Bender annual market outlook shows increased office, industrial space available

March 2, 2023

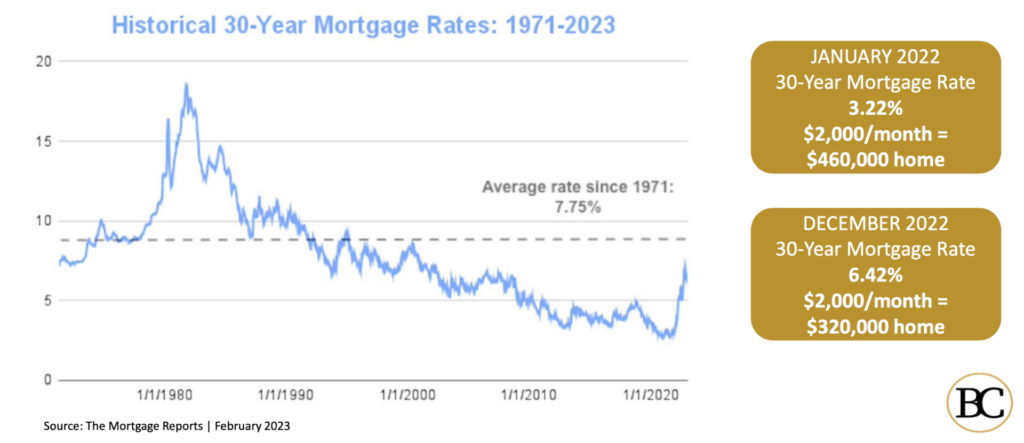

In January 2022, a $2,000-per-month mortgage payment supported a typical mortgage for a $460,000 house. By the end of the year, that had dropped to a $320,000 house.

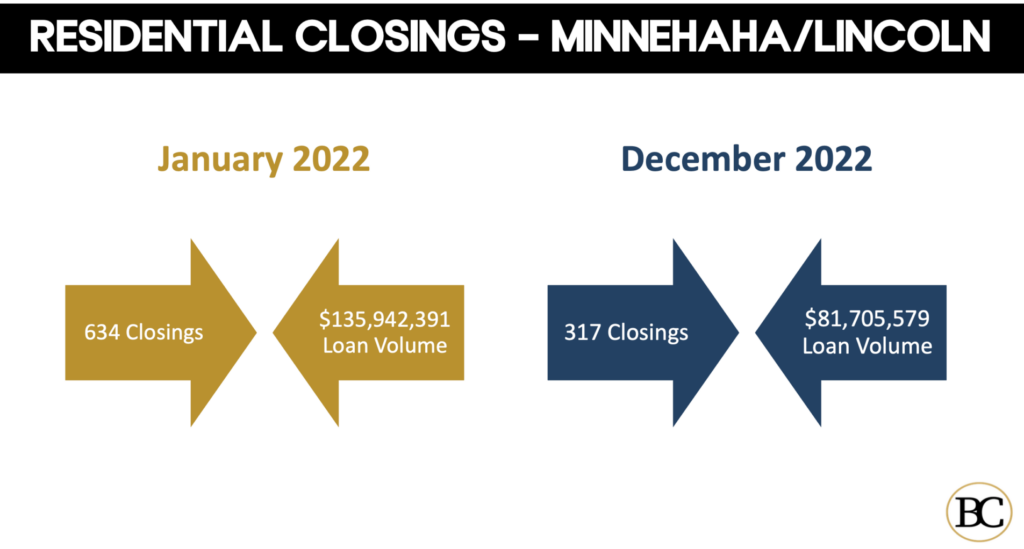

The number of real estate transactions in Sioux Falls nearly dropped in half too.

Why does that matter to a commercial real estate outlook?

“The commercial sector is going to lag 12 to 24 months behind that,” Reggie Kuipers, president of Bender Cos., said during a presentation at its annual market outlook.

For now, though, any softening in the market appears to be minimal.

Bender’s annual market outlook found increased vacancy in some sectors but still a healthy level of occupancy.

“We do think that recession is coming. Headwinds are coming. Maybe they’re already here,” Kuipers said, while adding:

“The business climate is 72 and sunny here.”

