How to invest in the stock market for beginners

Oct. 23, 2023

This paid piece is sponsored by MarketBeat.

In 2023, you can buy stocks in the same amount of time it takes you to place a bet on an online sportsbook. But does that mean you should become an investor?

Start by asking yourself this question:

Do you want to build wealth slowly or to get rich quickly?

If you want to get rich quickly, you may be better off placing that bet. Some will say that investing in the market is just another form of gambling.

If you’re looking to build wealth slowly, few things are more efficient than investing in stocks and allowing them to grow over time. Investing in quality stocks — while carrying some risk — can be a cost-effective way to build wealth over time.

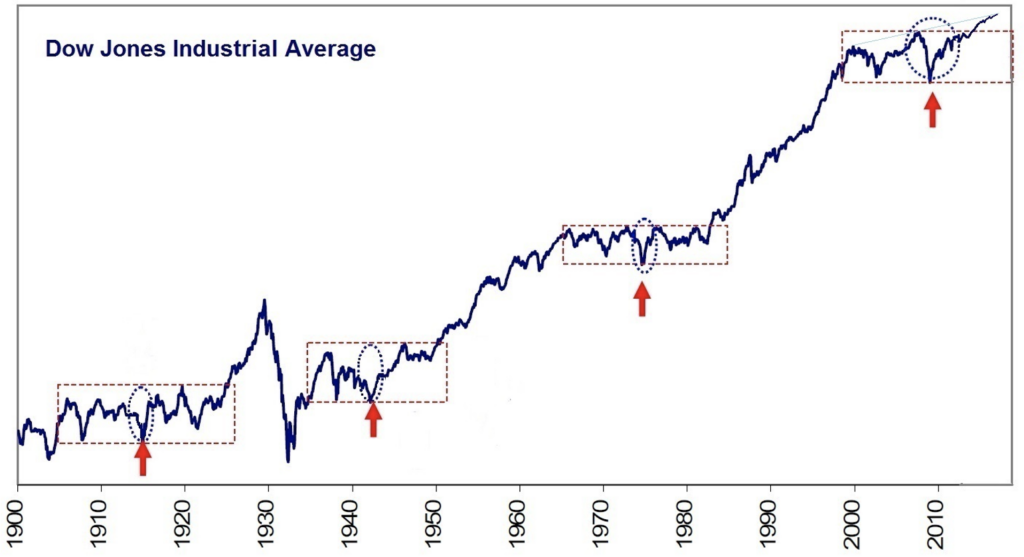

The one chart you need to burn into your memory

The chart below shows the growth of the Dow Jones Industrial Average since 1900. There have been times when the market didn’t move that much, and anybody who has lived through one of those periods knows how frustrating it can be.

However, the market’s direction has grown consistently over time. In short, time in the market matters more than timing the market.

Before you get started

Here’s a simple truth: Every dollar you put into the stock market is money you’re not using for something else. With that in mind, ask yourself some questions before you put money into the market:

- Do I have enough income to cover my basic expenses?

- Do I have a savings account or emergency fund that can continue to meet those expenses if my income is interrupted?

These may seem like obvious questions, but you’re doing yourself no good long term if you’re continually selling stocks to cover your basic expenses. Ensure you use money you can afford to part with to allow it to work for you.

Know your goals

If your primary goal is to save for retirement, an employer-sponsored 401(k) plan may be sufficient. A 401(k) allows you to use pre-tax dollars to invest. Often, your employer will match your contribution up to a certain percentage — free money, yay!

The benefit of a 401(k) is that it’s a set-it-and-forget-it option. In most cases, you won’t even miss the money. The downside is that you’re usually limited in your investment options. Plus, you’ll usually have to work with a fund manager who oversees your employer’s plan. A fund manager can provide solid advice, but it does come with fees that will eat away at some of your investment.

But let’s assume you have retirement covered and plan to put your money toward major life events such as a wedding, buying a house, travel, etc. If so, how much money do you need to reach your goals and how long do you have?

Now the fun part starts

In the past, buying stocks was a cumbersome process requiring you to work with a stockbroker. It could take a day or more for a trade to close, or settle. If you wanted to buy company shares, you had to buy full shares. That meant you needed hundreds or thousands of dollars available to start investing and even more to add to your investments.

