Sioux Falls-area CEO survey finds slight softening in business conditions but overall positive results

Oct. 17, 2022

Sioux Falls-area businesses appear to be weathering the current combination of inflation and interest rate hikes, with most continuing to report solid business conditions and plans for the future.

That’s according to the most recent SiouxFalls.Business quarterly CEO survey, conducted in partnership with the Augustana Research Institute.

The latest survey was conducted during late September and completed by nearly 80 CEOs and business owners.

“Despite significant headwinds at the national level caused by inflation and the fiscal and monetary tightening that is attempting to rein that in, CEOs in Sioux Falls remain optimistic,” said Reynold Nesiba, a professor of economics at Augustana University.

“Their comments lead one to believe that the Sioux Falls economy remains strong, continues to grow and remains resilient.”

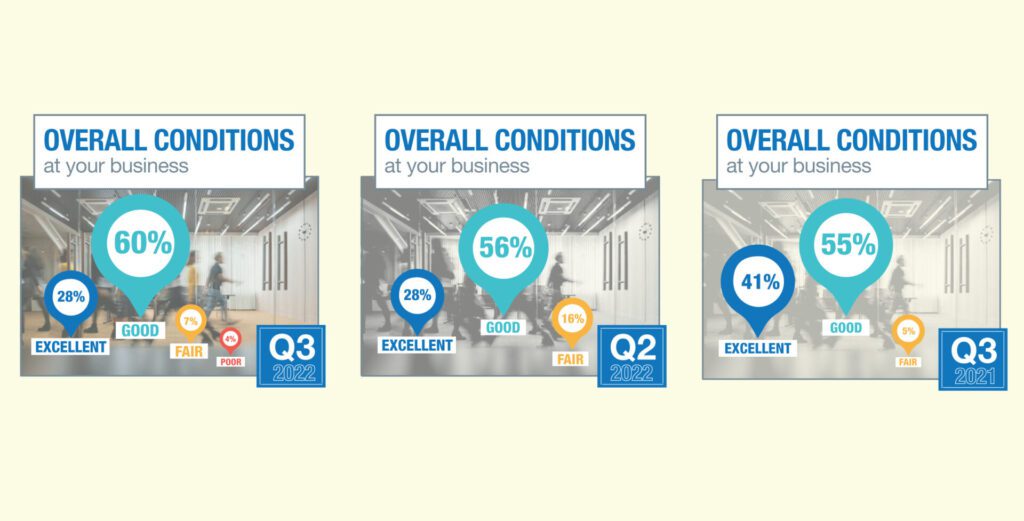

Overall, CEOs reported a mixed bag of business conditions in the third quarter compared with the second quarter, with 88 percent rating their own business conditions as good or excellent, 7 percent calling them fair and 4 percent calling them poor. Three months prior, no one called business conditions poor, though 16 percent called them fair.

One year ago, though, 96 percent said conditions at their business were good or excellent — so there has been deterioration.

Sales activity continues to show increases, though, with a majority of CEOs reporting at least a slight increase in the past three months.

