Bender Market Outlook: ‘Overall, Sioux Falls is in a healthy spot’

Feb. 22, 2024

Sioux Falls generally is countering the national trend when it comes to office vacancy — but the coming months still might show a drag on the market as some large buildings could be liquidated.

That’s among the findings of the annual Bender Market Outlook report from Bender Commercial Real Estate Services, which was released today.

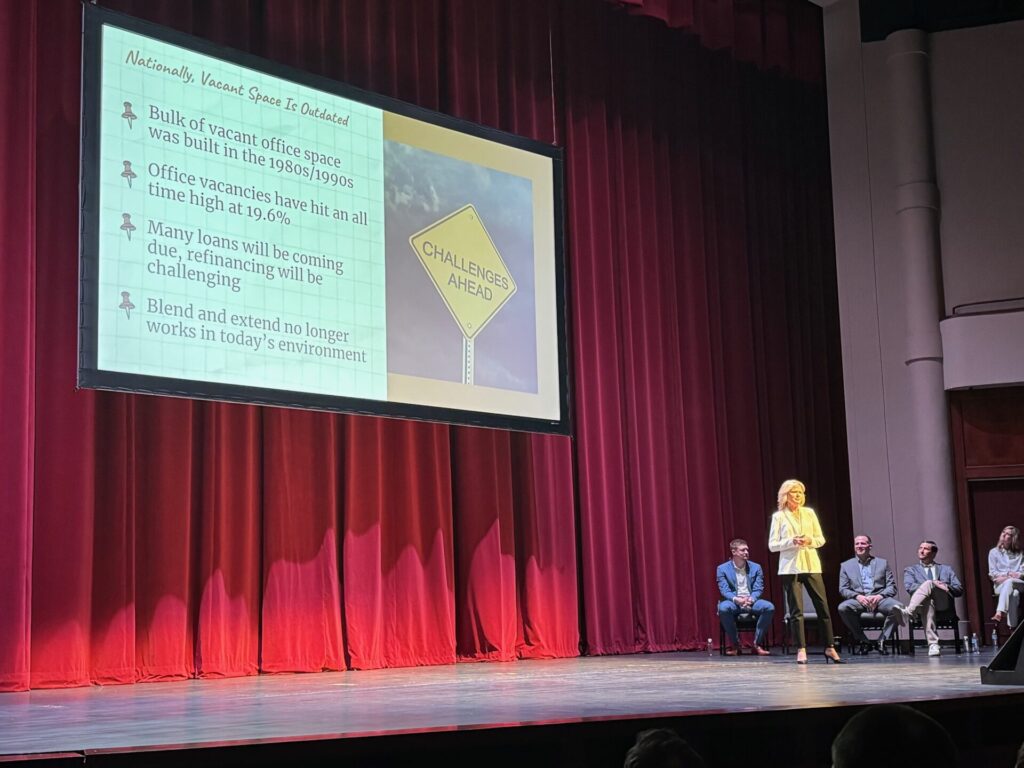

The office market has been one of the most-watched sectors nationally, with vacancies hitting an all-time high last year of 19.3 percent.

In Sioux Falls, Bender estimates the overall vacancy at 13 percent.

“We have not been as affected here locally as some of the larger metro markets by all of the office vacancy,” Bender partner Andi Anderson said.

“In the larger markets, the retailers and restaurants really need those bodies to make their businesses work, and here locally, most of our large blocks of vacancy are in the northern sector, and that has not caused as much of an impact.”

A deeper dive shows that of the 1.2 million square feet available, 900,000 square feet is in chunks of 10,000 square feet or more.

“The majority of that square footage is owned by corporate entities looking to liquidate these buildings, which will result in below-market sales over the next 12 to 18 months,” Anderson said. “Public and private dollars need to come together to come up with adaptive and creative reuses.”

