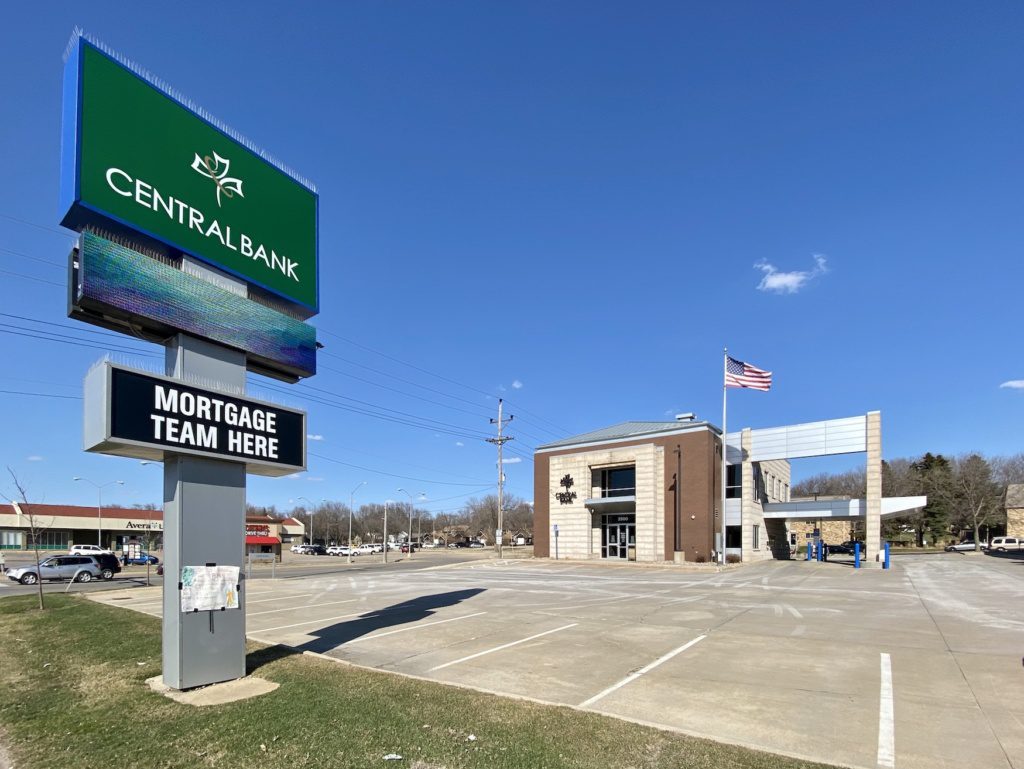

Growing together: Central Bank marks first year in Sioux Falls with customer focus, future plans

March 4, 2021

This paid piece is sponsored by Central Bank.

It would have been a historic year for Central Bank – even without the pandemic.

But instead, 2020 became a monumental year for multiple reasons. Weeks after Central Bank acquired MetaBank’s community bank division, COVID-19 took over everyone’s lives.

“COVID-19 impacted every business and resident in our community,” said Kathy Thorson, senior vice president, who leads the Sioux Falls market.

“And it became immediately clear that Central Bank’s customer focus and commitment to local involvement was exactly the emphasis we needed to meet that moment.”

Despite the disruption and ongoing needs generated by the pandemic, the former Meta team and the Central team moved ahead with their integration.

“Our cultures aligned well from the start,” Thorson said. “We immediately began to capitalize on best practices from both organizations. And our leadership and branch network remained the same, which brought an assuring consistency during an uncertain time.”

The combined teams “have progressed forward while capitalizing on opportunities to help customers grow financially,” added Tim Brown, chairman of the board and CEO.

“We’ve accomplished a lot,” he said. “Through numerous conversions, a high volume of Paycheck Protection Program loans and mortgage loans, and a worldwide pandemic, we were tested but became stronger.”

The year also has brought opportunities for growth, employee promotions and enhanced expertise.

“Together, we offer more expertise in specialized fields, additional technology and expanded product and service offerings,” Thorson said. “Our customers benefit from added perks like instant-issue debit cards, credit cards, insurance, a growing suite of mortgage programs and in-house loan servicing.”

The bank also stayed close to customers during the pandemic, walking them through government lending programs such as PPP and guiding them through mortgage savings as they purchased and refinanced homes.

“We stayed flexible and accessible,” Thorson said. “We offered curbside closings before and after business hours, directed additional resources to enhance our phone and digital customer service channels and invested in technology.”

The bank also supported numerous efforts to give back to the communities it serves.

“This was and continues to be a critical time for many people,” Thorson said. “It was important to us to contribute generously to community COVID-19 emergency funds, food banks and other community needs.”

The Central Bank staff also went “above and beyond for our customers,” added John Brown, president and CFO. “They worked long hours to meet deadlines, learn new processes and lend a hand to their co-workers. Their talents and contributions have allowed us to navigate through the complexities of a challenging yet rewarding year.”

This year is bringing both a continued focus on customers and a new look for the future. The bank’s lobbies are open, renovations were recently completed at the 33rd Street and Minnesota Avenue office and more are on the way at Western Avenue.

The new owners also are enjoying spending more time in Sioux Falls, they said.

“We’re humbled by the warm reception and deeply committed to the success of the community, the local businesses and those who call the area home,” Brown said. “It wasn’t the first year any of us expected, but we couldn’t be happier to be growing our presence in Sioux Falls and the surrounding communities.”

Member FDIC. Equal Housing Lender