Sioux Falls CEOs report some declining sentiment in quarterly survey

July 11, 2022

Sioux Falls CEOs are feeling less enthused about business conditions and the future, according to the most recent SiouxFalls.Business CEO survey.

SiouxFalls.Business conducts the quarterly survey in conjunction with the Augustana Research Institute.

The latest survey was conducted during late June and completed by nearly 100 CEOs and business owners.

“Local business conditions and expectations about the future remain high; however, they are lower than three months ago and significantly lower than the peak reached one year ago,” said Reynold Nesiba, a professor of economics at Augustana University.

“These data are consistent with other national data and an economy facing rising interest rates, high inflation, falling stock market values and continued disruptions to food and energy markets resulting from Russia’s attack on Ukraine.”

Business conditions largely are regarded positively but are showing some decline. The survey shows 84 percent of CEOs report conditions at their business are good or excellent, down from 92 percent three months ago and down 16 percentage points from a year ago, when 100 percent rated conditions that favorably.

“In any case, business activity remains high but is less euphoric than earlier this year or one year ago,” Nesiba said.

Looking ahead, 42 percent of CEOs expect above-average business activity in the next three months, down from 56 percent at the end of the first quarter. Forty-five percent are expecting an average increase.

The national data and analysis from The Conference Board’s June 28 report is consistent with the sample from Sioux Falls, Nesiba added. At the national level, the Consumer Confidence Index decreased in both May and June and is at its lowest level since February 2021.

“Expectations have not dropped as sharply among our survey respondents in Sioux Falls, but they have declined,” he said.

“In Sioux Falls, we continue to benefit from ongoing population growth of about 7,000 (people per year).”

Survey results also are provided to the Sioux Falls Development Foundation and the Federal Reserve Bank of Minneapolis to assist in their understanding of area business conditions.

“Overall sentiment seems to be declining, but only modestly, which is not a big surprise under current conditions,” said Ron Wirtz, regional outreach director for the Minneapolis Fed.

“Despite the decline, I would still characterize overall sentiment as quite positive. Heck, if I were to see this survey’s responses in a vacuum – without knowing where they came from or seeing earlier results – I’d feel pretty good about them.”

Overall sentiment – the share of positive minus the share that is negative – “is still net-positive by a wide margin virtually across the board,” he added. “It’s just not as wildly optimistic. Given all of the challenges, that’s still impressive, and I think a testament also to the current strength of the Sioux Falls economy.”

Wirtz reviews monthly building permit data in Sioux Falls, and the numbers “continue to be off the charts, which is another really positive sign for the economy,” he said.

Sales and pricing

Most CEO report that sales increased in the previous quarter, with 61 percent reporting a slight or significant increase, versus 70 percent three months ago.

“A strong business climate is characterized by strong sales. One way to measure these directly is to examine sales and use tax receipts for the state of South Dakota,” said Nesiba, noting that May sales tax figures show ongoing general fund receipts growing at 9.6 percent compared with this time last year.

“The Legislature adopted an overall revenue forecast of 6.5 percent growth,” he said. “We now expect total general fund revenue to be between $2.11 billion and $2.13 billion. This will result in a surplus of general fund revenue between $49.2 million and $68.6 million.”

Many CEOs also have implemented pricing increases, with 78 percent saying they raised prices slightly or significantly, compared with 76 percent three months ago.

“There is no way from the survey to tell if input prices are increasing at the same rate as output prices. In an inflationary environment, rising prices can be profitable for a firm. It depends whether output prices are increasing faster than input prices,” Nesiba said. “Firms with little market power or a limited ability to raise prices because of competitive conditions can face a profit squeeze if their input prices – costs – are rising faster than their output or sale prices – revenues. Those firms who operate with market power and who can raise their prices faster than input prices can find an inflationary environment highly profitable.”

State of hiring, capital expenditures

Despite potential headwinds, CEOs still are focused on hiring, with 58 percent saying they had a slight or significant increase in hiring in the past three months, compared with 65 percent three months ago.