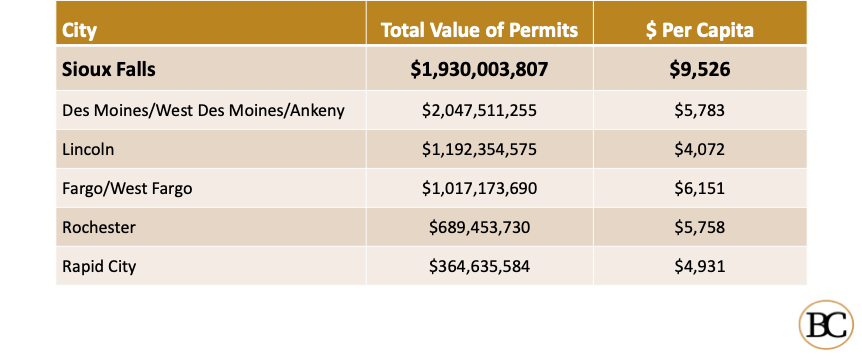

Sioux Falls’ building activity at nearly $2 billion in 2022 outpaced regional communities, especially on a per-capita basis.

“We’re going to watch this trend and watch this continue to grow,” Kuipers said.

Office market

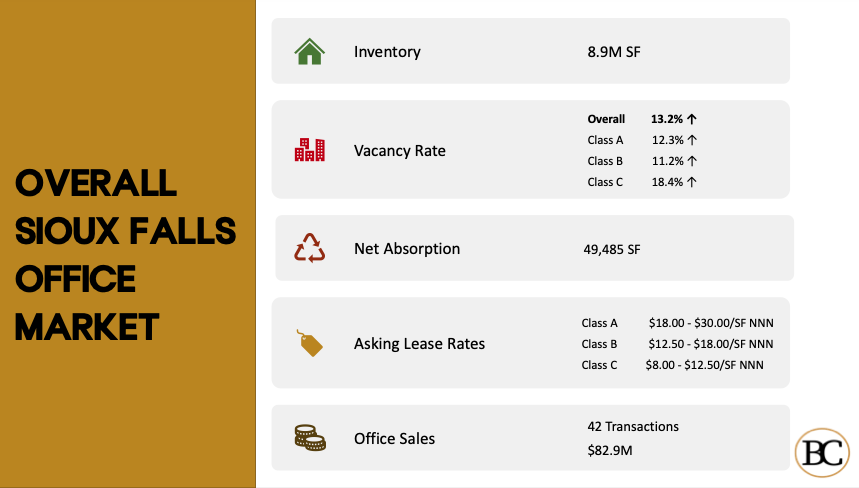

The office market saw increased vacancy in 2022, reaching 13.2 percent overall but below the national average of 17.5 percent.

“We had a lot of call center space hit the market,” Bender’s Alex Soundy said.

Cherapa Place and The Steel District also added more than 300,000 square feet to the market.

For landlords, there still is demand, he said.

“Tenants are looking for high-quality office space with good amenities,” Soundy said, adding that employers are using their spaces as a way to attract workers back to the office.

The office market also might be leveraged to help businesses avoid announcing mass layoffs, Kuipers said.

“But they’re going to force people back to the office, which they know will thin their herd,” he said.

Within the downtown, the vacancy rate was 11.2 percent for Class A, or the highest-quality space, 9.5 percent in Class B and 4.5 percent in Class C.

“It is safe to say that the demand was there” for the addition of Cherapa and The Steel District.

“With that large addition, we only saw a single-digit increase in Class A vacancy,” Soundy said. “Watch for the rest of that vacancy to be filled up going into 2023.”

The suburban office market has higher vacancy, including 21.9 percent in Class C space.

“We’ve had that vacancy rate continue to tick up year over year,” Soundy said. “This is mainly being driven by call centers.”

There is nearly 600,00 square feet of call center space available for lease, sublease or sale, he said.

“Watch for some of these call center buildings to be purchased and repurposed.”

Going forward, Class A lease rates and Class C vacancy will continue to increase, Soundy predicted.