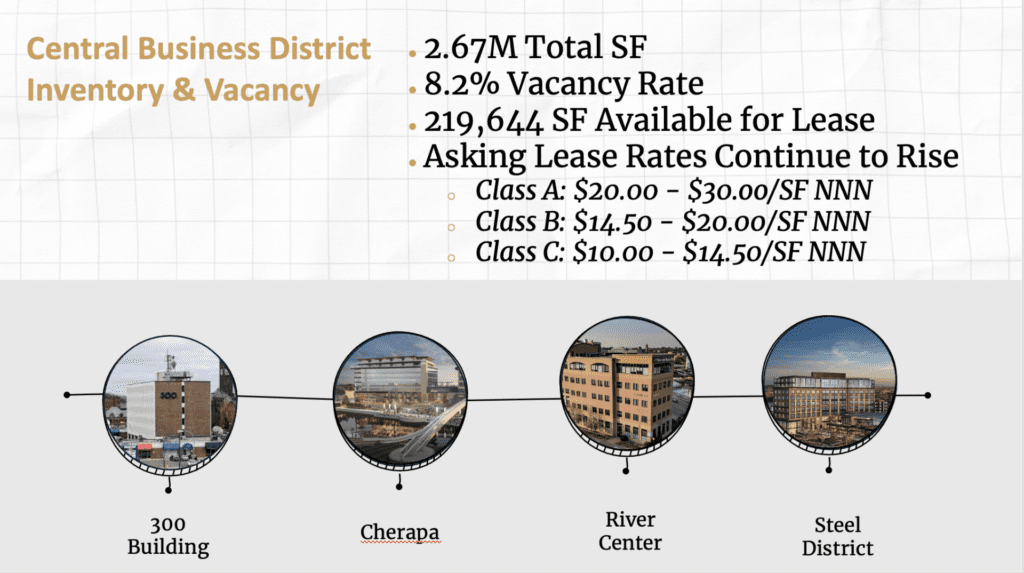

Downtown Sioux Falls is reporting a vacancy about half the citywide rate in its Class A, or most high-end, space. That vacancy rate is 7.6 percent, down from 11.2 percent in 2022. The vacancy rate in Class C space is the highest at 9 percent — twice what it was in 2022.

“There are a lot of announcements coming that will continue to make downtown a great option for tenants to consider,” Anderson said.

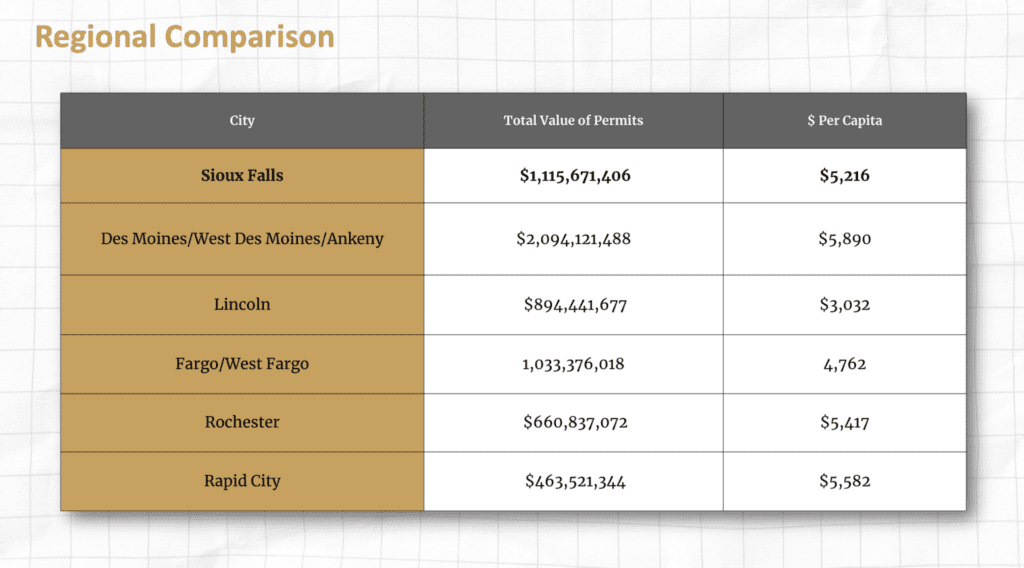

Bigger picture, the Sioux Falls economy showed a strong 2023, although it didn’t outperform its regional peer communities.

“This was a surprising slide this year. Most of the comparison cities were around $5,000 per capita. Sioux Falls was right in that mix,” Bender president Reggie Kuipers said.

“I’d look for Sioux Falls to pop back up to the top next year with the upcoming announcements for large projects, which were lacking from the 2023 numbers. Overall, Sioux Falls is in a healthy spot. Most of the underlying local fundamentals point to expanding economy in spite of rate growth.”

There is still “a strong appetite” from business owners and real estate investors to deploy cash reserves into real estate, despite higher interest rates, he said.

“Seller expectations are gradually resetting and adjusting to current market conditions,” Kuipers said. “As such, in order to get deals agreed to, we saw several buyers pivot to creative financing models such as swap notes, seller carry-back, contract for deeds, loan assumptions, membership interest purchase agreements and other creative means.”

Even as existing mortgage rates reset, “most local property owners with good property management will be in good shape,” he continued.

“Those who are poor operators and/or overleveraged will be caught, but I’d anticipate that is less than 5 percent of property owners/operators in our market. There is an incredible amount of cash sitting on the sidelines waiting for a ‘value’ opportunity. As such, I’d anticipate a small turnover from overleveraged borrowers to more experienced investors.”

Commercial real estate owners also have felt a squeeze from property tax increases — up 55 percent in Minnehaha County and 63 percent in Lincoln County in the past five years. Insurance costs are up an estimated 45 percent in that time, he said.