Today, investors can start investing for as little as $1, and trades settle in seconds.

That’s both good and bad. It’s good because you can buy fractional shares of some of the best companies in the world and add to them over time. It can be bad because it can encourage investors to be much more aggressive than they need to be.

Here are some simple steps to help you get started on a successful investing journey.

Pick your online broker

Investors can choose from many online brokers, including the popular Robinhood and Webull. You can also invest with one of the “big boys” such as Fidelity, Vanguard and Charles Schwab. Some investors feel that using one of these established names gives them access to more and better research and advice.

That may be true, but be careful. This advice may come at a cost. Believe it or not, you can be your own best resource when it comes to buying stocks.

Pick your stocks

It’s important to have a strategy when picking through thousands of stocks. That number grows exponentially when adding mutual funds, index funds, exchange-traded funds, etc..

Unfortunately, this level of choice can steer investors away from investing but don’t let it. Just as online brokers make investing easy, several financial sites make your research more efficient, including MarketBeat.

MarketBeat.com homepage

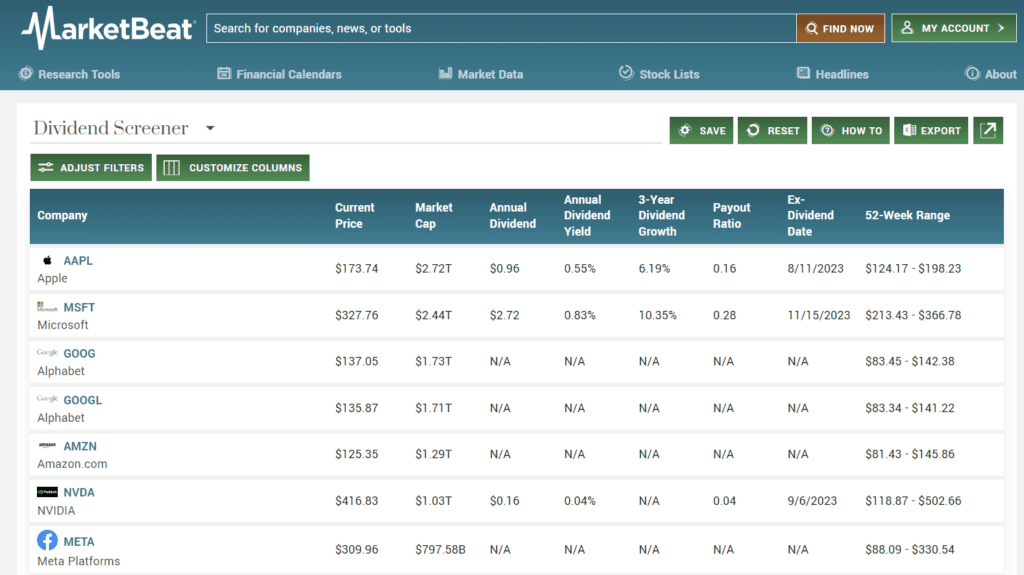

MarketBeat is a one-stop resource that investors can use to analyze the fundamentals of a stock and chart patterns. It sends timely alerts for stocks you own or are interested in buying. You also can access many of these features for free, including the company’s stock screener and dividend screener.

MarketBeat.com dividend screener

Many investors choose to become All-Access members, which gives them access to an even broader range of research tools like advanced screeners, premium reports and premium stock lists.

Plus, as a reader of SiouxFalls.Business, you have access to MarketBeat’s Monthly Market Recap. The Monthly Market Recap highlights approximately two dozen stocks that have a tie to the greater Sioux Falls area.

Buy your stocks

Some investors choose to start with just one stock. Others may want to spread out their investment over several stocks. There’s no limit to the number of stocks you can own, but you’re responsible for keeping track of your stocks. A resource like MarketBeat can help you, but fewer stocks may be better if you don’t have a lot of time to track your investments.

Where you start isn’t where you’ll finish

If you knew everything about investing, you’d be doing it already. The best way to learn about investing is by doing it.

Will you make some mistakes?

Most likely.

You’ll also change your mind about a stock you once loved. As time goes on, you may find yourself investing in stocks you never thought you’d buy.

That’s all a part of an investor’s journey, but the first step is to get started, and there’s never been a better time than right now.