“Sioux Falls has always had an extremely healthy medical office market, and I expect that to continue going into 2023,” he added.

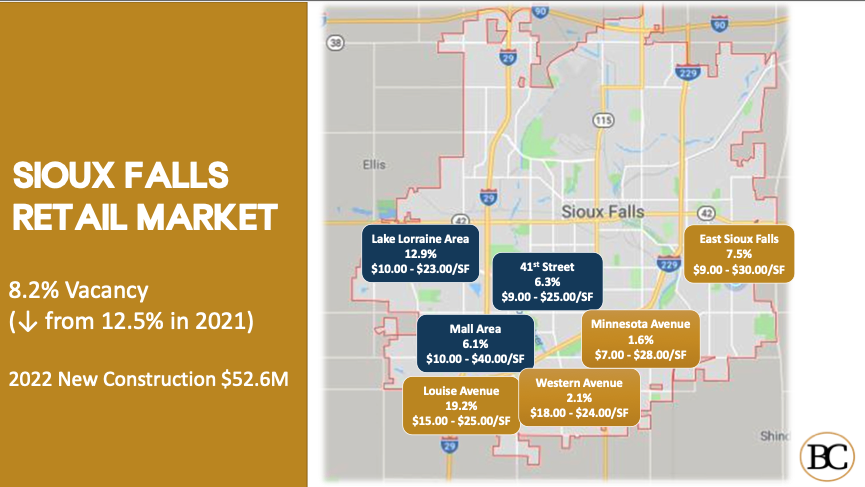

Retail market

Retailers are back to leasing space after a slight pause during the pandemic.

“Retailers have had a pretty good couple years. If you’ve owned a retail center, you probably felt pretty good about your investment,” Bender’s Rob Kurtenbach said.

Retail vacancy, at 8.2 percent, is down from 12.5 percent a year ago.

New names in the market include Dillard’s, opening in 2024, and Kwik Trip, which has several locations coming. Several retailers, including Chipotle and Crumbl Cookies, opened second locations in the city.

“Steel District and Cherapa … there are going to be some real exciting announcements coming in the future on the retail side for those two projects,” Kurtenbach said.

Retail property sales likely will drop following two record years, and vacancy likely will go up based on new projects, he predicted.

Industrial market

The industrial market saw a 5 percent increase in overall industrial space last year, including some of the first large industrial buildings built without immediate tenants.

Much of the space could be filled by the end of the year. Bender’s Rob Fagnan said.

Despite the new construction, the vacancy rate is 2.56 percent, compared with the 3.9 percent national average.

“We’ve always been a pretty tight market but also a very healthy industrial market here in Sioux Falls,” Fagnan said.

Companies are paying “much more on a price per square foot for industrial property than they ever have in the past,” he added.

“We’ll continue to see another strong year in 2023 for new construction. Vacancy, we continue to absorb all that available space … so I think we’ll stay in that 2 to 3 percent vacancy range.”

