Jodi’s Journal: Jamie Dimon’s visit – the rest of the story

Aug. 8, 2021

“Is it your biggest interview ever?” my friend asked when hearing what was on my schedule last week.

That answer was a quick “no.”

My biggest interviews happened when I was just starting in the profession – I was actually a teenager – and those would make a whole series of columns themselves.

You could argue interviewing Jamie Dimon wasn’t even my “biggest” interview this week, given I also had a chance to sit down with Ashley Furniture founder and chairman Ron Wanek – who also could be another column.

But I absolutely was thrilled with the chance to interview Dimon, who’s not only CEO of the nation’s largest bank, JPMorgan Chase, but also a leader among the world’s CEOs.

This is someone who has been voted among the most influential and respected business leaders both by his peers and by the business media.

The only part where I struggled a little was with the questions. What do you ask someone who has been interviewed by everyone? That’s what makes high-profile interviews tough. It can feel like every quote has been given, every sound bite recorded.

I always default to a foundational element: my audience. I report for those interested in local business news. So I would attempt to keep this conversation local and focused on what my audience would want to know.

I did not expect my first exchange with Dimon would involve him asking a question instead of me.

But as he arrived in Sioux Falls to waving Chase flags and pompoms, shook some hands and made his way to the podium where he would speak at the bank’s ribbon-cutting for its first branch in South Dakota, he veered my way first.

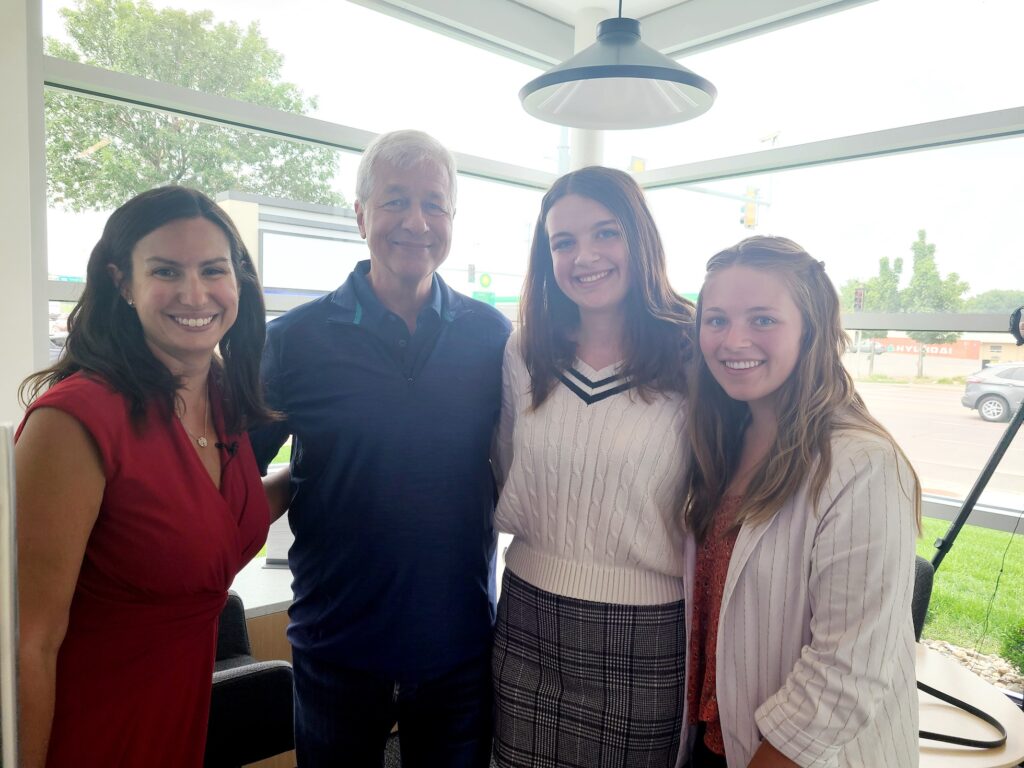

We shook hands, and he did the same with the two student-reporters standing next to me.

“Are these your kids?” he asked.

“Not exactly,” was the first thing that my “caught off-guard” self thought to reply.

I later explained to him that as their boss, there are some definite parallels to parenthood, which he understood. Molly Wetsch and Chloe Houwman have been reporting for us the past several months, and both plan to study business and finance in college, so I wanted them to experience this with me.

By the end of the day, it definitely had been a learning experience for all of us.

You can watch the full interview below, but essentially I talked about the Sioux Falls market, how it fit into some larger national themes and what Dimon’s thoughts were on our post-pandemic future.

I was lucky – the team at Chase granted me a generous amount of time and had no restrictions on what could be discussed.

But if they had given me time for only two questions, these would have been them.

First, I thought about what is the Sioux Falls economy’s biggest threat to growth, the element that would both interest and potentially concern my leadership audience the most.

Labor.