Looking ahead, 85 percent expect average or above-average hiring in the next three months, up from 82 percent three months ago.

“In Sioux Falls from May 2021 to May 2022, unemployment has fallen from 3.4 percent to 2.3 percent, and the labor force has grown from 158,700 to 161,300,” Nesiba said. “This means that 34 percent of the nonfarm labor force in South Dakota now occurs in the Sioux Falls metro area.”

CEOs are still making capital investments in their businesses and planning more. In the second quarter, 84 percent reported slight or significant increases in capital investment. This is the same as one year ago and down from 89 percent three months ago.

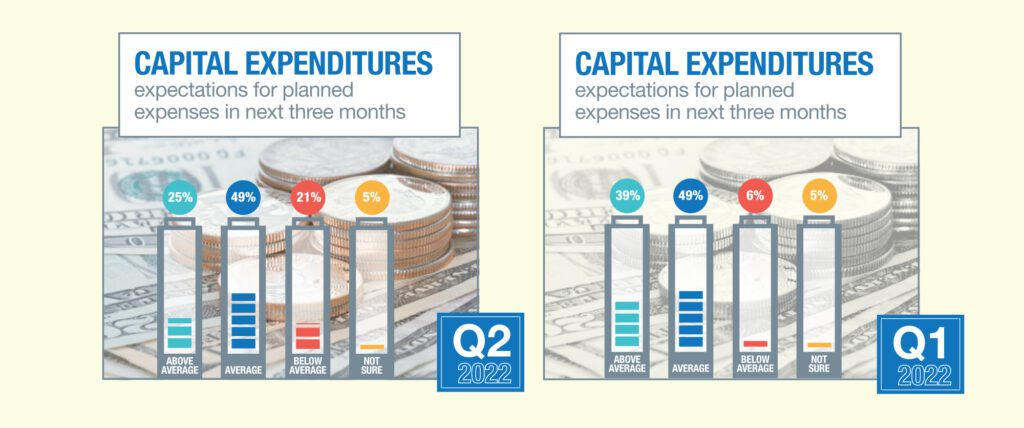

Expectations for future capital expenditures remain high, but are declining from a year ago and the previous quarter. Many firms — 74 percent — expect average or above-average capital expenditures in the next three months, compared with 88 percent in the prior three months. And 21 percent now expect below-average capital spending, compared with 6 percent three months ago.

“This 21 percent (report of) decline in expected capital investment is among the most pessimistic findings from this quarter’s survey,” Nesiba said. “Investment spending is historically highly volatile. Rising interest rates have made funding capital expenditures more expensive. Inflationary pressures, tight labor market conditions and slowing economic growth have likely contributed to these less robust expectations for future capital expenditures.”

The survey results are also consistent with a late June report from the Bureau of Economic Analysis, he said.

The latest data on GDP growth is from the first quarter when growth fell at an annual rate of 1.6 percent.

“This was down sharply from the 6.9 percent growth recorded in the final quarter of 2021,” Nesiba said. “The decrease in real GDP reflects decreases in net exports – exports declined and imports increased – declining federal government spending, a reduction in private investment, as well as declining spending by state and local governments.”