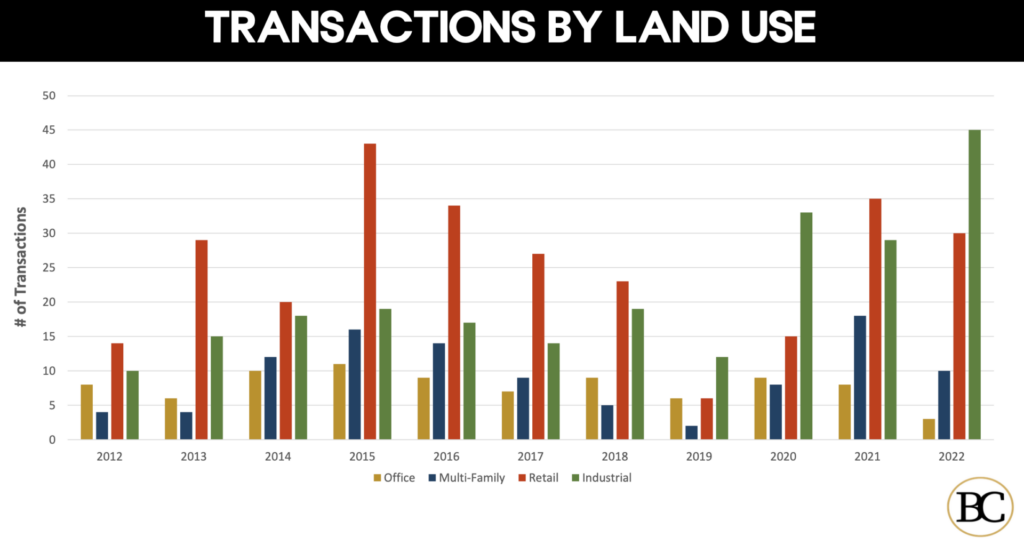

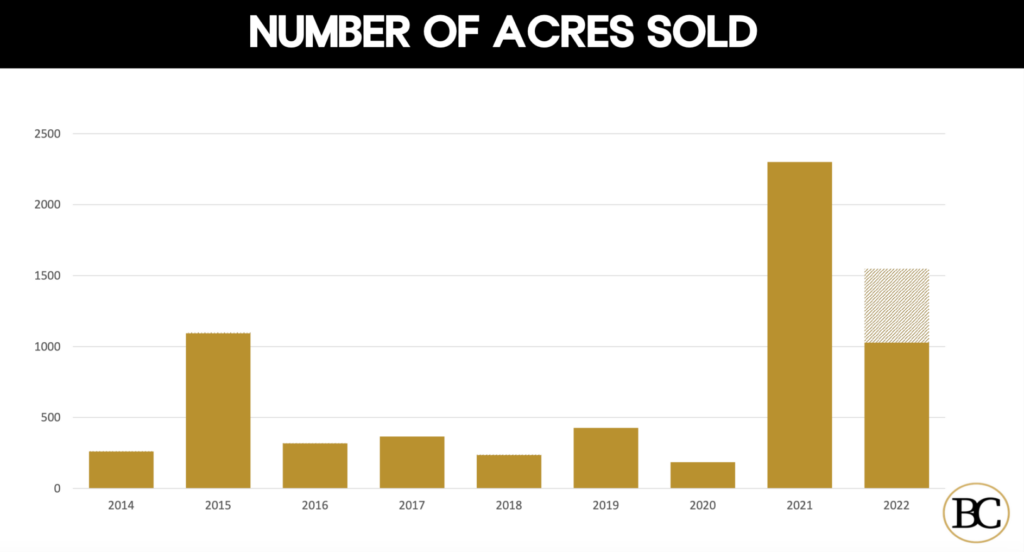

Land market

In land sales, improved land deals essentially were the same as in 2021. Office land hit an all-time low though, while industrial transactions shot up.

“That’s a lot of demand in our industrial market. That’s over 106 transaction in the last three years,” Bender’s Bradyn Neises said.

“Our traditional users for office, particularly our medical users, they’re not looking for office sites anymore. They’re looking for retail sites.”

Those offer more accessibility for patients and visibility for their businesses, he said.

There also was a strong year in unimproved land sales, but other deals that were under contract never came together because buyers pulled back, Neises said.

Going forward, “I think we’ll see some private developers really turn their focus to industrial and bring more industrial offerings,” he said, adding surrounding communities will accelerate plans to get industrial parks on the market.