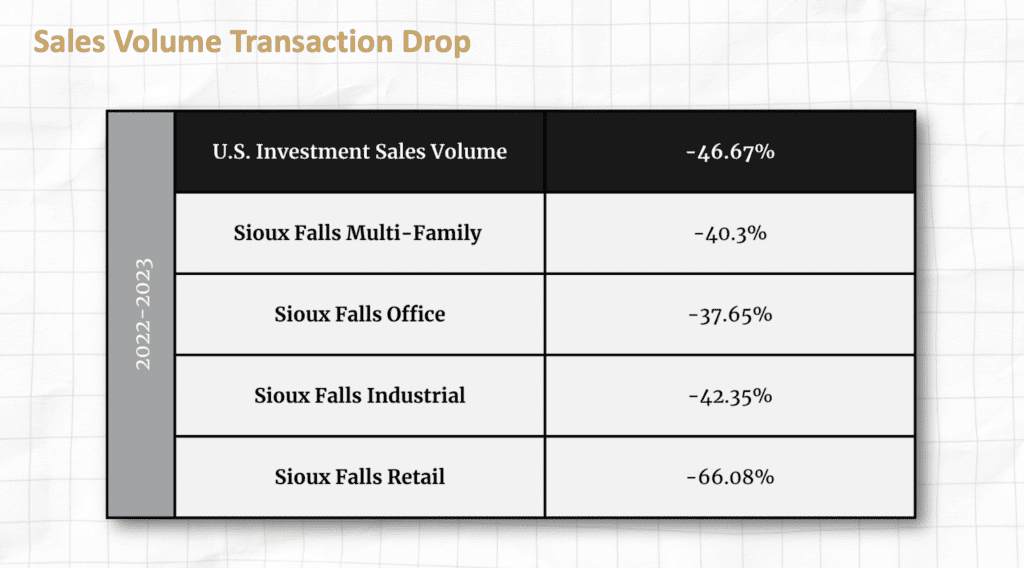

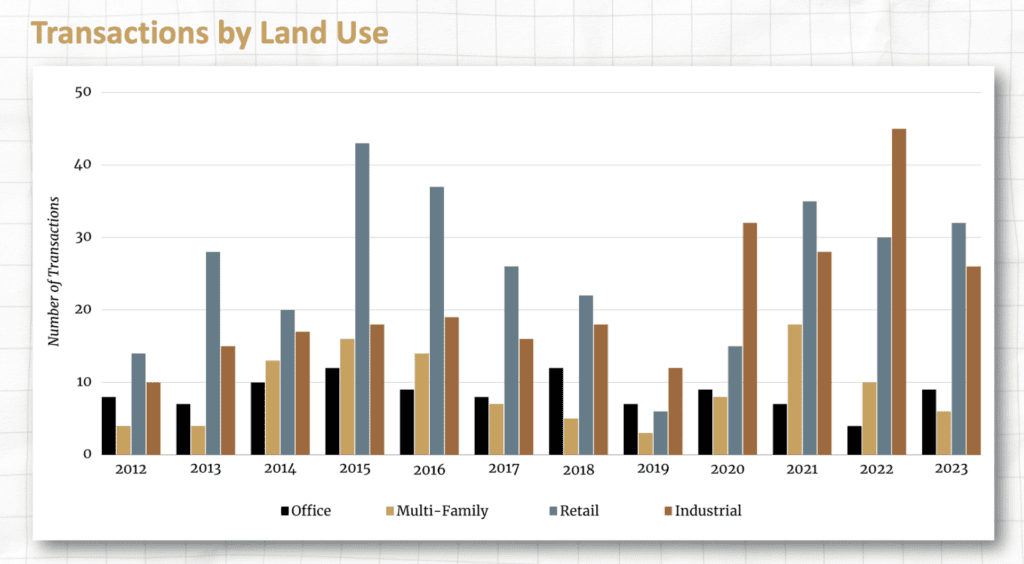

The increased cost of doing business contributed to a significant drop in real estate transactions in Sioux Falls last year.

“This steep drop is 100 percent caused by interest rates, not a crisis of liquidity,” Bender partner Nick Gustafson said.

“It happened so fast that long-held assumptions have been taken off the table.”

The situation is “simply a math problem,” he continued, pointing out that with interest rates around 8 percent, buyers have to put 36 percent to 85 percent down to make a deal cash flow.

“It often makes more sense to let the capital sit in a 5 percent money market risk,” he said. “There’s historic amounts of capital waiting on the sidelines. There is not a crisis in any way, shape or form. It’s just expensive to borrow money right now, and investors have not had to deal with expensive debt for almost 20 years. There will be a reset of seller and buyer expectations should rates stay elevated for some time.”