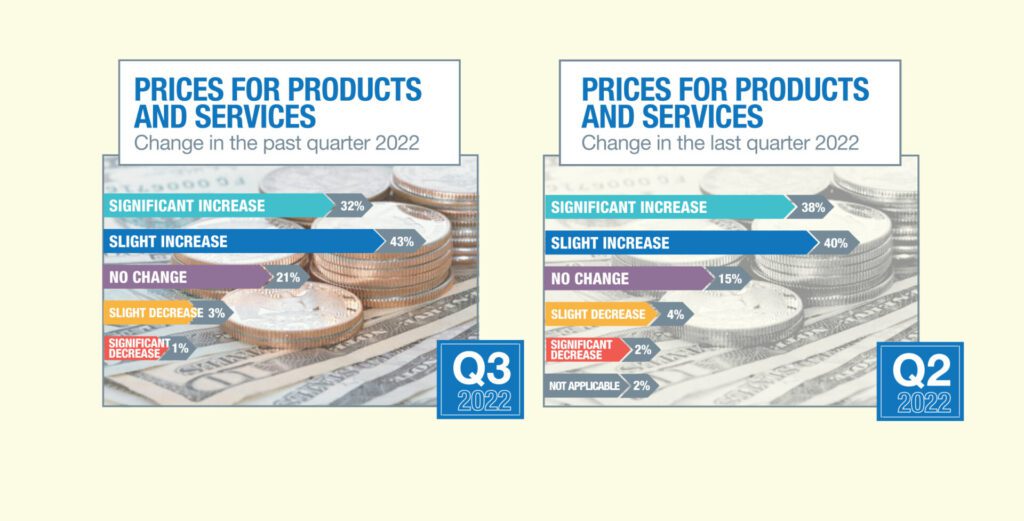

Prices are still going up, too, with three-quarters reporting their prices for goods and services have increased in the prior quarter.

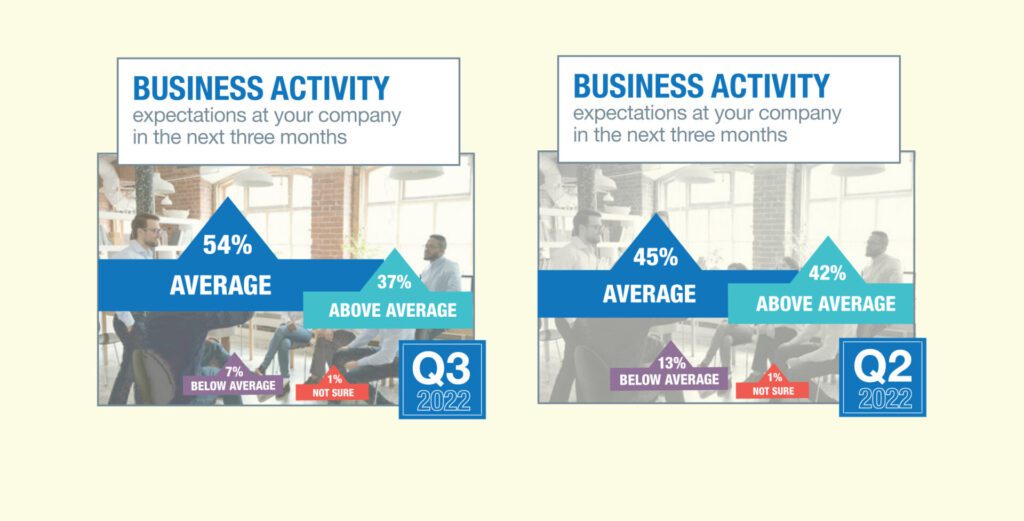

They’re also optimistic about the future, with more than half expecting average business activity for the next three months and 37 percent forecasting above-average business activity. Seven percent expect activity to be below average. While fewer CEOs projected above-average activity compared with the previous quarter, the number expecting below average also improved.

