As record-low home inventory persists, buyers slowly find less competition

May 9, 2022

It has taken almost two years – and depending on whose record is checked either 19 or 23 offers – but this week Josh and Katie Schorzmann finally will become homeowners.

They’re scheduled to close Friday on a house in west Sioux Falls after an experience that illustrates the continued challenges buyers face in today’s market.

“We just kept getting hammered on cash offers,” Schorzmann said. “We were outbidding people on a couple of occasions, and they went with the cash offers, $10,000 or $15,000 less, and it was hard on some of those to come up 15 to 25 percent over asking price because they weren’t worth it.”

The path to ownership for the Schorzmanns is riddled with uniquely pandemic-era challenges. In the spring of 2020, Schorzmann’s job serving at Red Lobster was put on hold while the restaurant closed.

“And I couldn’t get a house loan,” he said. “They were hesitant to loan to someone who worked for a place that might not be open in six months.”

By summer with the restaurant reopening, they were preapproved for up to $150,000 and then went back to the bank every few months as their income grew, and they were able to be preapproved for more.

By March 2021, they were ready to start bidding on west-side homes around 2,000 square feet and lost out on one after the other.

“It was difficult, and as a Realtor it really sucked seeing a client lose out on so many homes,” said Spencer Wilcox of Falls Real Estate, who worked with the family.

“It’s super frustrating, and they’re not the only clients I’ve written up several offers for. It’s time-consuming for everyone and frustrating, especially for these couples who are in a lease and they either need to renew or leave in three or four months, and most of the time you’re not going to find a home in three or four months. It’s going to take some trial and error.”

The numbers reflect that reality, including in the most recent report from the Realtor Association of the Sioux Empire.

In the city of Sioux Falls, inventory dropped to a 1.6-month supply in April, down 47 percent from the same time last year. New listings fell 13.8 percent, and closed sales dropped 5.8 percent.

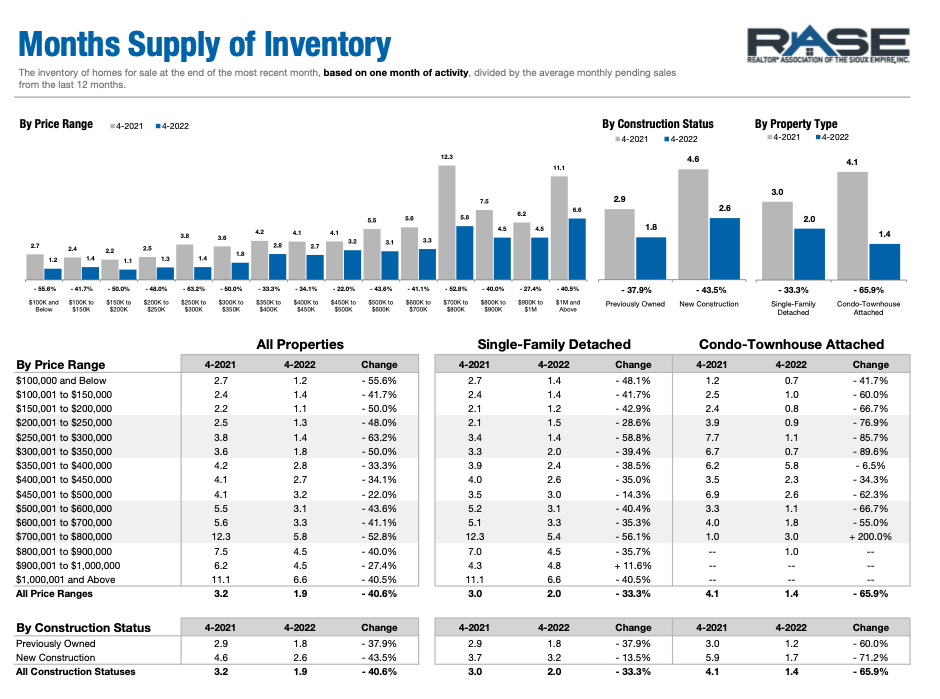

Here’s a closer look at inventory in the Sioux Falls metro area by price range and home style:

The average house in Sioux Falls spent 66 days on the market before selling, which is 12 fewer days than the same time last year.

