Learn more about retirement plan management at upcoming training

Sept. 21, 2022

This paid event listing is sponsored by Plan Sponsor Roundtable.

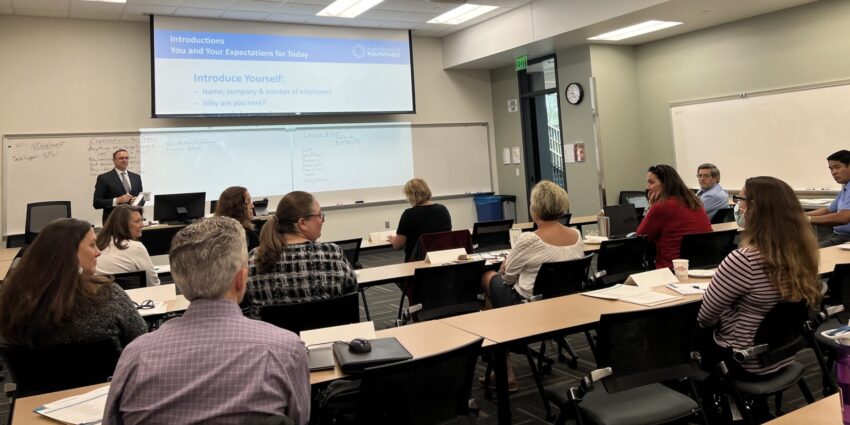

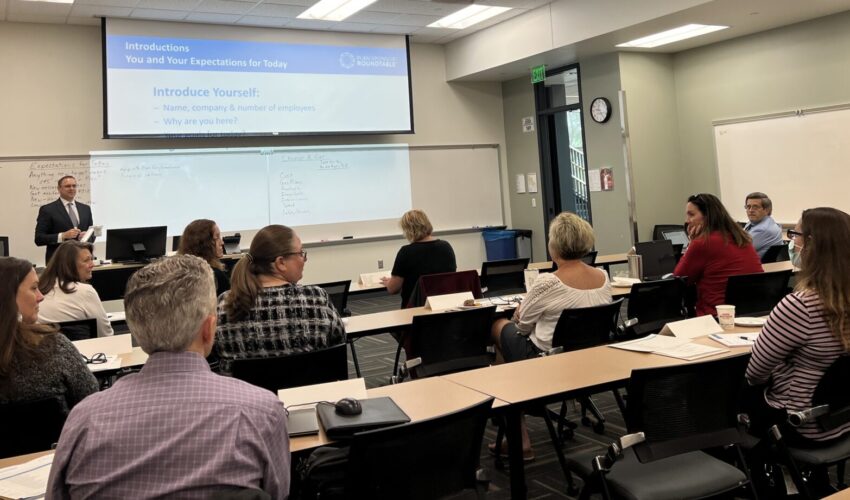

If you have significant responsibility managing a 401(k) retirement plan for your organization, a free upcoming training will help ensure you have the essential knowledge you need.

Presented by Plan Sponsor Roundtable, the training organization was founded by Twin Cities business leader Joe Brummel, who also owns Strategic Retirement Partners and recently relocated with his family to Sioux Falls.

Brummel created the roundtable concept a decade ago after realizing many business leaders wanted to have great 401(k) plans and make smart decisions but lacked the knowledge to do so.

“Even plan sponsors who were responsible for their company’s 401(k) for many years were making mistakes and not realizing it,” he said “They just didn’t know any better, and they were relying on service providers whom they thought were serving their best interests, which is not always clear. The response to our programs has been consistently great since we started, and we are happy to satisfy some requests for expanding to new locations this year.”

There’s nothing like the training offered locally, he said. It’s geared toward those who have authority over their organization’s retirement plan, such as a 401(k), 403(b) or 457.

“We tend to see a variety of business leaders such as owners, CFOs, controllers, HR professionals and other executives at our classes,” Brummel said. “The mix of perspectives and how we facilitate sharing is part of the unique value of our roundtable programs.”

The first free Foundational Fiduciary Training class in Sioux Falls will be from 9 a.m. to 3 p.m. Oct. 20 at Augustana University, 2001 S. Summit Ave.

“The response we have received from business leaders here has been very positive,” Brummel said. “Those with knowledge of the retirement plan industry have expressed that an educational program like this is very much needed here, that too many plan sponsors ‘don’t know what they don’t know.’ That comment resonated because we hear similar comments from new attendees at our Foundational class – they didn’t know what they didn’t know until they attended the class.”