Economy perceptions

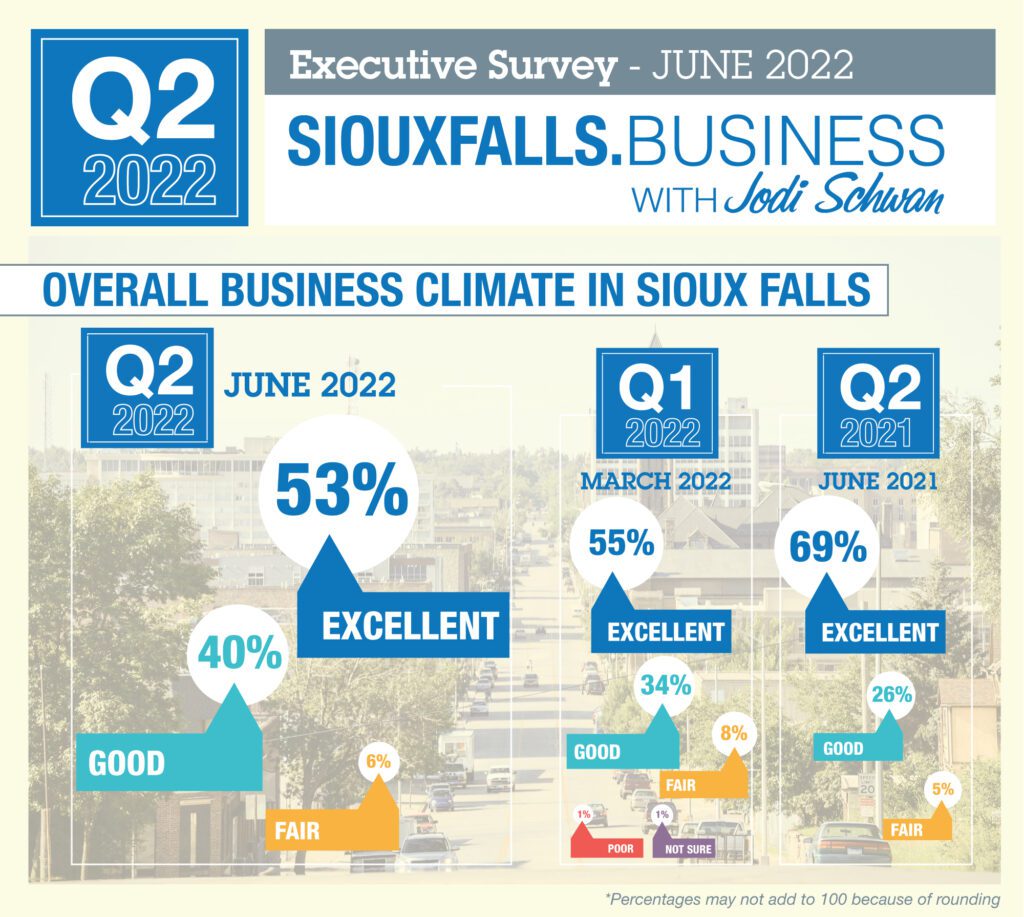

CEOs also have diminishing perceptions of the local and national economies. In Sioux Falls, 53 percent said the overall business climate is excellent, down from 69 percent a year ago.