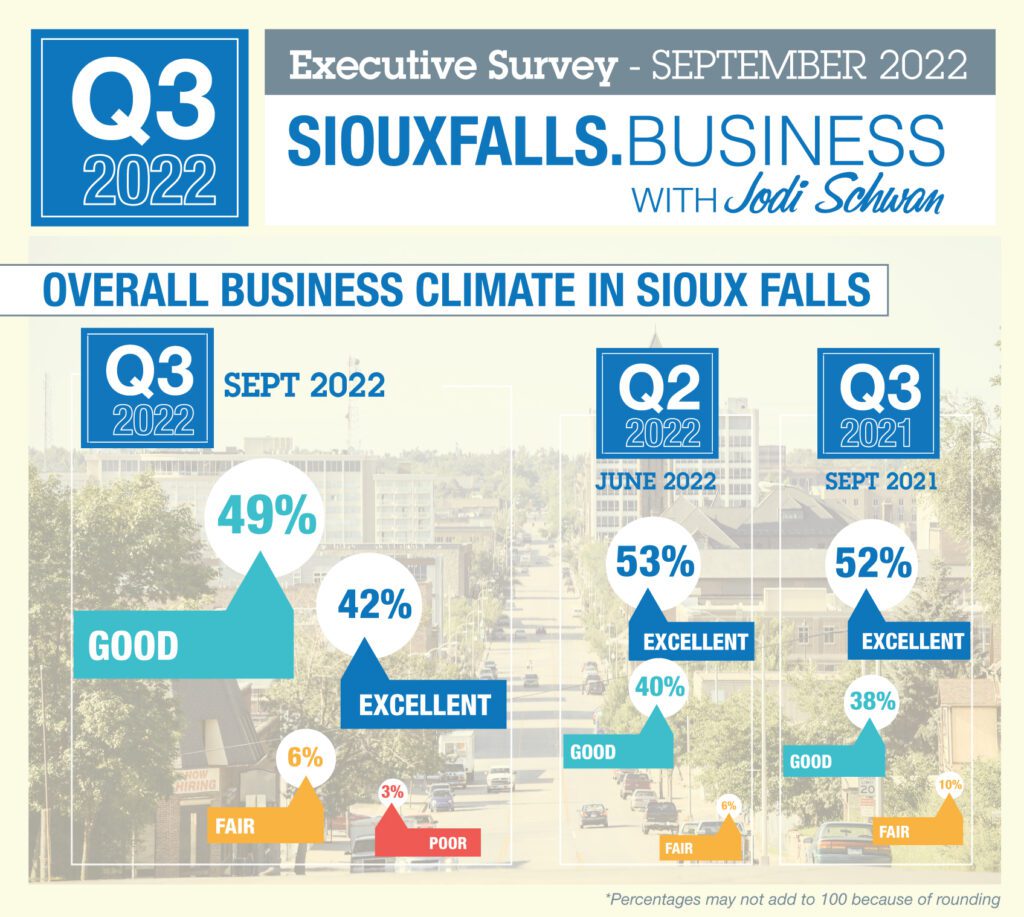

Overall attitude toward the business climate in Sioux Falls has softened, with 42 percent rating it as excellent, compared with 53 percent three months ago.