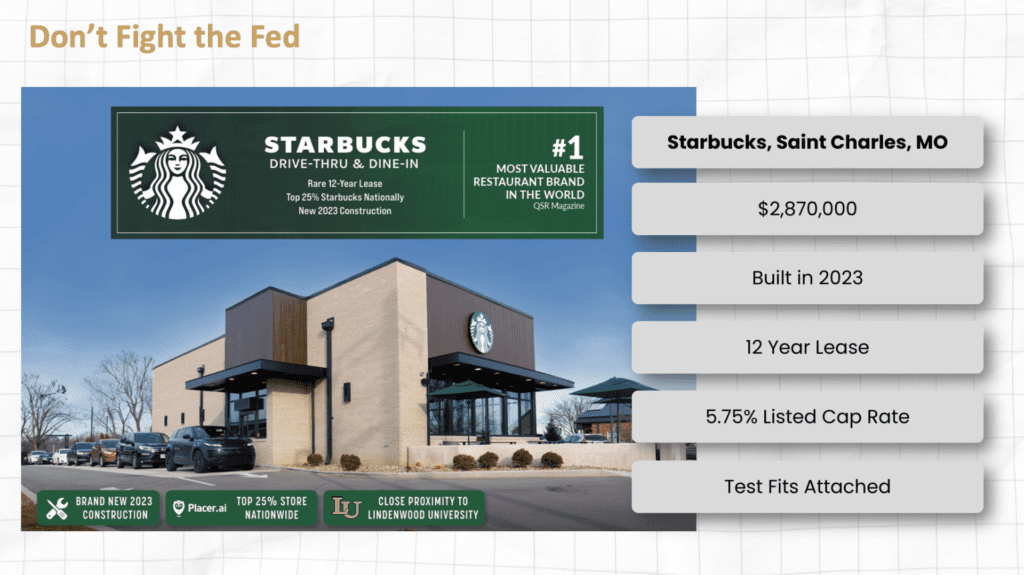

For instance, an example transaction involving a Starbucks location shows that a buyer would need to put 85 percent down to create a return comparable to a 5 percent money market investment.

“Rates will not stay this high forever, but they may not come down significantly this year if we have another hot inflation reading or two,” Gustafson said.

“I think buyers and sellers are adapting to this new interest rate climate. There are quite a few properties locally that have seen significant appreciation over the last five to 10 years. I see sellers being willing to do some profit taking, especially if they have a refinancing event in the next 12 to 18 months.”

Here’s a closer look at other commercial real estate sectors.

Retail

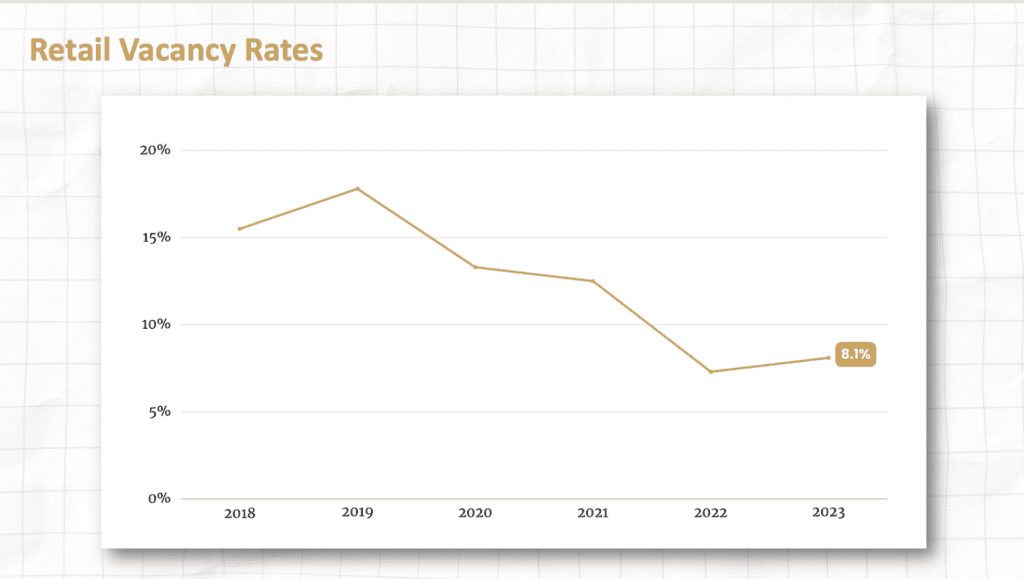

Retail vacancy is up slightly year over year to just over 8 percent.

“The retail market remains strong in Sioux Falls. Our vacancy rates have stabilized, the demand for retail land is strong, and new construction numbers have remained consistent over the last couple of years,” Bender partner Rob Kurtenbach said. “I expect all these data points to continue in 2024.”

Retailers are trending toward smaller-format stores, he added, primarily because of the increase in online shopping.

“We all shop differently today than we did five years ago,” he said. “This has caused retailers to reevaluate the footprint size they need with new locations.”

In some cases, such as coffee concepts, the movement is away from seating and toward walk-up locations.