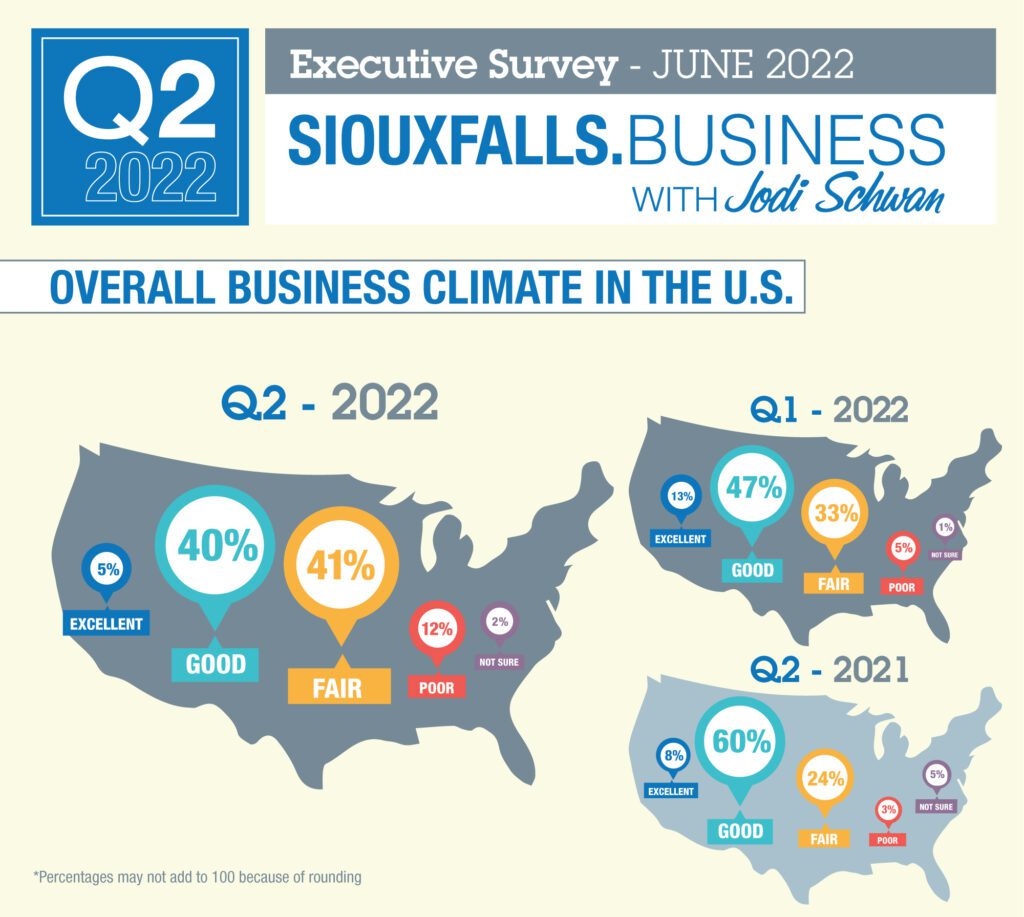

A majority rate the U.S. economy fair or good at 81 percent. And 12 percent rated it poor, up from 5 percent three months ago and 3 percent a year ago.

“More local business leaders — almost 50 percent — regard business conditions in Sioux Falls as significantly better than those in the U.S. as a whole. This disconnect likely reflects discontent over inflation, rising interest rates that are expected to continue and slower economic growth at the national level,” Nesiba said.

“In contrast, Sioux Falls continues to boom as measured by Sioux Falls building permits, population growth and business activity. Part of this optimism about the local business climate is fueled by unprecedented levels of federal, state and other spending in and around Sioux Falls.”

Why does the overall euphoria appear to be diminishing?

Nesiba points to:

- Increases in energy and food prices — in part exacerbated by Russia’s attack on Ukraine and that continuing war — have spawned rising global inflation.

- Continued supply chain disruptions have raised costs, slowed delivery and frustrated a variety of manufacturing, construction, health care, agricultural and retail processes.

- Congress and the president are reducing budget deficits sharply and thereby reducing the federal government’s net contribution to the overall economy. This reduction was one of the key factors for negative GDP growth in the first quarter.

- The Board of Governors of the Federal Reserve has announced clear plans for contractionary monetary policy and rising interest rates for the near future. “This shift from expansionary to contractionary policy at the national level will lead to slower or negative economic growth,” he said. “As a result, many see a national recession as increasingly possible in 2022. Sioux Falls is growing in population and employment. The number of construction cranes dotting our landscape has perhaps never been larger. However, our great city is not immune to global and national macroeconomic fluctuations. It is these macroeconomic factors that likely explain the source of our diminishing euphoria.”

Sioux Falls Development Foundation resources

Do you have further information to share about conditions at your business? Or are you looking to connect to additional resources to support your growth? The Sioux Falls Development Foundation can assist you in the following areas:

- Workforce development: The Development Foundation offers programs and initiatives to help you attract, retain and develop your workforce. Contact Denise Guzzetta, vice president of talent and workforce development, at 605-274-0475 or [email protected].

- Business growth and expansion: Whether your business is planning an expansion in the next five years or facing risk factors impacting growth, the Development Foundation can help by discussing existing building space, available land, potential local and state incentives and other resources. Contact Mike Gray, director of business expansion and retention, at 605-274-0471 or [email protected].