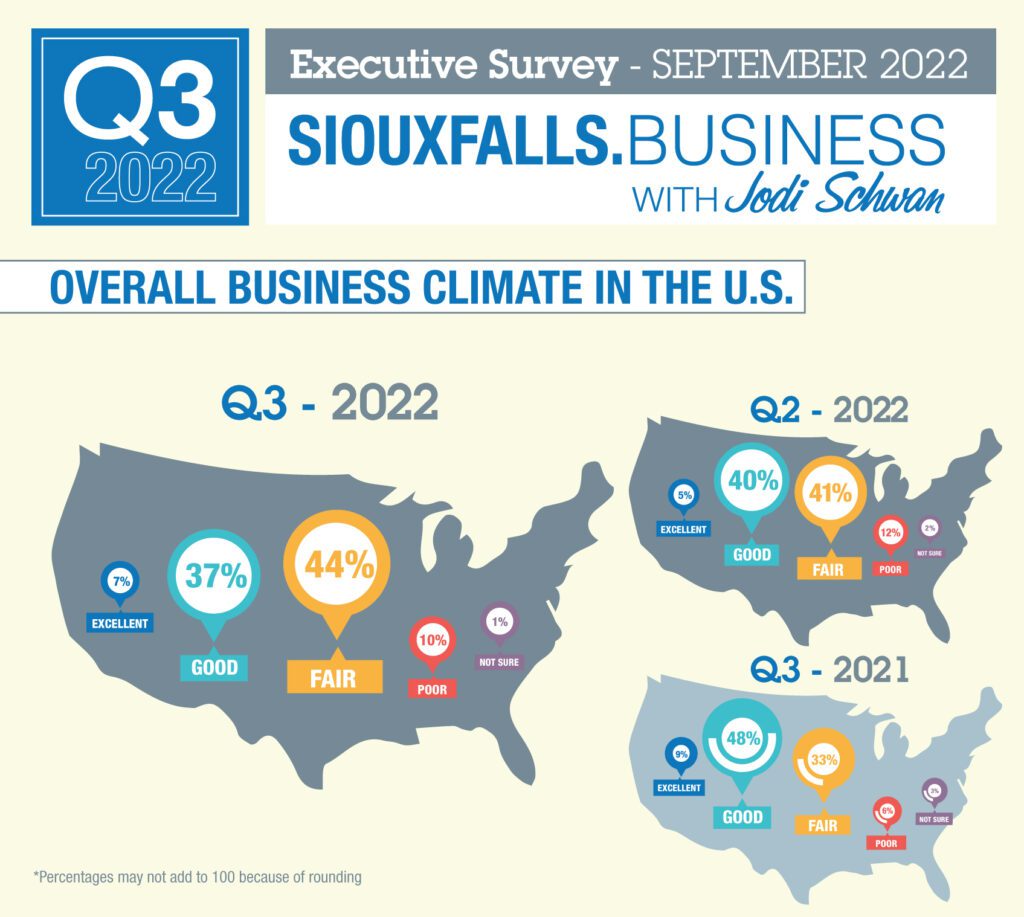

That’s still considerably better than how they view the national economy, with 44 percent calling it fair and 37 percent good. Those numbers are fairly consistent with the view in the second quarter.

Hiring still appears to be robust. Forty-five percent saw a slight increase in hiring in the past quarter, while 6 percent had a significant increase.

Projected ahead through the end of the year, nearly two-thirds of CEOs expect average hiring, with 22 percent projecting above average and 7 percent forecasting below average. That’s stronger than the projections three months prior.

“This seems consistent with the national picture. The U.S. economy is continuing to create new jobs but at a slower rate than in the recent past,” Nesiba said, pointing to a recent jobs report that put national unemployment at 3.5 percent.

“At the same time, the number of job openings fell, and applications for unemployment rose. The labor force participation rate — the share of folks working or actively seeking work as a share of the overall population — also fell. It is hard to believe that in April of 2020 the national unemployment rate peaked at 14.7 percent. We have made rapid and dramatic progress in less than 2 1/2 years.”