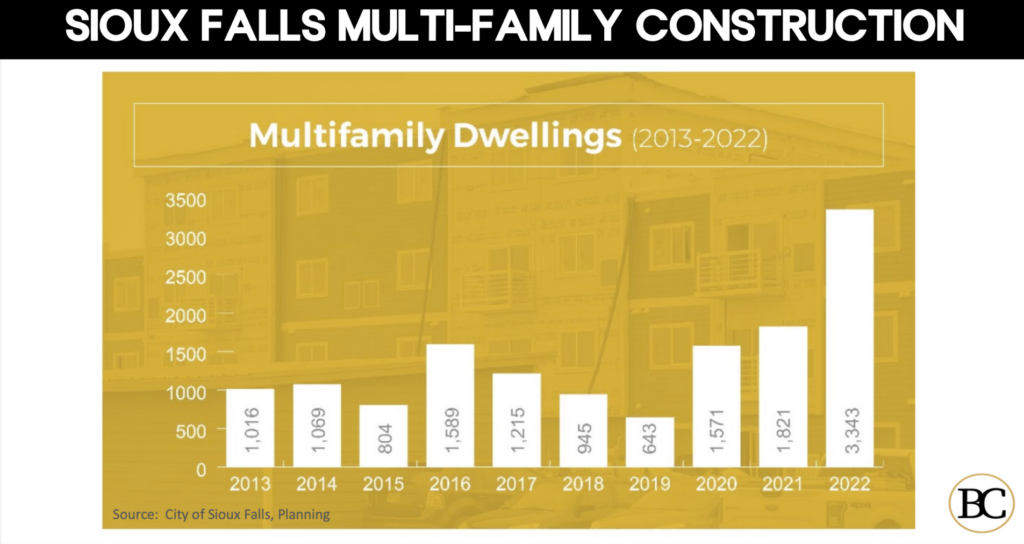

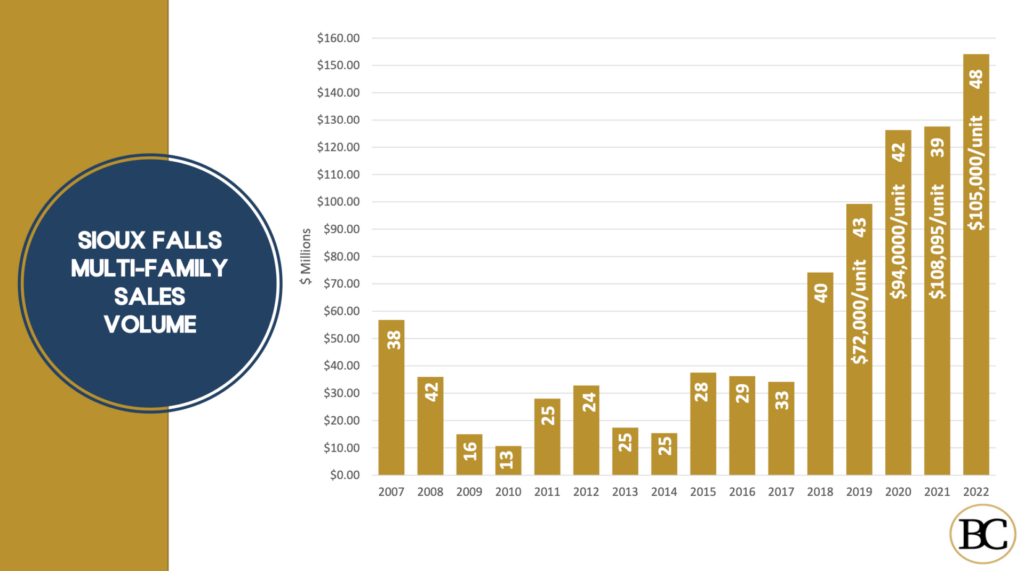

Investment and multifamily market

The Sioux Falls market experienced a record year, adding more than 3,300 units. The vacancy rate, though, still hovers under 4 percent.

“That’s pretty awesome,” Bender’s Nick Gustafson said.

“We’re not overbuilding the Sioux Falls multifamily market at this point. It’s a nice contrast to the national market. We’re looking pretty good with multifamily. In fact, we’re looking really good.”

Sales transactions hit an all-time high, he added.

“Wow,” Gustafson said. “That’s incredible.”

As vacancy predictably increases, sales also likely will drop as will construction, he predicted.

“We’re going to probably see about 1,200 to 1,500 new units get built, and that’s simply going to be due to cost of construction and interest rates.”

Capitalization rates for several multifamily and retail transactions were at or approaching 6 percent in many cases last year.

Going forward, “2023 is going to be a pause year for a lot of investment transactions,” Gustafson said. “We’re busy, we’re doing transactions, but some of the transactions that might have happened a year ago at 3 percent interest rates are going to pause this year.”

If the Federal Reserve continues to raise interest rates, “we are definitely going to feel that here in Sioux Falls in our investment market,” he said.