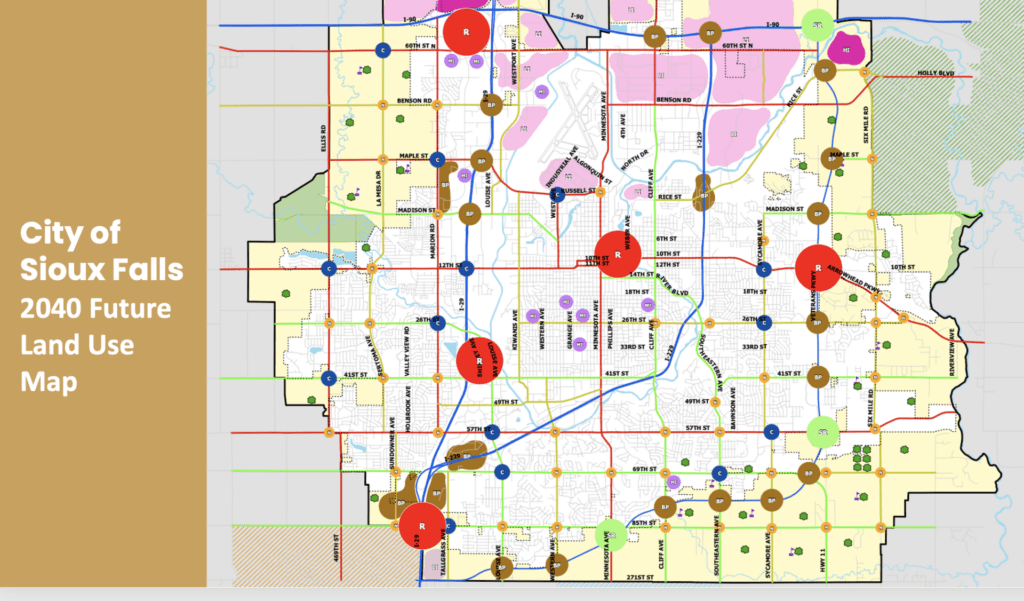

While Sioux Falls has identified the northwest, near Walmart, and southwest, near the future 85th Street interchange, as future regional retail centers, “I believe those large land parcels will be slow to develop as retailers of all sizes are looking at shrinking their footprint sizes with smaller concepts,” Kurtenbach said.

“Nationally, the trends are going to smaller neighborhood retail centers. With the demand of people working from home full time or in a hybrid model, we are seeing the demand for retail users to condense their size and come closer to the end user.”

Industrial

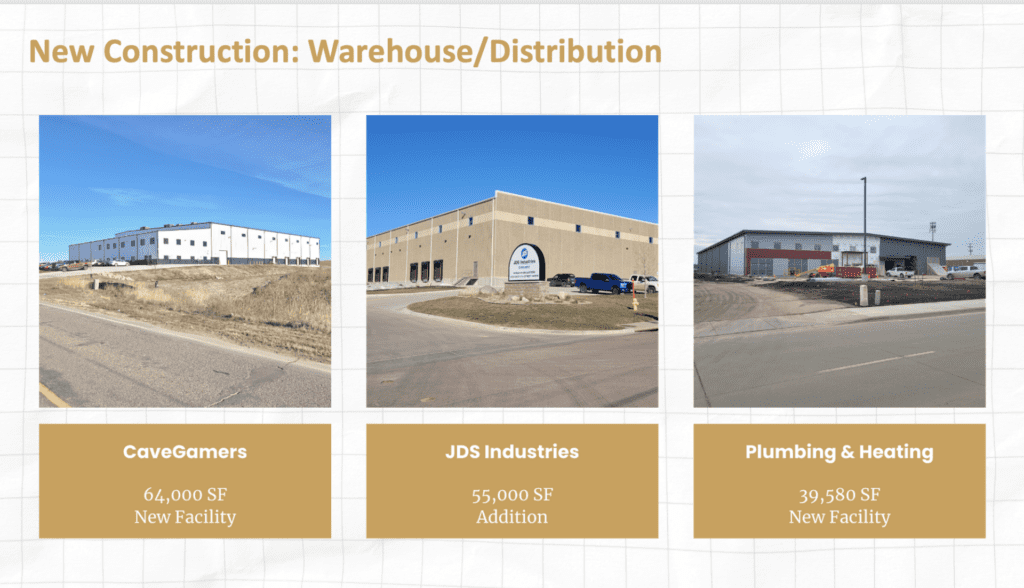

Contrary to many national trends, the Sioux Falls industrial market “remained strong in 2023,” Bender partner Rob Fagnan said.

“We continue to see high new construction and absorption throughout the market. Warehouse space continues to be built out; however, it’s on a smaller scale from some of the larger spec projects in 2022.”

The Bender report estimates industrial vacancy is up slightly over 2022 but still around 3 percent and below the national average of just over 4 percent.

