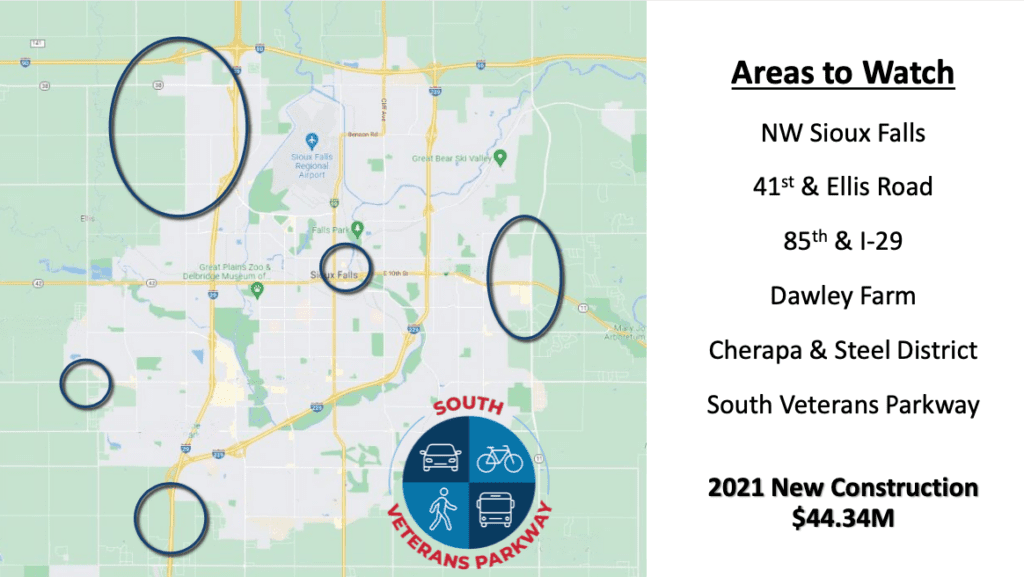

The northwest is positioned for retail growth, driven by new residential and major employment centers.

“Look for this area to really start to take shape,” Kurtenbach said. “Watch for retailers to fill the gap between Jefferson High School all the way up to I-90.”

On the east side, Veterans Parkway will continue to attract retail growth, he said.

“Dawley Farm is an area that is quite established but continues to grow,” Kurtenbach said, adding retail will continue to fill in to the north and eventually to the south.

Retail vacancy is 12.5 percent, down from 13.3 percent in 2020.

Empty big-box stores have largely been filled, “and we’ve really stabilized our vacancy rates,” he said.

“I think we’re going to see some additional retailers come as well.”

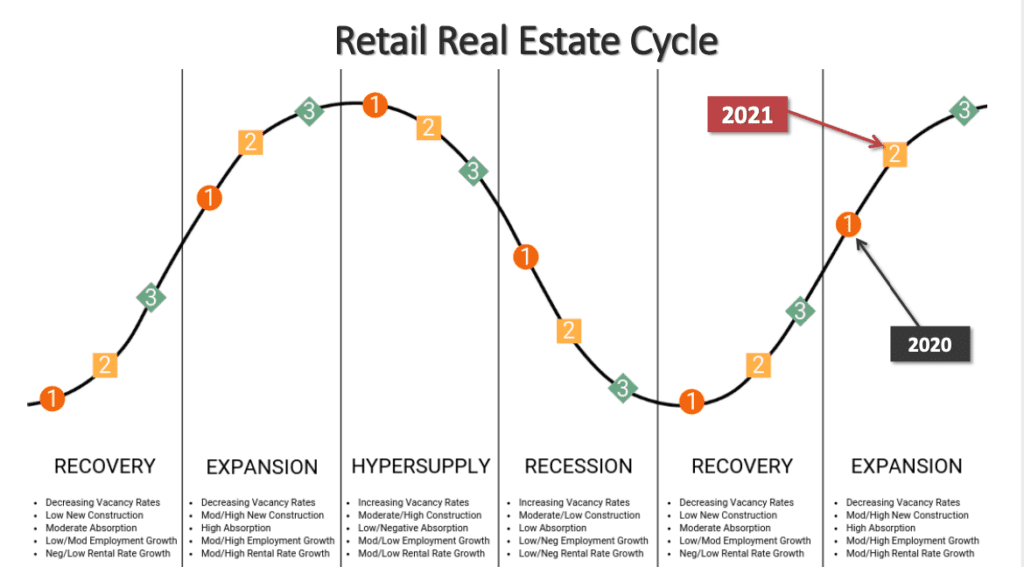

Here’s where Bender estimates the retail sector is at in the real estate cycle.