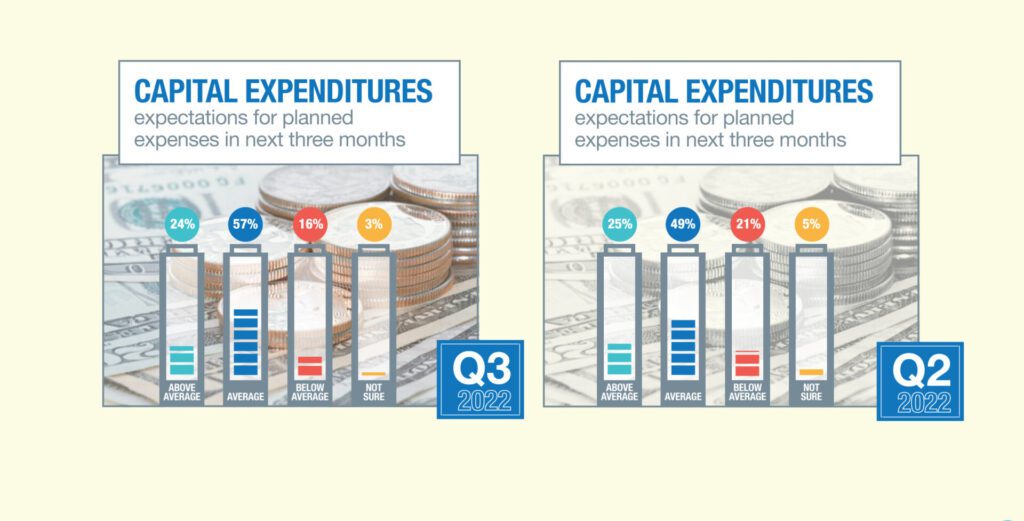

Nearly all Sioux Falls CEOs also said they have at least average capital spending planned for the remainder of the year, with one in four projecting above-average spending.

“Despite the pessimistic news about inflation and rising interest rates at the national level, Sioux Falls CEOs are reporting a much more positive picture,” Nesiba said. “The survey suggests rising business activity, steady sales activity and rising capital expenditures. This is good news for those of us who live and work here.”

Survey results also are provided to the Sioux Falls Development Foundation and the Federal Reserve Bank of Minneapolis to assist in their understanding of area business conditions.

“Our conversations confirm what the survey indicates: a slowdown brought on by supply chain issues, inflationary costs, higher interest rates and worker shortages,” said Bob Mundt, president and CEO of the Sioux Falls Development Foundation. “In general, a bit more cautious and deliberate in their decision-making.”

Comparatively, though, Sioux Falls stand outs.

“Overall results seemed quite positive — business as usual in Sioux Falls, even if it’s not business as usual almost anywhere else in the country,” said Ron Wirtz, regional outreach director for the Minneapolis Fed.

“While results declined slightly across the board, I would almost attribute that to some normal regression-to-the-mean stuff. It’s the old saying that what goes up must come done eventually. But overall activity and sentiment still seems quite strong/positive on balance. Given the many challenges in the economy – inflation, higher interest rates, supply chains, etc. – the survey suggests that Sioux Falls companies are still navigating those challenges quite successfully.”

The city’s “head-slapping” construction year likely is contributing to the positive sentiment and business activity, he added.

“Construction projects are expensive and really labor and input intensive, and it would seem all of that activity is probably having some spillover effects, especially among firms who derive much of their sales locally,” he said.

“Volatile markets tend to hit certain kinds of firms differently but consistently, compared with other types of firms.”

For example, the pandemic has been harder on small businesses that don’t have as much scale to weather price increases from vendors and supply chain issues. In this survey, though, there was a notable increase in the share of small firms responding, “so I would have expected things to turn a little more sideways because of that, but they didn’t, at least as much as I might have otherwise expected,” Wirtz said.

The impact of inflation and subsequent interest rate decisions by the Federal Reserve clearly are trickling down to a local level, Nesiba added.

“So many business decisions and policy decisions are being driven by inflation and expectations of inflation at this moment,” he said.

“Rate increases are expected to continue given the positive job report. … This will dampen overall spending. At the same time, the nation’s fiscal deficit — the federal government’s net contribution to the overall economy — will shrink by $1.7 trillion. This too will reduce overall aggregate spending. We will see if the fiscal and monetary tightening succeeds in reducing inflation without causing a recession. That seems unlikely. Given the strength of the Sioux Falls economy, we are poised to weather that downturn better than most.”

Sioux Falls Development Foundation resources

Do you have further information to share about conditions at your business? Or are you looking to connect to additional resources to support your growth? The Sioux Falls Development Foundation can assist you in the following areas:

- Workforce development: The Development Foundation offers programs and initiatives to help you attract, retain and develop your workforce. Contact Denise Guzzetta, vice president of talent and workforce development, at 605-274-0475 or [email protected].

- Business growth and expansion: Whether your business is planning an expansion in the next five years or facing risk factors impacting growth, the Development Foundation can help by discussing existing building space, available land, potential local and state incentives and other resources. Contact Mike Gray, director of business expansion and retention, at 605-274-0471 or [email protected].