Space to spare: National retailers looking at Sioux Falls have location options, if they want them

May 20, 2019

For the first time in at least recent memory, it’s easier to make a list of the national retailers that have left Sioux Falls in the past year than those that have opened.

On the plus side, count Forever 21 and Scandinavian Designs opening at The Empire Mall, Kirkland’s at Lake Lorraine, Ulta announcing a Dawley Farm Village location, Fleet Farm at the Sanford Sports Complex and lululemon deciding to make a temporary lease permanent at the mall.

The list of closings, though, is bigger and more recent, starting with two department store mall anchors, Sears and Younkers, and including both Shopko stores, Payless ShoeSource, Charlotte Russe, Gymboree and sister store Crazy 8, Hallmark Gold Crown, Rogers Jewelers and Toys R Us.

“It’s a whole different landscape,” said longtime commercial broker Ron Nelson, owner of Nelson Commercial Real Estate.

“We’re just in this period of reinvention. Retail is in a period of reinvention, and largely the delivery system is being reinvented. We’re still spending money, so it’s not like retail is dead, but we’re changing our patterns, and we don’t know where they’re going to land. I don’t know if there is ever going to be a ‘new normal’ just because of the continuous evolutionary state of technology.”

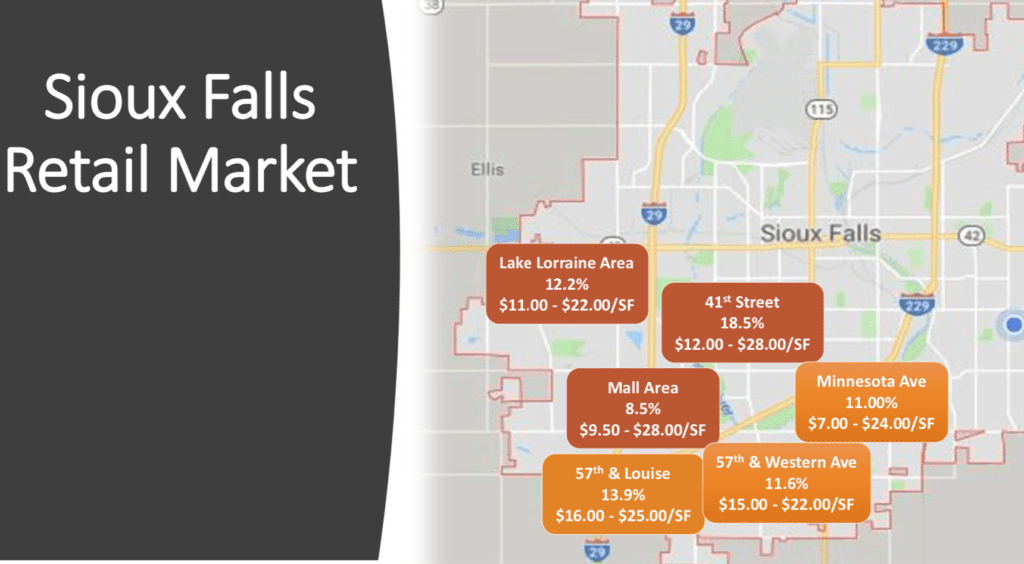

The contingent of Sioux Falls commercial real estate brokers at the annual RECON convention in Las Vegas this week will represent a market with potentially the highest vacancy in years. Earlier this year, the annual Bender Market Outlook from Bender Commercial Real Estate Services reported 15.5 percent retail vacancy citywide at the end of 2018, down a bit from 16.7 percent in 2017 but not factoring in closures that have occurred this year.

The report included double-digit vacancy everywhere but directly around The Empire Mall, including the 57th Street and 41st Street corridors where available space was hard to come by a handful of years ago.

Sioux Falls’ trajectory is far from an anomaly, though, as other markets nationwide have endured the same wave of national retail closures.

And the brokers meeting at this week’s convention, put on by the International Council of Shopping Centers, still report plenty of interest from retailers in looking at Sioux Falls.

“I’m booked solid,” said Raquel Blount, vice president of commercial real estate at Lloyd Cos. “We’re in a transition phase. It’s not all doom and gloom because overall nationally retail sales are up. It’s just some of the concepts that are old and tired are going through their issues.”

Who’s opening and closing

Few have a better pulse on which national retailers are growing or shrinking than Garrick Brown, head of retail intelligence for the Americas at brokerage firm Cushman & Wakefield.