“Vacancy ticked up a little bit, but that was predominantly a result of some companies moving into their newly built facilities — bringing to the market the Class B/C product they previously occupied,” Fagnan said.

Most warehouse space built last year was between 20,000 to 75,0000 square feet, unlike multiple larger warehouse development built on spec the year prior.

“The need for space still exists within our market, which is why I think the two large spec projects will get absorbed within the next 12 months,” Fagnan said. “The increase in interest rates should actually help with backfilling these spaces. With today’s interest rates – and where lease rates currently sit – the numbers don’t work for new spec construction. A tenant can either stay where they’re at, backfill existing space or choose to become an owner/user of a building they construct themselves.”

He anticipates continued investment in manufacturing and transportation as reshoring jobs and ongoing implementation of AI are driving the need for additional space.

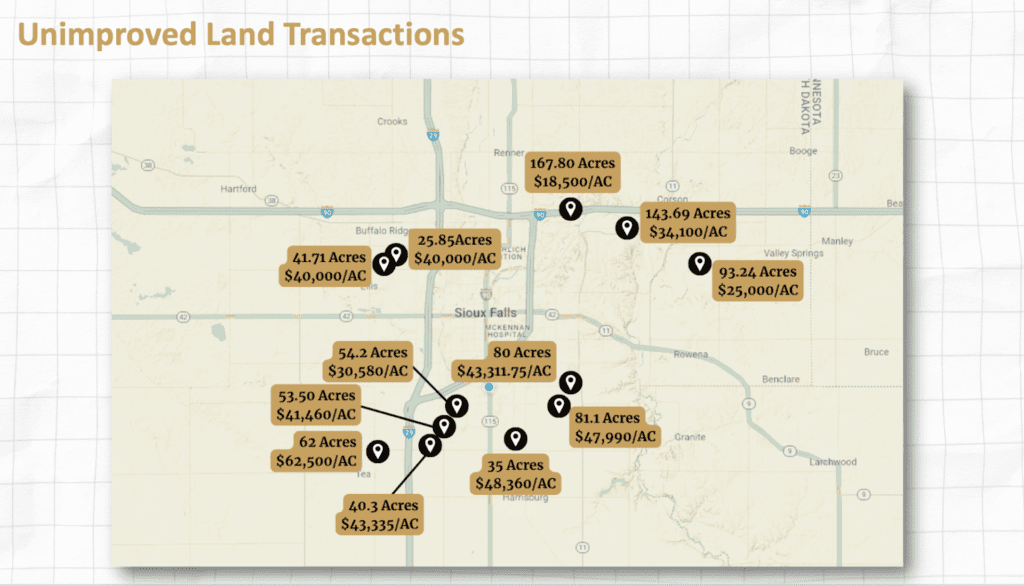

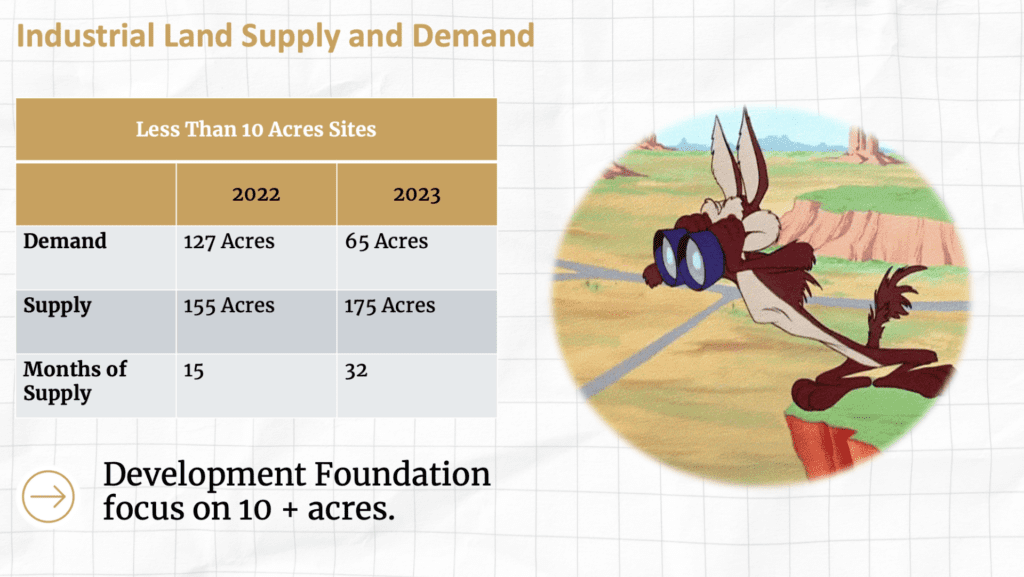

As industrial land sites smaller than 10 acres become rare in the Sioux Falls market, businesses have looked into the broader metro area for smaller parcels and less expensive land, Fagnan added.