“I do feel like we’re going to see more inventory than we did last summer,” Wilcox said. “I could be wrong, but I do feel like some sellers are going to be thinking to themselves, ‘We’ve already missed the hottest time in the Sioux Falls housing market, which was 2020 and 2021 and the beginning of 2022, and we still want to try to get the max for our house.’ So I feel like we should see more listings.”

On average, sellers received 103 percent of original list price in April, indicating plenty of bidding wars continue.

For the Schorzmanns to finally secure their home, they offered $301,500 on a house listed for $265,000, waived the inspection requirement and offered to cover up to a $10,000 appraisal gap.

But they needed to go all-in, Schorzmann said. Their fourth child is due in two weeks, and they rapidly were running out of room in their west-side apartment.

“The prices just keep going up and up, and the houses we could have bought last summer that we weren’t aggressive on have appreciated $30,000 or $40,000,” he said. “So that’s kind of hard to swallow. But we had to get something now.”

Fortunately, the house appraised over their offered price, he added, and he now works a job in recruiting that allows him to afford a bigger payment.

The multiple-offer situation is cooling somewhat, Wilcox added.

“In the last couple weeks, I’ve gotten quite a few homes under contract, and each one I feel like the most offers we were competing against was maybe three, which is crazy,” he said. “Earlier this year, you’d call a Realtor up and they’d have 22 offers. Even with one of my listings, I had one a couple months ago and we closed about a month ago, and it was a one-week close, cash offer, and we had 17 offers, and it went for 15 percent over asking … and now things are starting to, I don’t want to say get back to normal, but it’s getting better.”

Affordability crunch

The average 30-year fixed-rate mortgage exceeded 5 percent in April, the highest level since 2011, according to Freddie Mac.

“The recent surge in mortgage rates has reduced the pool of eligible buyers and has caused mortgage applications to decline, with a significant impact on refinance applications, which are down more than 70 percent compared to this time last year,” according to the RASE report.

“As the rising costs of homeownership force many Americans to adjust their budgets, an increasing number of buyers are hoping to help offset the costs by moving from bigger, more expensive cities to smaller areas that offer a more affordable cost of living.”

Nationwide, inventory is similar to Sioux Falls at about a two-month supply.

The share of Americans planning to purchase a home in the next year is falling, according to a housing trends report from the National Association of Home Builders, with 13 percent intending to purchase a home in the next 12 months, the lowest level since mid-2020.

“Declining affordability and low inventory have made it difficult for many buyers to compete in the current market as rising inflation, surging interest rates and record high sales prices have priced an increasing number of prospective buyers out of the market,” it said.

In Sioux Falls, the average price of home sold in April was $341,810, a 21.8 percent year-over-year increase. The median price jumped 16.8 percent to $294,500.

While interest rates will keep some out of the market, buyers continue to face competition from out-of-state movers, Wilcox said.

“And the people coming here most of the time are cash heavy. They’re coming from California, Minnesota; they probably just sold a home. I get people from New York, New Jersey, Washington and Oregon,” he said, adding that 10 times in the past year, the first time his buyers looked at their homes in person was at the final walk-through.

“They never once saw the house.”

Fortunately for the Schorzmanns, the wait appears to have been worth it. Their new home “checks all of our boxes,” he said. “Three bedrooms on the main floor, it’s a little over 1,8000 square feet, and it’s on a quarter acre, so it’s got a big enough backyard.”

While they waived an inspection to secure the house, they still plan to get one as soon as possible to fix any issues right away, he added.

“It’s just one of those risks you have to take. Otherwise, we’d still be looking for a house.”

It’s not your parents’ buyer’s market — but it is a buyer’s market