Daktronics details record backlog, plans to improve liquidity

Dec. 12, 2022

Daktronics Inc. reported a sales increase, a net loss and a plan to improve its liquidity in its quarterly earnings out today.

The Brookings-based manufacturer reported results from its fiscal 2023 second quarter, which ended Oct. 29, as well as initiatives underway “to improve liquidity and cash generation as the company emerges from pandemic-related conditions that led to historic inventory buildup.” The release comes after it reported with the SEC last week that “there is a substantial doubt about the company’s ability to continue as a going concern.”

Net sales for the quarter totaled $187.4 million, up 14 percent from the same time one year ago and up 9 percent from the prior quarter. Its product order backlog is at a historically high $463.1 million.

The company reported a net loss of $13 million for the quarter in large part because of a non-cash deferred tax asset valuation adjustment.

Daktronics is the world’s largest supplier of large-screen video displays, electronic scoreboards, LED text and graphics displays, and related control systems.

Daktronics recently manufactured and installed a new LED video wall in Cook Children’s Hospital’s new Prosper, Texas, location.

“We achieved sales increases even though our capacity was constrained due to significant and unusual part shortages, a challenging labor environment, operating disruptions from COVID-19 related absences and the first quarter COVID-19 mandated shutdown of our Shanghai production facilities,” Reece Kurtenbach, chairman, president and CEO, said in a statement.

“I am proud of our team’s ability to increase our sales output during the second quarter and through the first half of the year under these conditions.”

Kurtenbach said “unprecedented and persistent supply chain conditions caused lower gross profits through fulfillment as well as higher costs for materials, labor and freight that were not all able to be passed on to our customers.”

Daktronics decided to keep delivery windows for its customers as close as possible to the original commitment date as supply chain and manufacturing constraints would allow, even though that sometimes added additional costs to fulfill projects, he added.

“To address supply chain volatility, we aggressively secured inventory to fulfill orders for our customers, consuming cash while increasing predictability of operations,” he said.

“We did all this because Daktronics has distinguished itself for 54 years by meeting our customer commitments on delivery dates, product quality and customer support. Our people displayed enormous strength, adaptability and resiliency over the past year and a half to maintain that reputation, securing supplies of critical components and responding to customers when demand came rushing back.”

Daktronics recently announced it is continuing a long-term partnership with Clemson University to design, manufacture and install a more than 7,200-square-foot LED video display for the end zone at Frank Howard Field at Clemson Memorial Stadium in South Carolina.

In order to buy and build component inventory and fulfill its backlog, the company temporarily amended its credit facility, which is a pre-approved loan, from $35 million to $45 million through the end of January, 2023. The maturity date is April 29, 2025.

However, because “we cannot be certain that we will not experience significant future disruptions or need additional liquidity beyond our current sources to fund inventory levels, operations and capital expenditures, it was concluded during the preparation of our quarterly financials, according to the accounting principles generally accepted in the United States of America, these conditions ‘raise substantial doubt about our ability to continue as a going concern.’ This conclusion then required a recording of a valuation allowance for uncertainty in recoverability of our net deferred tax assets and current year tax benefit, resulting in us recording a $14.8 million non-cash charge for income taxes in the quarter, of which $13 million was to reverse previously recorded deferred tax assets,” Kurtenbach said.

The company’s cash, restricted cash and marketable securities at the end of the second quarter totaled $7.7 million, compared with $61.6 million at the end of the same period a year ago and $22 million at the end of fiscal 2022. There was $26.4 million drawn on the line of credit as of the end of the second quarter, compared to no advances as of a year ago or the end of fiscal 2022.

So far this fiscal year, cash has been used for strategic growth in inventory stocking to add stability in production, growth in accounts receivable because of increased business and capital investments to increase manufacturing capacity.

“Our business continues to adapt and recover from the enduring implications of the pandemic,” Kurtenbach said. “Supply chain disruptions have started to ease, and we expect our inventory levels to peak in the third quarter and begin to decline to more normalized levels as order backlog is fulfilled and we reduce purchases.”

The company’s focus on improving cash flow and enhancing liquidity includes addressing its $463.1 million backlog, as well as:

- Productivity improvements from previous investments in factory capacity expansion and capital equipment and hiring only critical production and service personnel to increase output.

- Operating margin improvement through pricing actions, product mix adjustments and prudent management of operating expenses.

- Reengineering designs for supply chain resiliency.

- Normalizing inventory levels as supply chain challenges continue to ease.

- Aggressive management of working capital.

- Concentrating capital investments on maximizing asset returns.

- Obtaining additional sources of liquidity, with the consent of its lead banking partner.