For larger parcels in Sioux Falls, “our supply is OK for the time being, but one or two large land transactions can drastically change the availability of land within a short period of time,” he said. “We thought we had decades’ worth of industrial land when the Development Foundation acquired their 800-plus acres, but that mindset has shifted with the size of some of the projects that have been built in Foundation Park over the past couple years.”

Land

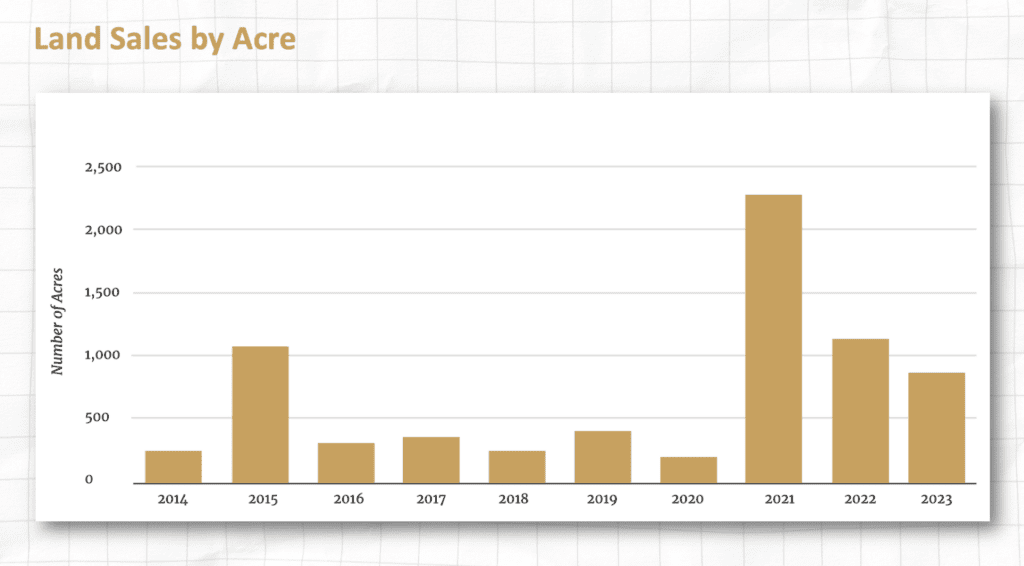

Sioux Falls notched a strong year for volume of land transactions, though the number of acres purchased fell slightly to 950 acres.

“I believe that we are settling into a new normal for our Sioux Falls region for acres purchased for development,” Bender partner Bradyn Neises said.

“From my perspective, it is getting more challenging to find large tracts of land in Sioux Falls that are ready for development.”

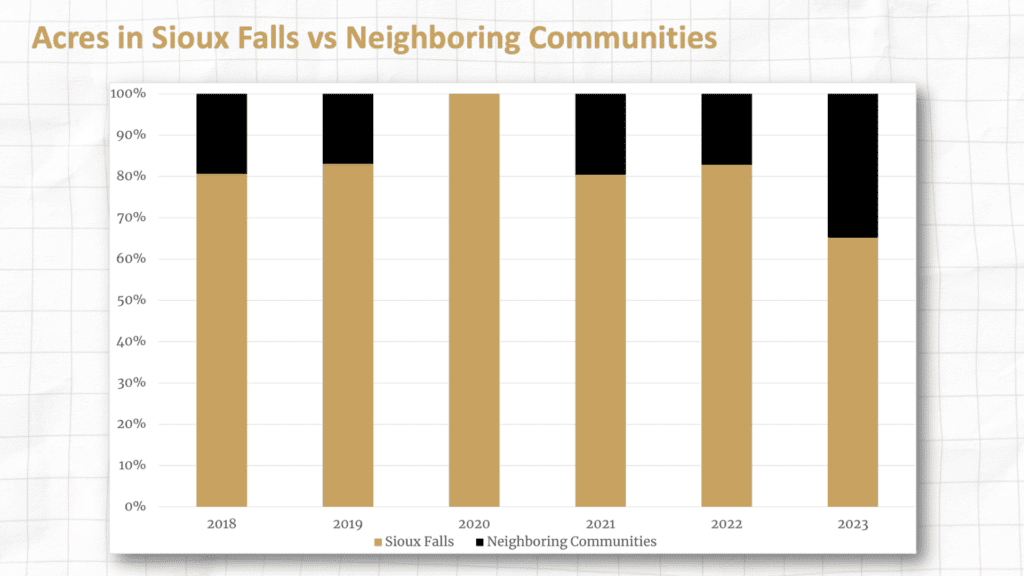

As suburban communities grow closer to Sioux Falls and with improvement corridors such as Veterans Parkway, developers are more comfortable purchasing land in communities such as Brandon, Harrisburg and Tea, he said. Between 2018 and 2022, 80 percent or more of the acres purchased were in the growth area of the Sioux Falls city limits. In 2023, it dropped to 65 percent.