Here’s what to expect during the class:

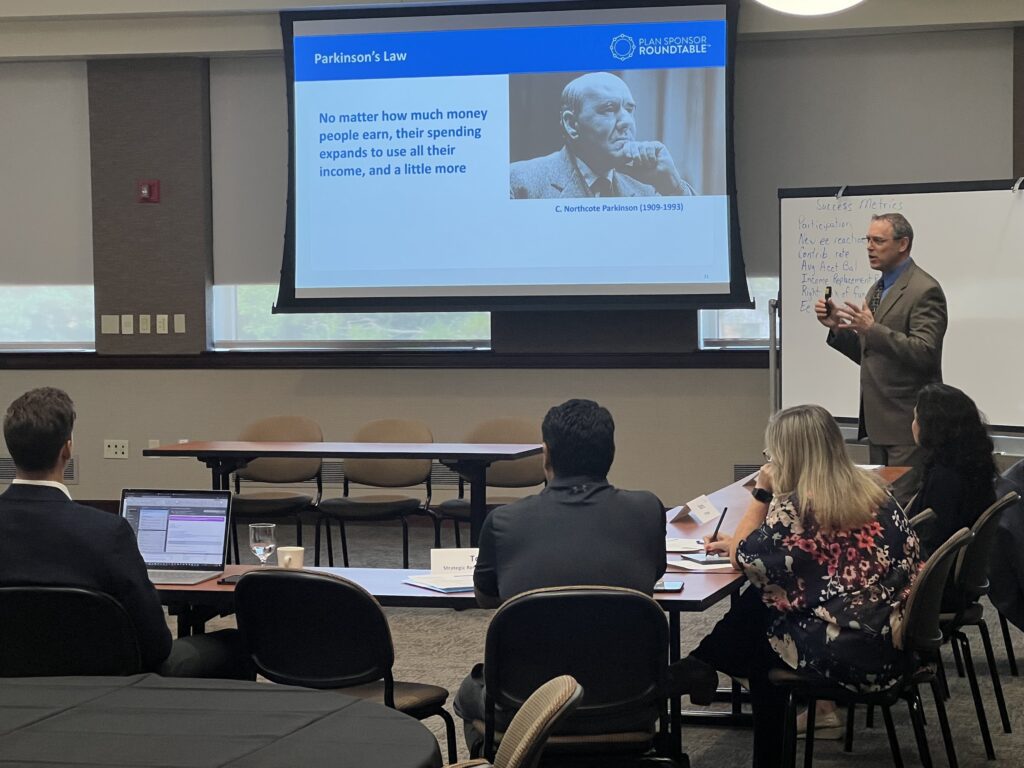

It covers fiduciary roles and responsibilities, who is who in the retirement plan industry, behavioral finance — how people think and behave financially — and retirement plan trends and best practices.

“For much of the training, we use analogies and interactive exercises from outside the industry that are very relatable,” Brummel said. “We cover a lot of essential knowledge for plan sponsors in this program, and everyone walks away with an action plan.”

The agenda includes five sessions:

Session I: Behavioral Finance for Improving Plan and Participant Outcomes – An insightful presentation that sets the tone for the rest of the sessions to build upon.

Session II: Keynote speaker topic – For the Oct. 20 program, this will be an expert on the new Pooled Employer Plans, or PEPs, which are new and generating a lot of questions.

Session III: Ask the Panel – Plan sponsors can ask any questions on retirement plans to a panel of industry experts.

Session IV: What Is and Is Not Working in Today’s 401(k) Plans? – Small-group breakouts over a working lunch followed by a combined sharing of issues and solutions.

Session V: The Ideal Plan – An insightful illustration of how to create your ideal plan and the impact of that for your employees.

“We hold our Foundational class specifically at a college or university to help set expectations – this is going to be a learning experience,” Brummel said. “This is very interactive, which is the way adults learn best, and our training includes a combination of academic knowledge and real-world experiences. Much of what we teach is new to even the most experienced plan sponsors. And for anyone new to the retirement plan industry, we translate the industry’s jargon and don’t speak over anyone’s head.”

For human resource professionals interested in maintaining their SHRM certifications, this class provides five hours of continuing education credits. For CPAs, the hope to be approved for five hours of CPE credits.

“Financial support is provided by organizations in the retirement plan industry who believe in our educational mission,” Brummel said. “By the way, while many of those companies provide financial support and experienced speakers, we do not allow them to pitch any products. We often hear from new attendees that they kept waiting for product commercials but were pleasantly surprised we were true to our educational mission.”

Attendees at previous sessions shared comments such as:

- “So much to learn but it was explained in a good & optimistic way.”

- “I highly enjoyed the experience, learned a lot and am excited to implement what I learned.”

The hope is that Plan Sponsor Roundtable will add more programs in Sioux Falls based on demand.

“If you care about your employees and want to better understand your fiduciary role and retirement plan best practices, our Foundational Fiduciary Training class is essential,” Brummel said. “Informed fiduciaries make better decisions – bring your entire retirement plan committee. Even if it is just you!”

While the training is free, registration is required. Click here to learn more and sign up.