Right?

Right.

And I’ve become increasingly frustrated by those, even in leadership, who insist on oversimplifying this issue.

They are quick to tell you the reason we don’t have more people working is because certain people can make more on enhanced government benefits because of the pandemic than in some jobs.

And, at least in Sioux Falls, I just can’t logically make a case for that in this moment in time. Not with less than 3 percent unemployment and a still-robust labor force participation rate. There’s something more going on. But what is it?

Dimon didn’t claim to have all the answers. But he did immediately acknowledge it’s not that simple.

“People are always looking for the simple answer,” he said, while going on to suggest there are at least four distinct reasons why businesses might be struggling to hire.

Of the 7 million people out of the workforce, 1 million or 2 million probably have decided to retire, he said.

“That’s fine. That takes place. We think it accelerated that,” he said.

There could be another 2 million waiting for school to start before looking for a job, Dimon continued.

“They have kids at home. They have people at home. They don’t have care. So they’re going to wait until September.”

Another 2 million could be still bringing in more in benefits than employment, he acknowledged, giving the example of someone whose benefits equate to $20 per hour being reluctant to return to a $12-per-hour service job.

“That job will always be available. It isn’t like they’re going to lose a good job,” he said.

And the rest is likely churn. People have moved.

“They’ll eventually start looking for jobs around here, but they haven’t even started yet,” he said. “So it’s a whole bunch of reasons.”

He also reminded me that a tight labor market can be “a great thing.”

“Jobs are plentiful. That’s good. Wages are going up, particularly for low pay. That’s not so bad,” he said.

“This is the most dynamic, prosperous economy the world’s ever seen. It will find a way to grow again.”

That was the first question. And the second was one I probably most wanted to know.

This one was about being a CEO today. If you’re a true leader, it always has been about more than just leading your business. It’s about being a leader in your business community, your state and even your nation if given the opportunity.

And what it means to be a CEO is changing. In the past year, our CEOs have been asked to weigh in on public health, election law, social justice and any number of other issues outside the core of their business.

“How do you feel the role has changed and what is most necessary to be an effective leader at this moment?” I asked Dimon.

His first words on the topic were these:

“First of all, I think business and government have to collaborate to succeed with civic society,” he said, which includes institutions such as churches and community colleges.

“It will not work if we’re at each other’s throats.”

America has seen a period of slow growth in the past 20 years, Dimon continued, which “has hurt lower-paid people more than anyone and minorities more than anyone,” he said.

“I think it’s because of health care, education, regulation, taxation, immigration, litigation. If we fix those things, I think we could grow a lot more.”

He gave the example of health care, where America produces some of the best people and facilities in the world, and spends 18 percent of gross domestic product while the rest of the world is at approximately 9 percent, yet “our outcomes aren’t that better. In fact, they’re worse,” he said. “We have more infant mortality. We have more obesity; people dying younger. We have drug problems.”

Fix these and other problems, and “America will be healthier for it,” he continued. “And health is an important part of productivity and happiness.”

They were all great points, I thought, and worthy topics that a CEO should be helping tackle in addition to the individual’s actual business. But then one word popped into my head, and I figured it was worth a quick follow-up.

The word was trust.

I guarantee you there will be people reading my work or watching my interview who, for whatever reason, don’t trust Jamie Dimon or others in similar roles. They’re “big banks,” part of “big business.” Those same people likely don’t trust me, either. I’m “the media,” which we all know carries a stigma that sadly has taken root even deeper in recent years. And they certainly don’t trust “the government.” That’s probably an entirely separate column.

You can’t lead if people won’t follow, and they won’t follow if they don’t trust. I didn’t even pose it in the form of a question for Dimon so much as I did a thought.

“I trust you,” he responded. “I can tell by talking to you. But you earn it every day, and you look at what people actually do.”

I consider Dimon trustworthy as well, but as he continued: “Too many people blanket with the same, ‘Oh, the media is not trustworthy.’ That’s prejudice. Some are quite trustworthy. Some aren’t. Make a distinction. It takes a little courage to make a distinction.”

It takes courage to lead in today’s environment, too, whether you’re a small-business person as I am or the leader of the nation’s largest bank or somewhere in between. It also takes a willingness to engage in your community, to be part of the solution when it comes to educating people who will become your future workers, supporting better health for all and pointing out when policy is limiting our potential shared prosperity.

And the point about earning trust can’t be underestimated. It’s the same thing I tell myself and others about the need to approach how we do our jobs in a climate of distrust. And it applies just as well to anyone in business as it does to someone like me in the media. You earn it every day, as Dimon said.

The whole interaction lasted less than 20 minutes and also involved some great conversation with the students, when Dimon asked about their career plans and reminded all of us he believes journalism plays a critical role in the nation’s democracy. You can tell a lot about a businessperson by how that person treats the youngest employees. Want to work your way to the very top, as Dimon did? That seems like a good place to start.