Land market

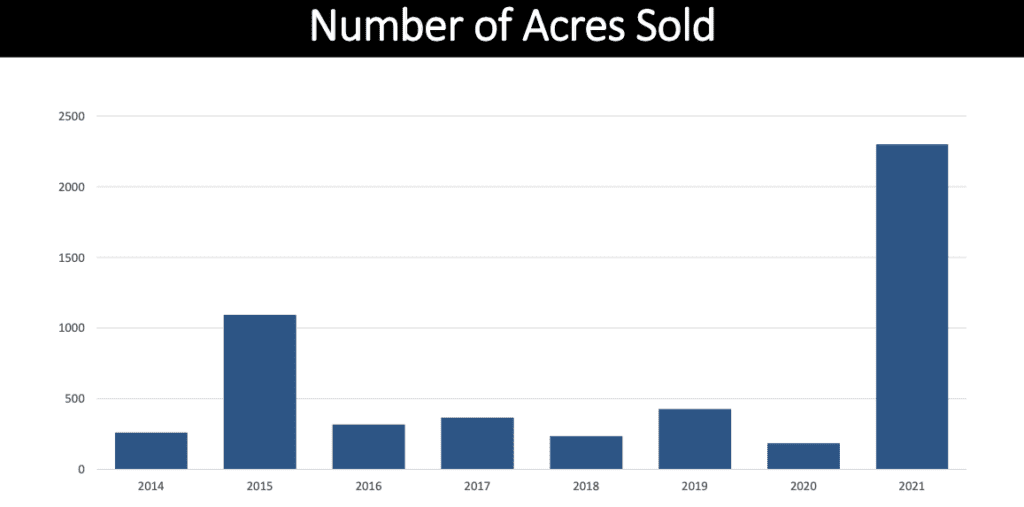

The amount of land sold in Sioux Falls shot up in 2021 at nearly 2,500 acres and more than doubling the last closest year in 2015.

“Just to put that into perspective, the city of Tea has about 2,200 acres annexed into the city limits,” Bender’s Bradyn Neises said. “That’s a big year.”

Residential land sales in the past year in the metro area ranged from $25,000 to $50,000 per acre, while commercial land went for $50,000 to $75,000 per acre. Sites being “land banked” for future development ranged from $16,000 to $26,000 per acre.

Developers “are going out, buying land and trying to capture some of that demand,” Neises said.

“I still think we’re going to have a strong year. We might not buy the (equivalent of the) city of Tea. Maybe Hartford is more manageable.”

Investment market

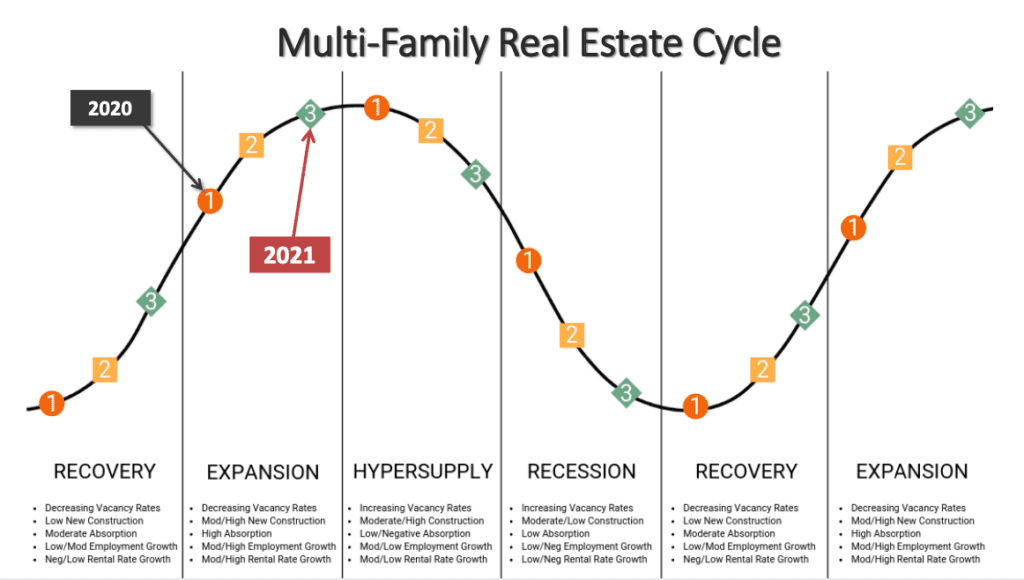

The Sioux Falls apartment market is experiencing historically low vacancy, around 3 percent, which is half of what was available last year.

“That’s incredible,” Bender’s Nick Gustafson said. “That means there’s almost no apartment units available.”

Construction prices might be the only thing curtailing new construction to add supply, he said.

Rents pulled back during the beginning of the pandemic, but as vacancy rates plummeted, there was “intense rental growth,” Gustafson said.

For apartment buildings that sold, the average transaction was more than $108,000 per unit in 2021, he said, up from $72,000 in 2019.

“That’s incredible,” Gustafson said. “And it was a record year.”

He predicts that even though interest rates are expected to rise, capitalization rates on apartments won’t change much.

“We know, just with our own clients, there are so many investors waiting for the right property to purchase, there’s so much capital on the sidelines right now,” he said. “Cap rates are not going to go up any time soon.”

Here’s where Bender estimates the multifamily sector is at in the real estate cycle.