Brown annually surveys national retailers about their growth plans and projects potential openings.

Here’s his take on what’s ahead:

Grocery market

While industry disruptor Amazon is expected to further change the grocery landscape with its acquisition of Whole Foods, it hasn’t shared when or how it plans to start adding more physical stores.

“Everyone right now is waiting to see what Amazon does with Whole Foods,” Brown said.

“They’ve been building their infrastructure to support the stores, and I think they’re getting ready for a big bricks-and-mortar push. I think by the end of the year we’ll see Whole Foods ramp up significantly, and we could be talking hundreds of stores in the next few years.”

Other growth in grocery is coming from smaller stores. Trader Joe’s will add about 25 stores this year, and Sprouts Farmers Market will open about 30. Aldi plans to add about 150 stores, and its German cousin chain, Lidl, is ramping up its growth.

“I’m hearing 30 stores this year … and I think they will continue with the East Coast going inland. I haven’t heard anything about the West Coast at this point, but that’s where Aldi is doing its great push,” Brown said. “Eventually, I think both will be national.”

Department stores

The department store landscape continues to see challenges, but Brown predicts fewer overall closures this year compared with last year.

Dillard’s, which announced it was renovating and expanding the former Younkers at The Empire Mall and planning to open later this year, hasn’t moved forward with a building permit yet.

The retailer is expected to open one or two stores this year, Brown said.

“But that’s more than the last few years when it’s been zero.”

The recent announcement that Kohl’s will begin accepting returns for Amazon in July prompted speculation the online giant could acquire the department store, but Brown said it might not be necessary.

“Kohl’s has been finding all sorts of ways to try to find more relevance,” he said. “And their new (store) template is about half the size of their old one. The traditional Kohl’s was 80,000 square feet, and what they like now is about 40,000 to 50,000, and that’s a general trend of people shrinking footprints and trying to be more effective with the sales floor they have. I haven’t heard any official opening announcements, but I’ve also not heard any official closing announcements from them.”

Kohl’s also is experimenting with putting Aldi grocery stores within its buildings as well as fitness centers, he said.

Dollar stores

After 10,000 store openings since 2011, the market for dollar stores is getting a bit saturated, Brown said.

That said, Dollar General still plans to open 975 stores this year, and Dollar Tree plans to open 350. While Family Dollar announced almost 400 closures, it is still opening some too, including a new store planned in Sioux Falls next to Bagel Boy on Minnesota Avenue.

“Now, it’s a battle for dominance, and I think that’s where it will be the next couple years,” Brown said. “At its peak, Dollar General did 1,300 stores a year, and I think now it will be more selective, and it’s really about going head-to-head with the competition.”

Another value-oriented chain to watch as a potential one for Sioux Falls: Five Below. It sells merchandise priced at $5 or less and is adding about 160 stores this year.