“So we will be watching how that trend plays out in the future,” Neises said. “My prediction is that the percentage will flip in 2024, and there will be more acres purchased in our surrounding communities than in our Sioux Falls growth area.”

In terms of improved land, large sales such as the state of South Dakota One Stop at Dawley Farm Village and Orthopedic Institute in the Bakker Crossing development drove activity in office land sales. Retail was up slightly, driven by many convenience store land purchases. Industrial and multifamily were lower.

“Last year, I talked about an imbalance in our supply and demand for lots less than 10 acres. I point that out because that is a majority of the market, and the Sioux Falls Development Foundation has committed to offer larger sites and not subdivide them and compete in this market,” Neises said.

Industrial land prices have seen a 40 percent price increase, he said.

“The lack of supply and high price has tamed demand, and that is why we saw a pretty steep pullback in industrial land sales, “Neises said. “All that being said, I believe there is still demand in our industrial land market, and I predict that private and community economic developers will add more supply to our market, helping provide more competition and stabilize pricing in our industrial land market.”

He predicts the metro area will see another 1,000 acres purchased this year.

“As we continue to add population, services in the office and retail markets will continue to look for sites to accommodate that population growth. Pricing in these categories I expect to stay steady,” he said.

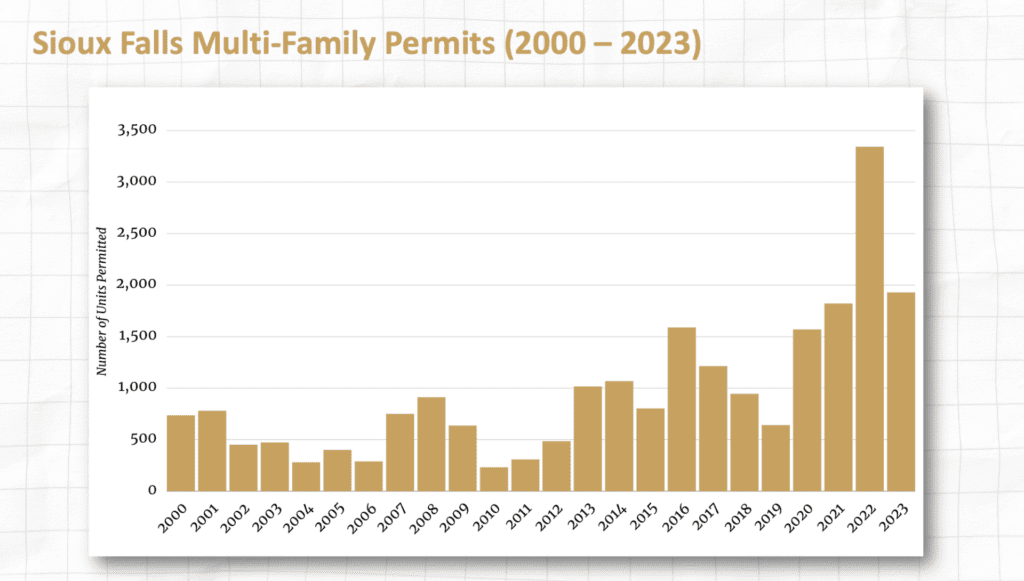

“Multifamily is in a different category. Our community may have overproduced with the spurge of multifamily development the past few years. I think moving forward, multifamily developers have hit pause on new projects to really see the impact from the additional supply and how the vacancy rate will be impacted.”

Multifamily

While multifamily occupancy is still a relatively healthy 94 percent, “we haven’t seen the full effect of absorbing the record number of units that are currently under construction,” Bender partner Alex Soundy said.

“People often forget that it takes 12 to 18 months for developers to deliver occupancy from when the initial permits were issued. So as we look back at the record year Sioux Falls had in 2022 with 3,343 multifamily units permitted, we still haven’t seen the full effect of absorbing those units. That being said, I anticipate vacancy rates to be on the rise and rent growth to stagnate in 2024 as we absorb these new units.”

Interest rates caused a slowdown in development last year, but numbers still were above historical averages.

“Moving forward, interest rates will remain the biggest hurdle for many developers as it’s hard to pencil new projects with current financing costs combined with the high cost of new construction,” he said.

“There are still plenty of developers who are continuing to remain bullish and banking on rent growth and high demand for rental units as more and more people are priced out of homeownership and continuing to rent. That being said, I do anticipate a slowdown for multifamily units permitted in Sioux Falls in 2024 as the math simply doesn’t make sense.”

There’s still strong activity in multifamily sales, though most were valued-added opportunities or required creative financing, he said.

“Heading into 2024, I think we will continue to see investors get creative with deal structure to get deals done, and I also think we’ll have a softening of seller expectations as looming mortgage maturities will force investors to sell,” Soundy said.

“There are deals to be had in every market; investors just need to make sure the math makes sense.”