“In our 54-year history, we have not been faced with the perfect storm that the last two years represent, beginning with the immediate implications of the economy shutting down in the spring of 2020, followed by the sudden rebound in activity while supply chains were delayed, snarled and often closed,” Kurtenbach said.

“These times have stressed our liquidity beyond levels that we have ever seen, and our financial resources have not been sufficiently flexible. Our immediate priority is to restore our balance sheet to historical levels of liquidity.”

The company is pursuing ways to strengthen and diversify its financing flexibility, he added, and has increased prices while focusing business development on “the most profitable opportunities.”

Other actions include “carefully matching our production schedules, inventory and labor to demand fulfillment,” he continued. “Our completed and planned capital investments will also increase our capacity as we enhance our automation capabilities. As supply chains continue to ease, we are further conserving cash by reducing inventory purchases and lowering inventory levels. We are prudently managing operating costs. We will continue to actively monitor market and supply conditions, adjusting pricing and operations accordingly.”

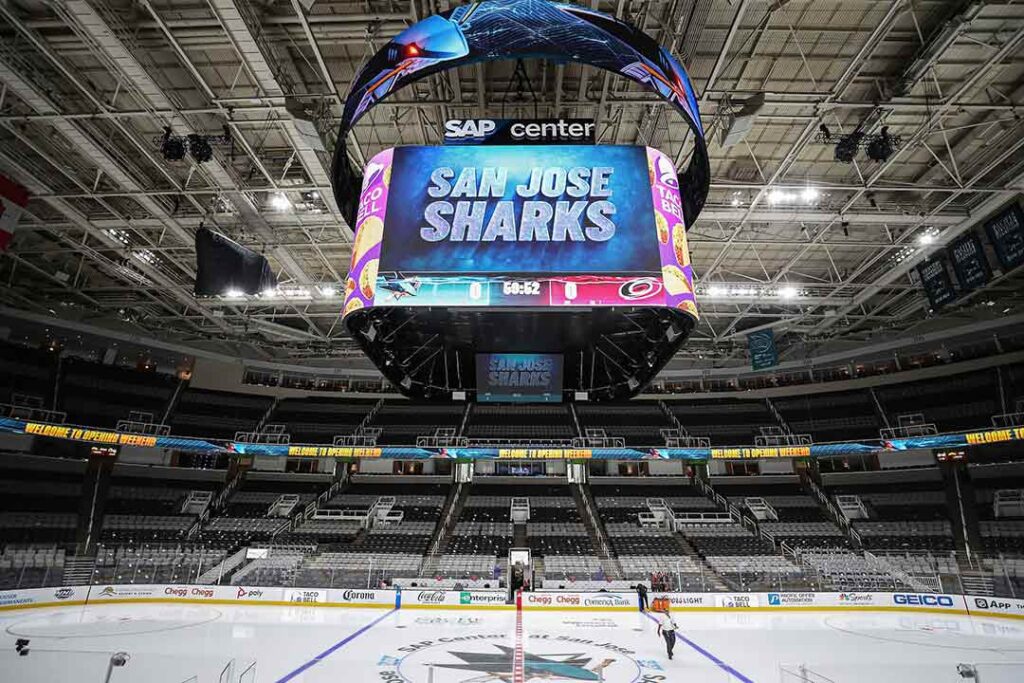

Daktronics recently designed, manufactured and installed multiple new displays in California at the SAP Center in San Jose for the San Jose Sharks.

Orders for the second quarter increased 11.7 percent, compared with the second quarter a year ago, and they increased 2.2 percent year-to-date. The company was able to achieve its sales growth largely by fulfilling backlogged orders despite multiple supply chain disruptions and labor shortages, it said.

Gross profit as a percentage of net sales was 16.9 percent for the second quarter, compared with 19.6 percent a year ago, a reflection of inflation in materials, freight and personnel costs.

“In addition, extraordinary supply chain disruptions created intermittent work stoppages and factory inefficiencies, adding additional costs to meet customer commitments,” the company said. “These conditions are beginning to abate. Prices were increased in late calendar 2022 and throughout 2023; these price changes are just beginning to be realized through sales as we work through backlog without price changes. We expect sales price changes to be realized through the remaining 2023 fiscal year.”

Because of the related income tax implications of acknowledging “the substantial doubt in our ability to continue as a going concern,” the company reported it expects to conclude that its disclosure controls and procedures and internal control over financial reporting were not effective as a result of material weaknesses.

“Our going concern policy did not contemplate evaluating the income tax implications of reaching a substantial doubt going concern conclusion,” it said. “In addition, the material weaknesses relate to the untimely internal communication to support the functioning of internal controls and the resulting accounting for income taxes. The company continues to evaluate its disclosure controls and procedures and internal controls over financial reporting, and its ultimate conclusions on these topics may differ from what the company currently anticipates.”