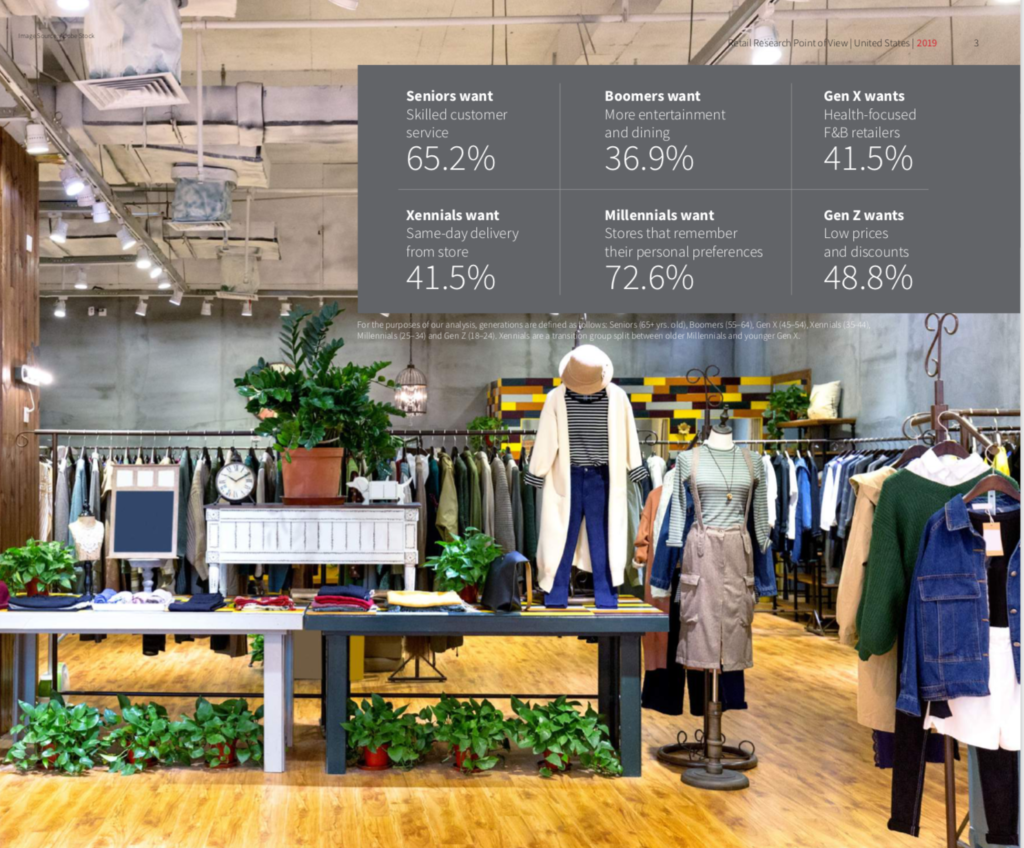

What consumers want

While retailers and property owners try to deliver what consumers want, there’s no substitute for asking them.

That’s what commercial real estate services firm JLL did recently in a survey released for RECON detailing what shoppers expect from retail destinations looking out toward 2030.

The takeaways? Consumers are looking for convenience, entertainment and flexibility to shop how they want, when they want.

“Most of this is not surprising, but really interesting to note is that sometimes just because technology is new and shiny doesn’t mean that’s necessarily what the shopper wants,” said Taylor Coyne, JLL retail research manager.

That means investing in back-of-house systems that allow shoppers to order online and pick up in the store or easily ship from the store to home.

“I don’t necessarily have to go into a store and interact with a robot to help me pick out the shirt or pot I need,” Coyne said, adding the goal is to create “a seamless experience. Some retailers are beginning to do it really well. And once I’ve had that, this experience at a store, I’m going to expect it everywhere.”

Another emerging trend involves rental options. Six in 10 people said they would be willing to rent everything from trendy to high-quality products from a store. That includes electronics, jewelry and clothing.

“Gen Z are the biggest most likely group, along with millennials, to be able to rent, but you’re seeing it from all generation groups, which is really interesting,” Coyne said.

Almost 30 percent of respondents said they want family-friendly entertainment, opening opportunity for adventure-themed and virtual reality concepts, she added.

“And they want chef-driven food halls, high-end dine-in movie theaters and a focus on health and wellness in their dining options and … that ties in as well to the wellness theme we’re seeing in general – good food and healthy options but also putting fitness in the (shopping) center. Some of those concepts are big enough to take that vacant department store space.”

More options

The concepts considering coming to Sioux Falls have more options than ever, brokers agreed.

“We used to have The Empire Mall area when someone wanted to come into the market, and now we have so many more options,” Blount said.

New national retailers in recent years have opened first, second or third locations at Lake Lorraine, 85th and Minnesota, and Dawley Farm Village.

“In some respects, it’s more difficult to get deals done,” agreed Kristen Zueger of Van Buskirk Cos., who represents Lake Lorraine and has a full schedule this week meeting with businesses interested in considering locating there.

“In this market, some of the competition is pretty great. We have competition with the amount of vacancy coming available at the mall and with the (former Sioux Falls Ford) site.”

The players also continue to change, said Ryan Tysdal, also of Van Buskirk Cos.

He’s marketing a list of properties, including space in front of Walmart at 85th and Minnesota. That retail development is a good example of how things have changed, he added.

Those business include SafeSplash Swim School, Orangetheory Fitness and Code Ninjas coding school.

“All those tenants are something you probably wouldn’t buy online,” he said. “So you still have tenants for these spaces, but they’re different than they were 10 or 15 years ago. Retail in Sioux Falls has not slowed down one bit. We’re seeing it all the way from small-shop strip mall tenants up to box-store tenants. They’re still coming to Sioux Falls. It’s an extremely viable market for retail.”